Ichimoku Cloud

Post on: 28 Май, 2015 No Comment

Introduction and History

Ichimoku cloud was developed during late 1930s by Tokyo newspaper journalist Goichi Hosoda. However, it had taken 30 years of refinements before it was released, in the late 1960s, to be used by other traders.

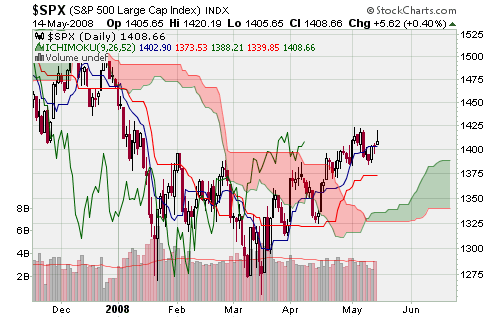

Ichimoku cloud, which is called Ichimoku Kinko Hyo in Japanese, is a versatile and very handy technical analysis indicator for identifying entry and exit points, multiple support and resistance levels and overall market trend. The beauty of Ichimoku is that while it generates trading signals, it also tells us the strength of those signals. Similarly while it identifies the trends, it also indicates the momentum of the trend.

At the first glance a Ichimoku cloud chart may seem to be a complex set of too many components but the truth is that it is as simple to use as it is powerful.

We will try to explain this indicator in a simple manner. However, It would be better if the focus remains on familiarizing oneself with the names of the components and the usage rather than going into the details of the formulas and their construction aspects.

Before we start, we wish to mention that the Ichimoku cloud works better on longer time-frame charts (i.e. daily or weekly charts) and should be avoided on shorter time frame charts. In fact we recommend daily charts more than other time-frames.

Components and Construction

20cloud%20components.jpg /%

The above chart illustrates the Ichimoku Kinko Hyo on a Forex trading platform. Please check this chart for a better picture of the construction of this indicator.

As we had indicated above, please note that at the first glance, the construction of the Ichimoku cloud may seem complex, but in fact people who have been using the crossover methods of moving averages. or MACD will find that the cloud works in a similar way. The beauty of this indicator is that it serves the purpose of a combination of indicators to identify trends, strength of the trend, multiple levels of resistances and supports as well as to generate trading signals — hence the name Ichimoku, which means one glance. It tells us a lot in just one glance.

The Ichimoku cloud consists of five lines or components. Out of these, two lines called Senkou Span A and Senkou Span B make the main cloud. The other three are known as the Tenkan Line, the Kijun Line, and the Chikou Span.

Components

- Senkou Span A or Leading Line 1

- Senkou Span B or Leading Line 2

- Cloud: made by Senkou Span A and Senkou Span B lines.

- Tenkan-Sen (Tenkan Line)

- Kijun-Sen (Kijun Line)

- Chikou Span or Lagging Line

Japanese terms related to Ichimoku cloud

Being an indicator developed in Japan, all the terms related to Ichimoku cloud have Japanese names. Before we go ahead let’s have a look on the meanings of the Japanese terms used for various components.

- Ichimoku. Ichi in Japanese means one (1). Ichimoku means One glance

- Kinko = Balance

- Hyo = Chart

- Ichimoku Kinko Hyo = Balanced (equilibrium) chart at a glance

- Sen = Line

- Tenkan Sen = Conversion line

- Kijun-Sen = Base line

- Senkou-span A = Leading span 1

- Senkou-span B = Leading span 2

- Chikou = Lagging span

- Kumo = Cloud

Calculation

The original period setting for Ichimoku cloud, as described later, used to be with periods 9, 26 and 55. Based on these periods the various components of Ichimoku cloud are calculated as follows:

- Tenkan Line (Conversion Line): (highest high + lowest low)/2 calculated over last 9 periods.

- Kijun Line (Base Line): (highest high + lowest low)/2 calculated over last 26 periods.

- Chikou Span (Lagging Span): most current closing price plotted 26 time periods back.

- Senkou Span A (Leading Span A): (Tenkan Line + Kijun Line)/2 plotted 26 time periods ahead.

- Senkou Span B (Leading Span A): (highest high + lowest low)/2 calculated over past 52 time periods and, sent 26 periods ahead.

Lag and Lead times for plotting Senkou and Chikou spans

As clear from the above formulas, the Senkou spans which form the main cloud are plotted in advance for the future and the Chikou spans are plotted with a time lag by the same number of periods. These facts are explained visually in the following chart:

20cloud%20calculations.jpg /%

Please note that the above explanation is for the Ichimoku cloud with settings of 9, 26, and 55. These were the original settings when a trading week used to be a six-day week. Nowadays, many of the traders use the settings of 7, 22, and 44 periods. If we use the period settings of 7. 22 and 44 then the values 9, 26 and 55 will have to be replaced by 7, 22 and 44 respectively, in the above formulas. This is also covered under the section Period Settings .

Trading Signals

The trading signals generated by Ichimoku cloud are not just limited to buying and selling signals but also include resistance and support levels and trend identification. These are as follows:

Resistance and Support Levels

Ichimoku provides multiple levels of resistance and support levels. These are as follows:

The main resistance and support levels can be derived from the Tenkan Sen, the Kijun Sen, and the upper and lower edges of the main cloud. These levels indicate either the support level or the resistance level depending on the position of the price-action.

Second level of resistance or support

The second level of resistance or support is the Kijun Line. When the price-action breaks below the Tenkan Line during an upward move, then the Kijun Line becomes the second level of support. Similarly, when the price-action breaks above the Tenkan Line during a downtrend, then the Kijun Line becomes the second level of resistance.

Third and forth levels of resistance or support

The third and fourth levels of resistance or support are either the upper edge or the lower edge of the cloud. When the price-action is above the cloud during an uptrend and both the first and second levels of support of the Tenkan Line and the Kijun Line are broken, then the upper edge and the lower edge of the cloud become the third and fourth levels of support, respectively.

Similarly, during a downtrend, when the price-action is below the cloud and breaks above the resistance of the Tenkan Line and the Kijun Line, then the lower edge and the upper edge of the cloud become the third and fourth levels of resistance, respectively.

Trend Identification

The Ichimoku cloud can be used to identify and analyze underlying trends, that is, if a trend exists. The trend can be identified as follows:

Position of the price-action with respect to the cloud

- When prices are closing below the cloud, it means a bearish trend or a downtrend.

- When the prices are closing over the cloud, it means a bullish trend or an uptrend.

- When the price action is inside the cloud, it means a range or a sideways movement.

Position of the price-action with respect to various support and resistance levels

The resistance and support levels are derived from the Tenkan Line, the Kijun Line, the upper edge of the cloud, and the lower edge of the cloud. These levels act as support when the price-action is above these levels, and the same levels become resistance when the price-action is below these levels.

Strong Uptrend

A strong uptrend is indicated when the price is above the cloud and continuously stays above the first level of support of the Tenkan Line.

Strong downtrend

A strong downtrend is indicated when the price is below the cloud and continuously stays below the first level of resistance of the Tenkan Line.

Position of the Chikou Span with respect to the cloud

- Downward (bearish) pressure if the Chikou Span remains below the current price-action

- Upward (bullish) force if the Chikou Span remains above the current price-action

Bullish and Bearish Crossover Signals

The trading signals given by the cloud are of two kinds:

- Crossover signals

- Non-crossover signals

Crossover signals with classification according to strength

These signals are generated by the crossover of the Tenkan Line and the Kijun Line. Similar to the strength of the trend, the Ichimoku signals also tell us whether the signal is strong or weak.

- Tenkan Line crossing over the Kijun Line means a bullish signal for a long-position.

- Tenkan Line moving below the Kijun Line means a bearish signal for a short-selling trade.

The beauty of this indicator is that it also indicates the strength of the signal so that the weaker signals can be ignored.

Points to be observed:

- Position of crossover with respect to the cloud: The crossover may take place above the cloud, below the cloud or inside the cloud.

- Position of the price-action with respect to the cloud, at the time of the crossover.

- Position of the Chikou span with respect to the cloud, at the time of the crossover.

The logic behind the classification according to the strength is quite simple and is as follows:

- A bullish signal when the price-action is already in a bullish trend is considered as a strong bullish signal.

- A bearish signal when the price-action is already in a bearish trend is considered as a strong bearish signal.

Strong Bullish Signals

- The Tenkan Line moves above the Kijun line.

- At the time of the crossover, the price-action is above the cloud.

- At the time of the crossover, the Chikou span is above the cloud.

- The crossover takes place above the cloud.