How will the US$ Affect Grain Markets

Post on: 7 Август, 2015 No Comment

Ted is the Chief Market Strategist and Vice President in charge of the Zaner Ag Hedge Group and specializes in agricultural hedging employing various strategies using futures, futures spreads, outright options and option combinations. He believes it is paramount to be able to use different strategies to adapt to market conditions. Ted works with large to mid size grain and livestock producers and end users in North, Central and South America.

How will the US$ Affect Grain Markets?

Mar 05, 2015

TRADING COMMODITY FUTURES AND OPTIONS INVOLVES SUBSTANTIAL RISK OF LOSS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. YOU SHOULD CAREFULLY CONSIDER WHETHER TRADING IS SUITABLE FOR YOU IN LIGHT OF YOUR CIRCUMSTANCES, KNOWLEDGE AND FINANCIAL RESOURCES.

The general affect of the US$ on grain prices is pretty straight forward. A stronger US$ makes exports less competitive while a weaker US$ makes exports more competitive. Also, a stronger US$ can be an indication of deflation which suggests lower commodity prices while a weaker US$ can be an indicator of inflation which suggests higher commodity prices. For the most part the US$ is not a daily driving factor for grains unless it is at extremes. Different markets can have more or less exposure to US$ fluctuations. Lets take a look at how the individual grain markets are affected by the higher US$.

When the US$ is strong it means it is gaining value relative to other currencies. This means that a strong US$ takes more of a given foreign currency to exchange for goods. So, if for example you are in Mexico and buying corn from the US and had to convert your pesos to US$ it would add to your overall cost because you would have to spend more pesos to convert to the US$. In this case you may look to another country to see if you have a more favorable currency conversion. In this particular example it would take a major difference in the exchange rate for Mexico to buy corn from say South Africa because of the increase in shipping costs and/or higher local basis, but this exercise is meant to highlight that a strong US$ could mean that global end users will at least look to other alternatives.

Domestically a strong US$ is generally bearish commodity prices as well. A strong US$ can be an indication of deflation which means commodity prices go down. Think of it this way — If the US$ gains value from one day to the next then theoretically it would take less of the US$ to buy something then it would have the day prior. This only happens when the US$ is at an extreme case. However, recently the US$ has broken out to levels we have not seen in some time. At the very least this keeps the fund buyers who buy commodities for fear of inflation on the sidelines. Also, in extreme cases a very strong US$ can make buying commodities imports attractive. It is unlikely this will happen on a mass scale, but it could serve to put a ceiling in for some commodities (soybeans in particular).

Now that we have the general affects out of the way lets look at corn, wheat and soybeans individually. Each of the grain markets have different levels of exposure to the US$. Wheat for example is a global commodity in the sense that it is grown most everywhere and there are many countries with exportable supplies. This means that the global market for wheat is a very competitive one. Global end users for wheat have many different options to shop around so this means that the wheat market is arguably the most sensitive to strength in the US$. Corn on the other hand has much less global competition. While there certainly are multiple countries with exportable stocks of corn the US is far and away the largest corn exporter in the world. This means that a stronger US$ may have some impact on corn prices but, it could be fairly limited.

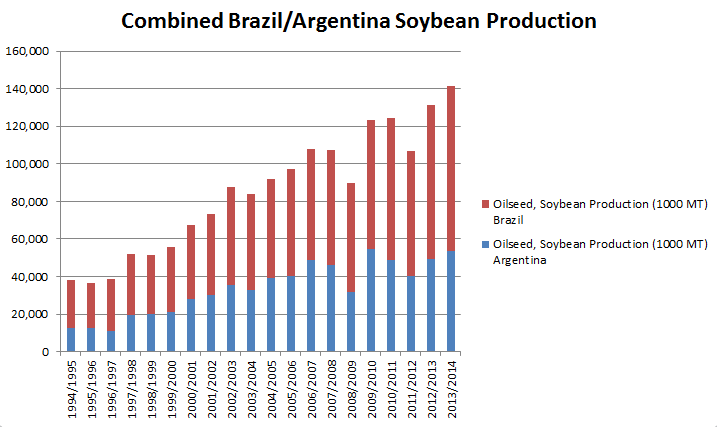

Soybeans have a complicated relationship with the US$. With China being the largest buyer of US soybeans and their currency pegged to the US$ a higher US$ does not have a large impact on their purchasing power. However, just as our purchasing power for South American soybeans gets more favorable as the US$ rises theirs does as well. Furthermore, as the Brazilian Real comes under pressure Brazilian farmers will get more for their soybeans. The problem here is that the perception in Brazil may be that the currency advantage may get better over time and could cause Brazilian producers to defer sales. The other problem here is that if the US$ continues to rise against the Brazilian Real producers may be faced with a challenge when they go to buy inputs which are mostly based on US$ pricing. This creates a difficult situation for the Brazilian producer and may cause them to be reluctant to sell soybeans at least until they feel the currency conversion is flattening out.

The bottom line is that a continued rally in the US$ is negative for most commodities as it has an effect on both global and domestic purchasing power. The soybeans have the most complex relation ship with the US$ and although a higher US$ is mostly negative for prices it could also potentially slow producer sales. This is a situation that will need to be followed closely as we get into the time frame where South America should be getting the lion share of global export interest.

www.zaner.com/offers/calendar.asp

* My wife and I are very excited to welcome our new baby girl Emma to the world! She was born last Friday weighing 7lbs 12oz. Thanks to everyone for their support.

Feel free to give me a call or shoot me an email if you would like to talk about your marketing plan, the markets, weather, or just to visit. Also, follow me on twitter @thetedspread if you like.

May Corn Daily chart:

May Soybeans Daily chart:

May Wheat Daily chart:

All this means that speculators should be looking for opportunities and producers need to look to lock up some prices. Give me a call for some ideas. In particular, producers looking to hedge all or a portion of their production may be rather interested in some of the options / options-futures strategies that I am currently using.

In my mind there has to be a balance. Neither technical nor fundamental analysis alone is enough to be consistent. Please give me a call for a trade recommendation, and we can put together a trade strategy tailored to your needs. Be safe!

Ted Seifried (312) 277-0113 or tseifried@zaner.com

markethead.com/2.0/free_trial.asp?ap=tseifrie

Futures, options and forex trading is speculative in nature and involves substantial risk of loss. This commentary should be conveyed as a solicitation for entry into derivitives transactions. All known news and events have already been factored into the price of the underlying commodities discussed. The limited risk characteristic of options refers to long options only; and refers to the amount of the loss, which is defined as premium paid on the option(s) plus commissions.

FOR CUSTOMERS TRADING OPTIONS, THESE FUTURES CHARTS ARE PRESENTED FOR INFORMATIONAL PURPOSES ONLY. THEY ARE INTENDED TO SHOW HOW INVESTING IN OPTIONS CAN DEPEND ON THE UNDERLYING FUTURES PRICES; SPECIFICALLY, WHETHER OR NOT AN OPTION PURCHASER IS BUYING AN IN-THE-MONEY, AT-THE-MONEY, OR OUT-OF-THE-MONEY OPTION. FURTHERMORE, THE PURCHASER WILL BE ABLE TO DETERMINE WHETHER OR NOT TO EXERCISE HIS RIGHT ON AN OPTION DEPENDING ON HOW THE OPTIONS STRIKE PRICE COMPARES TO THE UNDERLYING FUTURES PRICE. THE FUTURES CHARTS ARE NOT INTENDED TO IMPLY THAT OPTION PRICES MOVE IN TANDEM WITH FUTURES PRICES. IN FACT, OPTION PRICES MAY ONLY MOVE A FRACTION OF THE PRICE MOVE IN THE UNDERLYING FUTURES. IN SOME CASES, THE OPTION MAY NOT MOVE AT ALL OR EVEN MOVE IN THE OPPOSITE DIRECTION.