How & Why Oil Impacts The Canadian Dollar (CAD)

Post on: 9 Апрель, 2015 No Comment

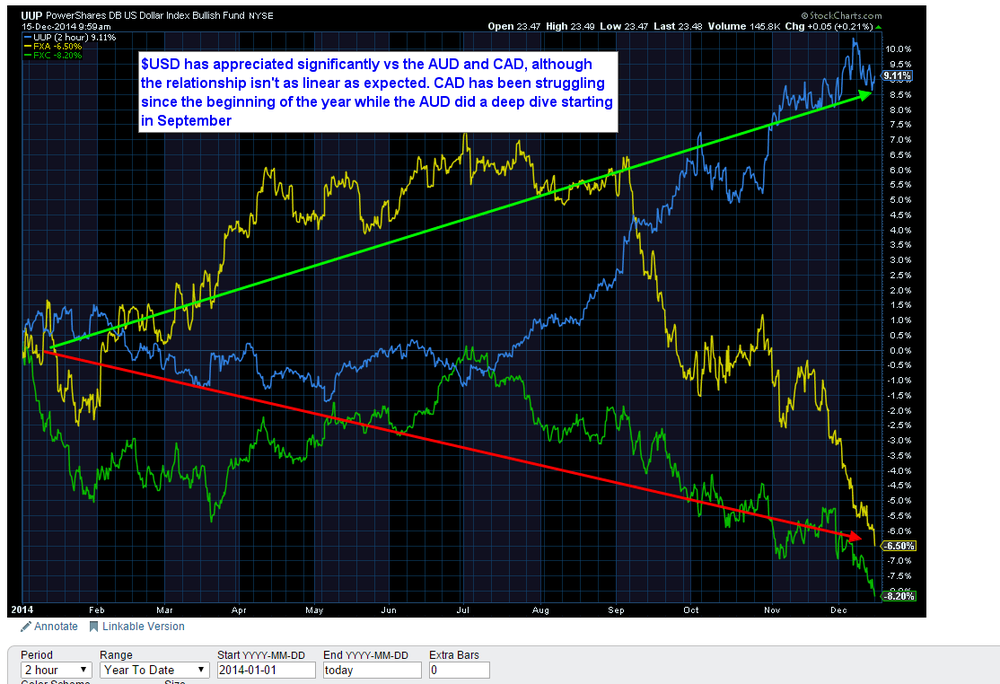

Over the last six months, the value of the Canadian dollar (loonie) has declined by approximately 12 percent, relative to that of the US dollar. Simultaneously, the price of oil fell by approximately 48 percent. The positive correlation between the two variables (the Canadian dollar-US dollar exchange rate. and oil prices) is high and has existed for a long time. A 10-year analysis of the correlation between the Canadian currency (against the US dollar) and oil prices show that there is a 0.78 positive relationship, with a score of 1 indicating a perfectly positive relationship. This high correlation — and the considerable extent to which the value of the Canadian dollar is tied to the US dollar — can be directly attributed to the way Canada earns US dollars, and the percentage of Canada’s revenue that this constitutes. A large part of Canada’s US dollar income comes from the sale of energy-based goods to the rest of the world and to the USA in particular. (For related reading, see article: Canada’s Commodity Currency: Oil And The Loonie )

Correlation of Canadian Dollar to Oil Prices

There has been a strong positive relationship between the price of oil and the Canadian dollar-US dollar exchange rate (which is expressed as either the price of the Canadian dollar in terms of US dollars (CAD/USD) or the price of the US dollar in terms of Canadian dollars (USD/CAD )), stretching back far into the past. As previously mentioned, a correlation analysis of data going back to January 2005 indicates that there is a 0.78 positive correlation between the Canadian/US dollar exchange rate and oil prices. This high positive relationship indicates that over the long run the likelihood is very high that increases in oil prices will result in increases in the value of the Canadian dollar relative to the US dollar. In fact, for 8 of the last 10 years, the direction of year-over-year changes in the Canadian/US dollar exchange rate and in oil prices have been the same. Figure 1 shows historical oil prices and the Canadian/US dollar exchange rate going back 10 years. Both data sets have similar trends (Note: Both series have been scaled for ease of comparison). (For a broader look at the Canadian dollar, see article: The Canadian Dollar: What Every Forex Trader Needs To Know .)

Contribution of Crude Oil Sales to Foreign Exchange Earnings

The high positive correlation between the Canadian/US dollar exchange rate and oil prices is due, in large part, to the large portion of the nation’s total foreign exchange earnings that is garnered through crude oil sales. Crude oil is the largest single contributor of foreign exchange to Canada, and its share has been increasing with the growth of oil sands. (See: Understanding The Economics Of Canadian Oil Sands .) Presently crude oil constitutes over ten percent of Canada’s total current account receipts — which represents all foreign exchange earned from the sale of goods and services, from financial and employment income,and from grants, and there is no other single service or single income source that generates as much foreign exchange as crude oil.

Over the last 6 years, crude oil has been the largest component of goods exported. Goods exported has accounted for over 72 percent of current account receipts earned by Canada. The top 5 categories of goods exported have contributed over 66 percent of the total goods exported and over 46 percent of current account receipts. These 5 categories of goods are ‘Mineral Fuels’, ‘Vehicles & Aircrafts’, ‘Machinery, Electrical Equipment, Parts etc’, ‘Base Metals’, and ‘Products of Chemical or Allied Industries’ (see figure 2). Of the top 5 goods, ‘Mineral fuels’—energy-based exports—is the largest foreign exchange earner. Crude oil accounts for over 60 percent of foreign exchange earned from ‘Mineral Fuels’, and it is also larger than the second, third, fourth and fifth largest category of goods exported.

The price of any commodity or service is determined by demand and supply, and in the case of the Canadian/US dollar exchange rate, the price is determined by the demand and supply of both Canadian dollars and US dollars. (For related reading, see: Main Factors That Influence Exchange Rates .)

Crude oil is priced in terms of US dollars by most importers, and so it’s not surprising that US dollars are likely the preferred currency for most energy-based transactions between Canada and the rest of the world. Furthermore, 97 percent of crude oil exported by Canada is shipped to the USA, and because crude oil exports account for a large portion of the US currency that is earned by Canada, movements in the price and the volume of crude oil have a significant impact on the flow of US dollars into the Canadian economy. In times of high oil prices, the amount of US dollars earned by Canada on each barrel of oil exported will be high, and therefore the supply of US dollars will be high relative to the supply of Canadian dollars, resulting in an increase in the value of the Canadian dollar. Conversely, when the price of oil is low the supply of US dollars will be low relative to that of the Canadian dollar, resulting in a fall in the value of the Canadian dollar. (For related reading, see article: Commodity Prices And Currency Movements .)

Importance of Crude Oil is Increasing

The importance of crude oil as a source of foreign exchange for Canada has been increasing over the last 6 years. Within these six years, the percent of Canada’s total earnings that have been generated by the sale of crude oil — which falls under the ‘Mineral Fuels’ category — has increased from 56 percent to approximately 74 percent. Also, the portion of Canada’s total current account receipts that is derived from crude oil sales increased from just over 10 percent to approximately 15 per cent. This growth in the share of Canada’s revenue that is earned through the sale of crude oil can be attributed to the expansion in the extraction of Canadian oil sands, a section of Canada’s oil industry which grew approximately 57 per cent over the last 6 years. Over the same period natural gas production has declined slightly, while the production of conventional oil rose by 24 percent.

The Bottom Line

The USD/CAD exchange rate is highly correlated to the price of oil. Correlation analysis of historical data going back 10 years for both series shows that both are correlated to the tune of 78 percent. While this high correlation does not mean that the aforementioned exchange rate and the price of oil will move in the same direction all the time, it does indicate that these two will move in the same direction most of the time.

This highly positive relationship between these two variables is partly due to the large contribution of oil to the amount of US dollars earned by Canada. Crude oil is the largest single contributor to the total amount of foreign exchange earned by Canada, and the importance of crude oil to the foreign exchange earnings of Canada has been increasing over time.