How Volatility Affects Forex Traders in Today’s Market

Post on: 22 Июль, 2015 No Comment

If you’re new here, you may want to subscribe to receive daily updates. Thanks for visiting!

For those of us trading forex expert advisors or trend following strategies, we may have gotten significantly less trades or signals from our systems. Or we may find that strategies which worked well previously are under-performing, or under-trading.

Lowest volatility in 10 years

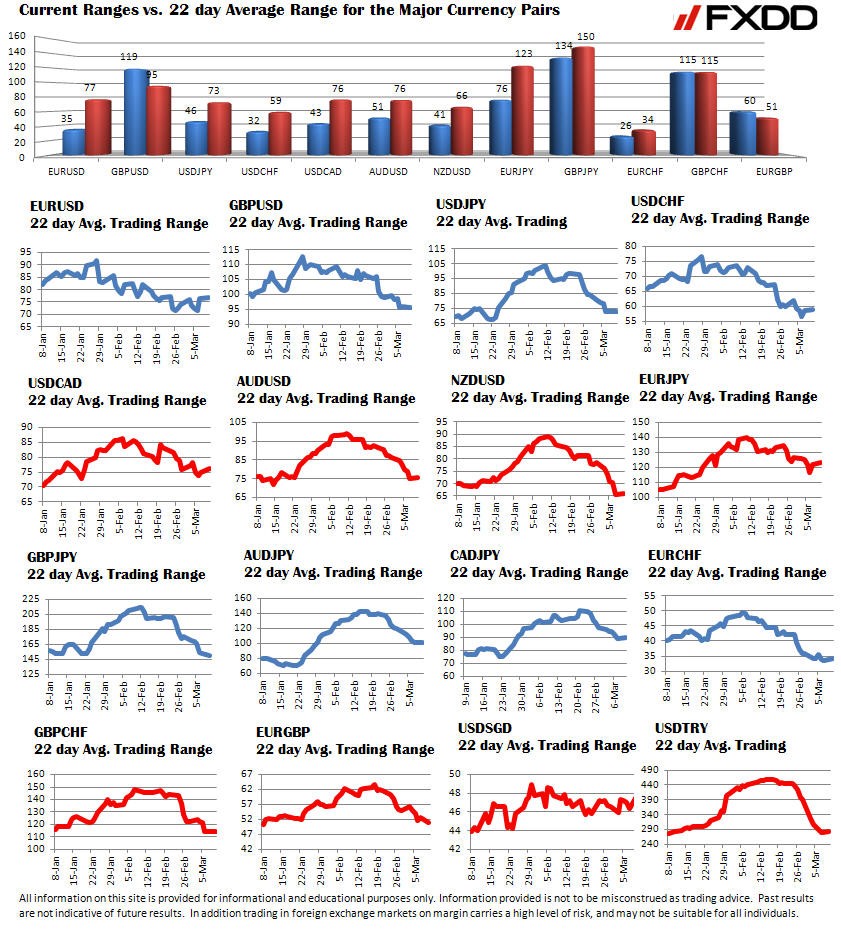

Currency volatility continues to hover at levels not seen in over 10 years, falling to its lowest level in more than 10-years in the second quarter. This can be attributed to rising geopolitical risks and downside risks to global growth. As a result financial market volatility has fallen back again as evident by the VIX index which has declined:

Why do forex traders care about volatility?

Investors look at various volatility indices due to following main reasons:

- Higher volatility means more risks, and also more opportunities

- Market tends to fluctuate more and by a larger extent

- Some trading algorithms work only with low volatility while others need high volatility

- Risk management techniques need to be adjusted based on the changes in market volatility

- Higher volatility introduces more emotional stress for any trader

- In a higher volatility environment historical correlations between various currency pairs tend to experience short-term deviations

Measuring Ranges on Metatrader 4 (MT4) Trading Platform

The Average True Range indicator stands above most others when it comes to the measurement of volatility. ATR was created by J. Welles Wilder (the same gentlemen that created RSI, Parabolic SAR, and the ADX indicator), and is designed to measure the True Range over a specified period of time.

ATR is a default indicator on the MT4 platform which appears as a single line below your charts. Below is the average daily range of EURUSD from 2010 to 2014, note how it has been decreasing:

Source: hushtrade.com

Ending of Low Volatility Environment?

Price action in foreign exchange markets over recent months suggests currencies previously thought of as risky, such as the Australian dollar or Sterling, have continued to perform well during times of geopolitical tensions and rallying US Treasury markets. The only pair still exhibiting a clear correlation to traditional risk factors has been US dollar/Japanese yen.

One conclusion for investors could be that the general lack of trends in G10 currencies will continue, with the dollar failing to recover in a sustained way until major global central banks markedly accelerate their pace towards monetary policy normalization. The current record low volatility in forex markets may end as the Bank of England and Federal Reserve consider raising rates sooner than expected.