How to Withdraw from 401k or IRA for the Down Payment on a House

Post on: 16 Март, 2015 No Comment

Buying a home can be a big step towards securing your financial future, but saving for the down payment can be very time-consuming.

However, if you already have money in your retirement accounts, you might be able to use it to speed up the process. Well discuss which accounts dont penalize you when you use the money to buy a first home as well as strategies for saving on penalties and taxes.

Using Your IRA for a Home Down Payment

The IRS discourages you from withdrawing money from your retirement accounts early by charging a 10% penalty on withdrawals before you turn 59 1/2.

Roth IRA

Among the various kinds of retirement accounts, pulling money from a Roth IRA will cost you the least in taxes and penalties. This is because you can withdraw contributions at any time without penalty or tax. In addition, after youve held the account for five years, you can withdraw up to $10,000 in earnings without penalty or tax for the purchase, repair, or remodel of a first home. In other words, if you withdraw all of your contributions, you can still withdraw another $10,000 and not pay the 10% penalty or taxes on any of it.

There is one caveat however: you only have 120 days to spend withdrawn earnings or you may be liable for paying the penalty. Also, for your convenience, your financial services firm will automatically prioritize the withdrawal of all of your contributions from a Roth IRA before any earnings.

Traditional IRA

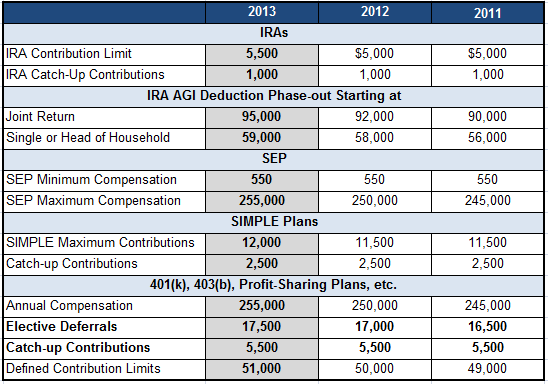

The next best choice is a traditional IRA. Youre still able to withdraw up to $10,000 for the purchase, repair, or remodel of a first home without paying a penalty, but youll have to pay regular income tax on the entire amount. SIMPLE and SEP IRAs follow the same rules.

With a traditional IRA, you must also use the money within 120 days for the purchase of a home or youll get hit with the 10% penalty. Alternatively, you can withdraw up to $10,000 penalty-free for the purchase of a home for your spouse, parents, children, or grandchildren.

Just like with a Roth IRA, your spouse can also withdraw $10,000 from his or her traditional IRA, so you can collectively obtain $20,000 penalty-free for a down payment if youre married. The $10,000 limit is a lifetime limit for each individual.

Using Your 401k for a Down Payment

Theres no specific penalty exemption for home purchases when you pull money out of a 401k. so any money you take out will be classified as a hardship exemption. Youll be assessed a penalty of 10% on the amount withdrawn and youll have to pay income tax on it as well.

If possible, roll over the amount you want to withdraw to an IRA, so you can avoid paying the penalty. However, you cant roll over a 401k thats with an employer for whom you are still working. If you have an old 401k from a former employer, roll that. Since a rollover can take time to process, fill out the necessary paperwork as soon as possible.

Borrowing from Your 401k

Another option with a 401k is to take out a loan. Your loan can be up to $50,000 or half the value of the account, whichever is less. As long as you can handle the payments (yes, you have to pay back this loan), this is usually a less expensive option than a straight withdrawal. Though you will pay interest, you wont pay taxes or penalties on the loan amount.

A few things to know about 401k loans:

- Since youre incurring debt and will need to make monthly payments on the loan, your ability to get a mortgage may be affected.

- The interest rate on 401k loans is generally about two points above the prime rate. The interest you pay, however, isnt paid to the company it goes into your 401k account.

- Many plans give you only five years to repay the loan. In other words, if you borrow a large amount, the payments could be substantial.

- If you leave your company, you may be required to pay back the outstanding balance within 60 to 90 days or be forced to take it as a hardship withdrawal. This means youll be hit with taxes and penalties on the amount you still owe.

- If payments are deducted from your paycheck, the principal payments will not be taxed but the interest payments will. Since youll be taxed again on withdrawals during retirement, the interest payments will end up being double-taxed.

Sometimes it makes sense to take a loan from your 401k to cover the down payment, like if youre getting an FHA loan and only need a small down payment. However, a large loan payment could have a big effect on your mortgage qualification.

Consider that a $5,000 401k loan will have a payment of $93 per month (at a 6% interest rate) over five years, while a $25,000 loan will have a payment of $483 per month. The latter payment could seriously hinder your ability to pay the mortgage every month, and the bank will take this into consideration when figuring what you qualify for.

Therefore, its wise to run numbers and ask your mortgage broker how such a loan will affect your qualification before you take one out. Conversely, if the amount you need will have too adverse an affect on your qualification, it might make sense to withdraw the down payment amount and pay the taxes and penalties.

Mortgage Interest Tax Strategy

Keep in mind that youll be deducting mortgage interest on your taxes after you purchase your home. This may actually wash with some or all of the income you report from a retirement account withdrawal.

For example, lets say you withdrew $25,000 from your 401k and paid $25,000 in mortgage interest the same year. The $25,000 youll report in additional income (from the 401k withdrawal) will wash with the $25,000 mortgage interest deduction. In other words, your taxable income wont be increased by the withdrawal, and you will effectively pay no tax on it.

However, you will still be liable for the 10% penalty, which is $2,500 in this case. This type of strategy can work for IRA, SIMPLE, and SEP withdrawals as well, but you wont be liable for the 10% penalty unless you withdraw more than $10,000.

Retirement Account Withdrawal Comparison

So which is best? This depends on what accounts you have and how much you have contributed to them. But in general, youll be assessed fewer taxes and penalties if you withdraw money for your down payment from a Roth before a traditional IRA, and from either of those before a 401k. Whether a 401k loan is better than an IRA withdrawal depends on how large it is and whether it will affect your ability to qualify for the amount and type of mortgage you want.

- Contributions in your Roth IRA. No income tax due, will not owe 10% penalty.

- Earnings in your Roth IRA up to $10,000 for the purchase of a first home. No income tax due, will not owe 10% penalty.

- Small 401k loan. Will not owe income tax or penalty. Monthly payments will be small and will have a minimal affect on mortgage qualification.

- Any withdrawal from a traditional IRA, SEP-IRA, or SIMPLE IRA up to $10,000 for the purchase of a first home. Income tax due, will not owe 10% penalty

- Earnings in your Roth IRA over $10,000 for the purchase of a first home. Income tax due, will owe 10% penalty.

- Any withdrawal from a traditional IRA, SEP-IRA, or SIMPLE IRA over $10,000. Income tax due, will owe 10% penalty

- Large 401k loan (limited to half of balance or $50,000, whichever is smaller). Will not owe income tax or penalty. Monthly payments can be large and substantially affect mortgage qualification.

- 401k withdrawal of any amount. Will owe income tax and 10% penalty.

Final Word

I withdrew money from my IRA to purchase our home and am especially happy since the stock market tanked soon after. Saving up for a down payment can take quite a while. The sooner you get into a home, the sooner you can start saving money on rent and deducting the mortgage interest on your taxes every year. You can also withdraw up to $10,000 without penalty from these accounts for the remodel or repair of a first home.

Are you planning to purchase a home soon? What is your source for the down payment?