How To Use The Stochastic Oscillator

Post on: 25 Июнь, 2015 No Comment

Binary options have been around for a while but it became a big hit with the rapid technological development. Nowadays, people in every corner of the world seek the assistance of binary option trading in order to make money while staying at home. This has given birth to a wide range of tools, which can make your life easy in binary option trading. The stochastic oscillator can be defined as a perfect example for this. George Lane created the Stochastic Oscillator primarily as a tool to evaluate price momentum displayed using a range between 0 and 100. This article will let you know the method on how you can use it in binary option trading.

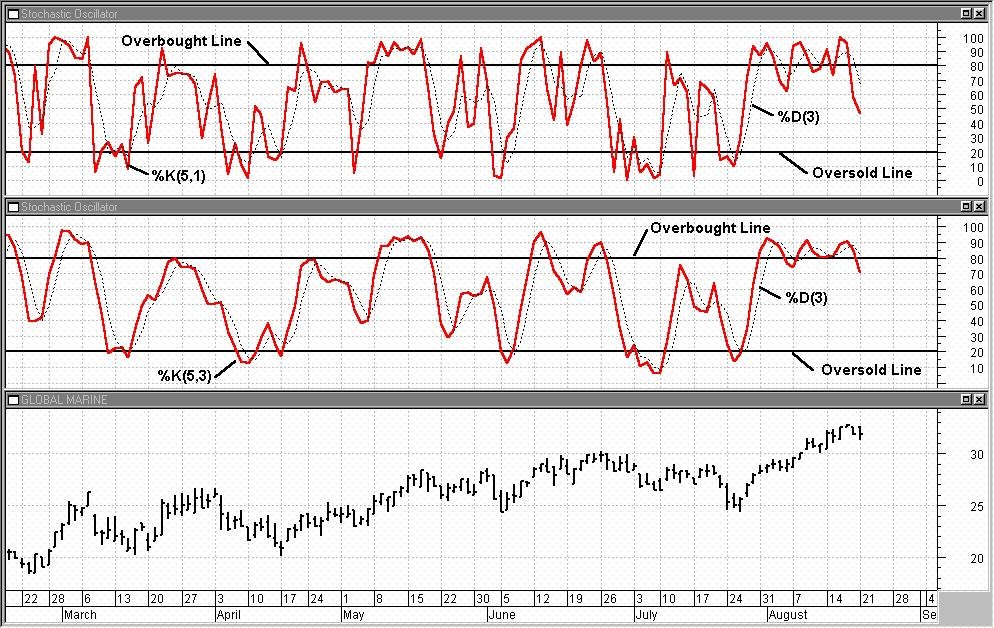

The Stochastic Oscillator indicator is a great FX indicator that was introduced to the world in 1950s. It is worth noting that this FX indicator is still used to this day by a lot of binary option traders worldwide. This article will describe how to supercharge your trading system with Stochastic Oscillator for great gain in any binary option stock trading. The Stochastic Oscillator shows the location of price in relation to local high and low of the last 5 candles. As a conclusion, when it reaches its low values it means that price is near a support level, and when it reaches overbought level it is near resistance level It is recommended to confirm these signals by price-action, to confirm that the price is actually on a support or a resistance level.

One trading tactic of trading the Stochastic is the overbought oversold system. When this index touches the overbought level downwards it is a sign that the bullish trend is at its end and it is the time to sell. When the Stochastic Oscillator index crosses the oversold level upwards it is a buy signal and a sign that an uptrend is about to begin. The idea behind this trading tactic is that when the price touches support or resistance level and begins to reverse, we join the trend and profit from it. It is recommended to trade with another Stochastic Oscillator with a longer period of calculation, to confirm the trend direction and make the signals more accurate. Another advantage of this method is the fact that it trades with very small stop loss.

Another trading method that uses this oscillator is the middle-line cross. When the index touches the middle-line from above it is a short signal and when it crosses it from below it is a long signal. This is the ordinary trend-following trading tactic that is late but may profit at Forex pairs that trend strongly. The POP tactic is also a popular trading technique. The basis of this system is to enter long trade when the index goes above 70, and sell trades when it goes below 30. Trades are closed when the Stochastic crosses the overbought or the oversold.

In conclusion, the Stochastic Oscillator is a very strong technical indicator that made profits for the last 65 years and will continue to profit this way for years to come. Learn to use and master this FX indicator, as it could highly improve your trading system and win rate.