How To Use ATR (Average True Range) In Trading Systems

Post on: 24 Июнь, 2015 No Comment

Recommended:

How To Use ATR (Average True Range) In Trading Systems

Fri, 06/26/2009 — 08:20 — IndicatorForex.com

The Average True Range is an indicator developed by Welles Wilder and published in his famous book ‘New Concepts in Technical Analysis’. It is used to calculate the average size of bar, in points. The word ‘True’ is added to the name because the indicator also takes into account Gaps and Limit moves, when calculating Average Range.

Absolutely NO THINKING is needed, just buy when Blue and sell when Red.

Calculation of the Indicator

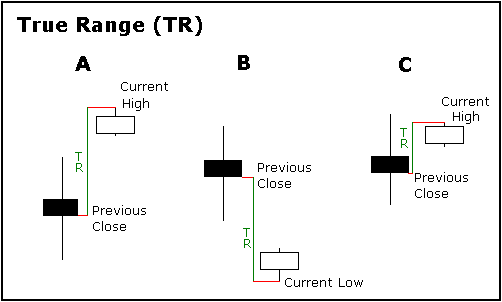

For each bar, True Range is defined as the maximum of the three:

1. Difference between High and Low.

2. Difference between High and previous Close.

3. Difference between Low and previous Close.

Than, a Moving Average (normally of 14 period) is calculated on the True Range, making it the Average True Range.

How to Use in Trading Systems

Identifying Bottoms and Tops

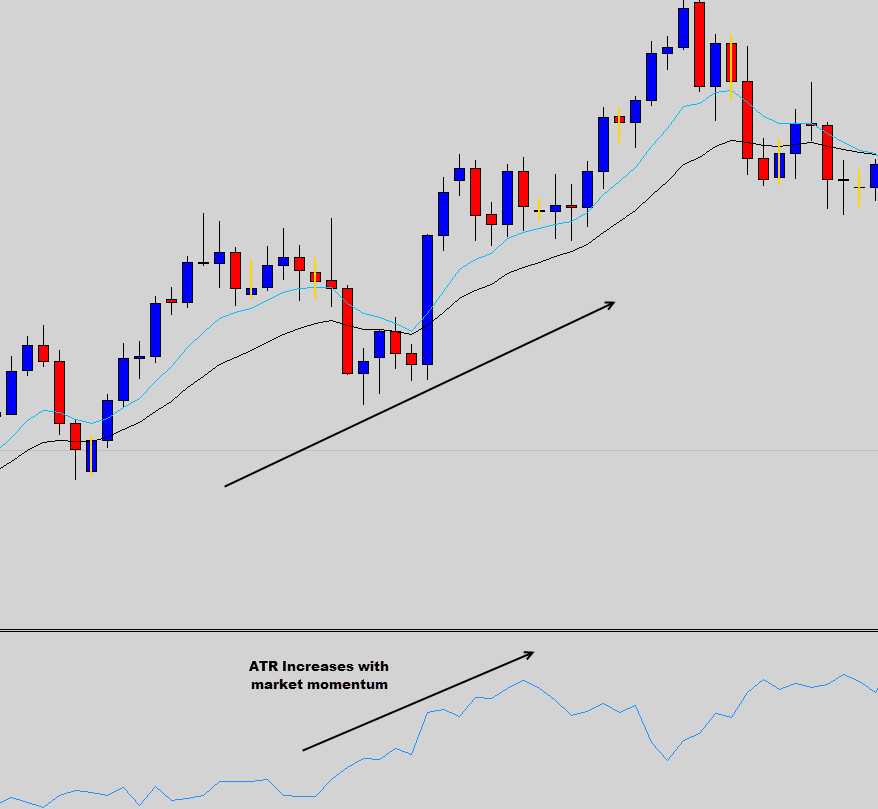

The ATR can be very useful in identifying potential bottoms and tops in markets. Using the assumption that bottoms and tops occur on light volume (and hence lead to reversal), a common way of interpreting the ATR is by looking for low readings. Periods where the ATR is in his local minimum indicate that price has reached a top or a bottom, and is prone to reversal.

Globalize Trading Systems to Adapt To Changing Market Volatility

Many novice trading systems are using solid number, hard coded in their systems, as parameters. For example: 15 pips for Stop Loss, 30 pips for Take Profit, etc. This is a wrong attitude of creating Trading Systems, because pairs and commodities constantly change in volatility and volume.

The ATR indicator can be used instead of solid number, to make the Trading System take into account the changing volatility of the commodity. For example: Instead of 15 pips for Stop Loss — 30% of the current Average True Range. Instead of 30 pips for Stop Loss — 60% of the current Average True Range. This way, in case market volatility changes dramatically, the Stop loss and Take Profit will auto-adjust themselves and your Trading System will continue to profit.

This is also very important issue to making the system global — to work on as many pairs and commodities. Using the ATR instead of using constant numbers can make your system work on many more pairs and commodities, thus increasing potential profits.

Trailing Stop Loss

The ATR can also be used for Trailing Stop Loss — a famous trailing stop loss mechanism called the ‘Chandelier’ stop loss uses the ATR to determine the amount of pips to trail stop. This way in case the currency pair becomes volatile the trailing stop adjusts itself and prevents early exit — and loss. This is also known as the Chandelier Trailing Stop, which is a well-known strategy for trailing stops in Trading Systems.

The ATR can be very powerful addition to your Trading System. Learn to use it and your trading systems will improve.

The Only FOREX Indicator that won 127,912$ in 2009!

Click here for more information