How to Trade ShortTerm (DayTrade)

Post on: 6 Июнь, 2015 No Comment

Talking Points:

- While short-term trading is attractive, it can also be dangerous. Short-term traders will often exercise poor risk management, and this can have very negative consequences. We share a strategy that can be used to trade short-term momentum with a focus on risk.

For every 10 traders that come to markets, at least 7 of them want to day-trade, or as we call it in the forex market, scalp. Even though many of these traders are still learning the market or are very new to trading, they know they want to embark on short-term trading.

The rationale behind this desire makes sense. After all, for most things in life the biggest rewards are for the hardest workers; those exhibiting the utmost of control and discipline long enough to properly implement their plan or strategy.

But trading is much different in the fact that this greater control that might be offered by short-term time frames introduces other, more difficult variables into the equation of a traders success.

By using a very short-term chart, traders expose themselves even more to the Top Trading Mistake. or The Number One Mistake that Forex Traders Make. Many of the reasons that traders lose money become even more difficult to contend with when scalping or day-trading. And if these traders are making other mistakes, such as using too much leverage or inappropriate strategy selection that top trading mistake can become even more problematic.

So, first and foremost before we get into the process of short-term trading, I want to specify that this is often the most difficult way for new traders to get started. Preferably, new traders will start with longer-term charts and approaches that may be more forgiving, and as they gain experience and comfort they can then elect to move into faster time frames.

The Biggest Challenge of Short-Term Trading

The biggest challenge of short-term trading is the same as the Top Trading Mistake. Too few traders looking to scalp actually do so correctly, under the incorrect presumption that trading on really short-term charts gives them enough control to trade without stops

While keeping your finger on the trigger may give you more control, it means absolutely nothing if prices gap against your position or if a really big piece of news comes out that completely de-rails your trading plan. So, even though you may be watching price action on a five or fifteen-minute chart, protective stops are still needed.

Further to this point, traders need to be able to focus on winning more when they are right than they lose when they are wrong. To put this another way, just because one is trading very short-term, it doesnt mean that they can ignore The Number One Mistake Forex Traders Make.

This can be a huge challenge on really short-term charts where near-term price movements are unpredictable. But its not impossible. In this strategy, Ill attempt to show you a way to do this.

An additional concern is variance. Per statistical analysis, the less information that is being analyzed in a data set, the less reliable that information becomes. If were looking at longer-term charts, such as the daily or the weekly charts, quite a bit of information is going into the formation of each individual candle. On a very short-term chart, the opposite is true. Significantly less information goes into each candle, and thereby each candle is less reliable as a forecast of future candle formations.

The Strategy

With all of the above being said, trading on short-term charts is still possible. It just requires that traders utilize even more control and discipline over their trading approaches and risk management. For new traders that often struggle with risk management, or staying disciplined; the results can be disastrous. But if those boxes are checked, traders can look to exert the upmost of control over their approach with shorter time frames.

But just because were trading on shorter-term charts, does that mean we want the entirety of our analysis to be performed on those time frames? Absolutely not. We can still incorporate analysis from longer time frames into our approaches in an effort to get the best probabilities of success.

The first step in the strategy is to add two moving averages based on the hourly chart. Most modern charting packages can offer the ability to build an indicator on a longer time frame, and we walk through the process to do just that for the Trading Station II platform in the article, Building a Better Indicator.

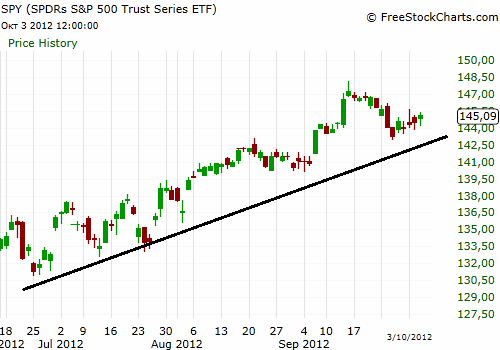

The indicators that I add are the 8 and 34 period exponential moving averages, based on the hourly chart but plotted on the 5-minute chart (shown below).

Multiple time frame analysis can help traders see the bigger picture

Created with Marketscope/Trading Station II; prepared by James Stanley

These indicators act as a compass for the strategy, helping to see whats taking place with a longer-term time horizon. If the faster 8 period moving average (based on the hourly chart) is above the slower 34 period moving average (also based on the hourly chart), then the strategy is looking to go long, and to only go long. As long as the hourly 8 period EMA is above the hourly 34 period EMA, only buy positions are entertained.

The hourly moving averages work like a compass, showing traders which direction to trade the trend

Created with Marketscope/Trading Station II; prepared by James Stanley

Once the trend has been identified, and the bias has been obtained, the trader can then look for entries in the direction of that trend; looking for momentum to continue on the 5-minute chart as it has been displayed by our hourly-moving averages.

And when looking to buy, we ideally want to buy low or sell high. So, just because the trend is up and were looking to buy, it doesnt mean we want to blindly do so. We still need a trigger for the position, and for this, we can incorporate another exponential moving average.

The trigger for this strategy is another 8 period exponential moving average, but this one is built on the shorter-term five-minute chart.

When price crosses the 8-period five-minute EMA in the direction of the trend, the trader can look to buy in anticipation of the bigger-picture trend coming back in force.

The trigger in the strategy is when price crosses the 8-period five-minute EMA in the direction of the trend

Created with Marketscope/Trading Station II; prepared by James Stanley

The large benefit behind the strategy is that just by the very act of price moving in the trend-side direction over the shorter-term EMA, traders are buying or selling short-term retracements in the direction of the momentum.

Risk Management

The most attractive part of the strategy is that it allows for traders to buy cheaply in anticipation of bullish momentum, or to sell expensively in anticipation of bearish momentum.

When prices make those short-term retracements, they create swings in price action. And per price action logic, of up-trends making higher-highs and higher-lows, traders can look to place the stop for their long position below the previous higher-low so that if the up-trend doesnt continue the trader can exit the position for a minimal loss.

Stops for long positions go below the prior periods opposing-side swing

Created with Marketscope/Trading Station II; prepared by James Stanley

In the case of short positions, traders would want to look to place stops for short positions above the previous lower-high, so that if the down-trend does not continue, the short position could be closed in an effort of mitigating the damage as much as possible.

In my opinion, this is the most attractive part of this type of strategy. It allows traders to attempt to avoid The Number One Mistake that Forex Traders Make even though very short-term charts are being used to trigger positions.

If momentum does continue in the trend-side direction, the trader could be in a very attractive position as prices continue to move in their favor.

Position Management

If the trend does continue, should the trader just sit on their limit order and wait for the sound of the cash register to cha-ching?

No way. When trading on short-term charts, things can change VERY quickly, and its the day-traders job to manage that risk.

When the position gets in the money by the amount of the initial stop (a 1-to-1 risk-to-reward ratio), the trader can look to move the stop to break-even so that, worst-case scenario should prices and momentum reverse, the trader puts themselves in a position to avoid taking a loss.

At this point, the trader can also begin scaling out of the position. Since a 1-to-1 risk-to-reward has been realized, the trader is actively attempting to avoid The Top Trading Mistake; and should momentum continue in the trend-side direction, the trader stands to profit considerably more.

As prices continue in the direction of the traders position, additional pieces of the trade can be closed or scaled out as prices move in their favor. We discussed this topic in the article, How to Reap Larger Rewards.

The goal is to get the average out from the strategy as large as possible, and if momentum is to continue, this strategy can allow the trader to do just that.

After the stop has been moved to break-even, and the initial risk is removed from the position; traders can even look to add-to the trade with new positions or new lots in an attempt to build a larger position with a significantly smaller amount of risk.

— Written by James Stanley

Before employing any of the mentioned methods, traders should first test on a demo account. The demo account is free; features live prices, and can be a phenomenal testing ground for new strategies and methods. Click here to sign up for a free demo account through FXCM.

James is available on Twitter @JStanleyFX

To join James Stanleys distribution list, please click here.

Are you looking to take your trading to the next level? The DailyFX 3 6 0 Course offers a full curriculum, along with private, weekly webinars in which we walk traders through dynamic market conditions using the education taught in the course.

Would you like to trade alongside seasoned professionals throughout the trading day? DailyFX On Demand gives you access to DailyFX Analysts during the most active periods of the trading day.

Would you like to enhance your FX Education? DailyFX has recently launched DailyFX University ; which is completely free to any and all traders!

Weve recently begun to record a series of Forex Videos on a variety of topics. Wed greatly appreciate any feedback or input you might be able to offer on these Forex videos: