How To Trade End Of Day Price Action Strategies at New York Close » Learn To Trade

Post on: 25 Май, 2015 No Comment

How To Trade End Of Day Price Action Strategies at New York Close

One of the key philosophies of my Forex trading approach is to trade end of day, and by that I mean trading after the New York close, which marks the end of the current Forex trading day. Many traders email me asking me things like Why is the New York close so important and How do I trade end-of-day and why should I? In this article I am going to answer these questions, so hopefully after reading it youll have a good idea as to exactly why end-of-day price action trading strategies are so powerful.

My objective here is to show you why I like to enter many of my price action signals at or shortly after the New York close, that means After Wall St Closes.

Why do so many traders enter trades at the End of the day?

The answers are quite simple:

1. Cleaner trading signals - Trading end-of-day removes noise and gives a clear and useful picture of what has occurred during the trading day. The signal carries more weight and has a higher probability than a signal which forms during the intra-day session. Many traders prefer to trade off these daily chart signals because it is a less stressful way to trade since you dont have to wade through hours of less-significant price action.

Especially for beginning and struggling traders, sticking to the daily chart time frames and trading in an end-of-day manner is very important for understanding how the markets move each day and for learning to trade from the most relevant view of the market.

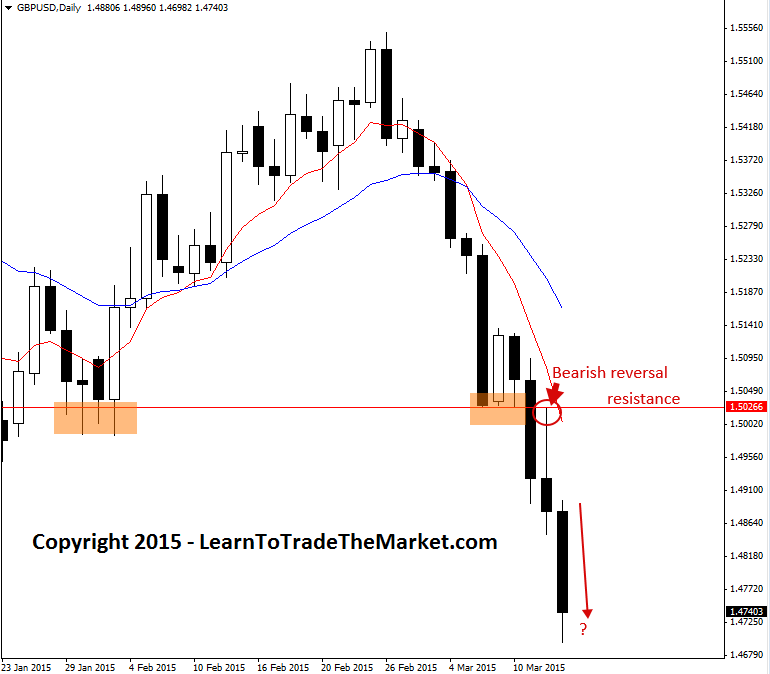

Heres an intra-day 15 minute chart of the GBPUSD and then a daily chart of the GBPUSD below it. You can see how much calmer and clearer the daily chart is and how it would be easier to trade off of and much less likely to cause you to trade emotionally than the 15 minute chart:

2. Time restrictions - A major factor in most traders lives is time, so the end-of-day approach allows the trader to go about their day to day business or job, and then come and look at the market at the end of the Wall Street close or shortly after, keeping an eye out for a nice price action signal. This is a far different approach than that of a day-trader who sits in front of his or her computer all day combing through tons of intra-day / short time-frame data trying to find a signal that will inherently be far lower probability than the same signal on the daily chart.

There is also a hidden benefit here; when you trade end-of-day and focus on the daily charts instead of the intra-day charts, you are FAR less likely to become emotional and over-trade. Traders who sit at their computers for hours on end and try desperately to find a signal, probably will find a signal. But it probably will not be a very high-probability one and it is more likely to be something they just sort of made up or rationalized on the spot rather than being an actual instance of their pre-defined trading edge. One of my core trading philosophies is to trade forex like a sniper and not a machine gunner. and this is far easier to do if you are an end-of-day trader who has a disciplined daily trading routine.

3. Simplicity and Clarity - Analyzing a price chart and making a decision on the near-term direction of the market should not be a complicated or messy task, so it makes sense to check your charts for a short time each day shortly after the NY close. Trading in this manner just keeps things clean and simple, and honestly, this is how I have traded for so many years, yet so many people out there overlook this approach, and I cant understand why. When the market closes, there is either a signal or no signal, so if theres a signal, the trader can act according to their trading plan and place trades etc.

An example of an end-of-day trade may be as simple as waiting for a break of a key market level and then waiting for the market to confirm the break out at the New York close, and then looking for a price action signal on a retrace back to the breakout level in the hope of making money with the trend break out, etc.

Heres an example of what this might look like on a daily chart of the EURUSD:

Hopefully, now you have a good idea as to why focusing on the daily chart and end-of-day trading strategies are so important. Whilst there is no perfect approach for learning to trade and for getting your trading back on track, in my opinion the best thing you can do is to trade in an end-of-day manner. Most traders jump down to the intra-day charts before they have a solid grasp of how to trade off the daily charts, and this just causes all kinds of emotional trading errors to occur.

Please feel free to watch some of my free trading videos to get a better picture of the style of price action trading that I am teaching in my forex trading course and members section. I think once you understand a little more about price action trading strategies and trading on the daily chart time frames, you will wonder how you ever traded any other way.