How to Trade Double Tops and Triple Tops (and Bottoms)

Post on: 21 Май, 2015 No Comment

Double Tops and Triple Top are reversal chart patterns, indicating a change in price direction is already underway. These patterns indicate that an uptrend is likely over, and a downtrend is now underway. Double Bottoms and Triple Bottoms on the other occur at market bottoms, indicating a downtrend is likely over and an uptrend is now underway.

Double tops, triple tops, double bottoms and triple bottom chart patterns occur in all markets and on all time frames. Heres what these chart patterns look like, how to interpret them, and ultimately how to trade them.

How to Trade Double Tops and Triple Tops

A double top is created when the price is trending higher, stalls and pulls back, rallies back the last high (or similar price) and then falls again. This creates two price peaks at a very similar price level, hence being called a double top. A double top is complete, and indicates the uptrend is over, when the price falls below the pullback low between the two peaks. For information on trends, see Trading Impulsive and Corrective Waves .

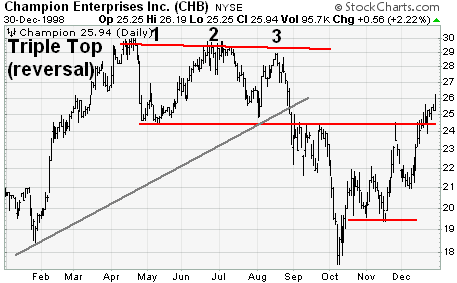

A triple top is the same, except the pattern is: peak, pullback, peak, pullback, peak, drop. All the peaks occur at similar price levels, and the triple top chart pattern is completeand indicates a downtrend is underwaywhen the price drops below the prior pullback lows. The following chart shows you what it looks like.

Figure 1. How to Trade Triple Top, Gold (XAU/USD) Daily Chart

The chart also reveals the trading strategy for double and triple top chart patterns. Since this is a triple top, there are two pullbacks in the pattern, in a double top there will be only one. For the double top, enter short trade when the price falls below the single pullback low. Place a stop loss above a recent swing high. Ideally this should not be the top of the pattern! To attain a target, subtract the high point of the pattern from the pullback low to get the height of the pattern. Then subtract this height from the breakout price (pullback low); this gives you your target.

The triple top has a few more options, as you can see in figure 1. The pullback lows may not be at the same level, giving multiple entry options. Either enter when the price falls below the higher of the two pullback lows, or enter when the price falls below the lower of the two pullback lows (or enter half your total position at both). These are marked Entry 1 and Entry 2 on the chart. As discussed above, place a stop loss above a recent swing high. These levels are marked with white lines and labeled Stop, Entry 1 and Stop, Entry 2.

Notice how the stop loss levels are below the top of the patternthis is what we want. If the price falls sharply and offers no swing highs to place a stop behind, its likely best to skip the trade. You dont want to be guessing where to place stop.

The height of this pattern is the distance between the tops, and the lower of the pullbacks (Entry 2). Subtract this distance from the breakout price of the whole pattern (Entry 2) to get a target.

Trading a triple top is very similar to trading a head and shoulders chart pattern .

How to Trade Double Bottoms and Triple Bottoms

Flip double and triple tops upside down and you get double bottoms and triple bottoms. With these bottom patterns, entry signals occur when the price rallies above the pullback high (double bottom), or moves above either of the pullback highs in a triple bottom. Figure 2 show some entry alternatives.

Figure 2. How to Trade Double/Triple Bottom in GBP/JPY Hourly Chart

Since the pullbacks dont all reach the same levels, the price moving above each one provides an entry option. You could go long when the price moves above a trendline connecting the pullbacks (1), or when the price breaks above the highest pullback (2) or lowest pullback. There are also option on where to place the stop loss. Stop, Entry 1 is close the low of the pattern which isnt ideal, but is acceptable if using entry 1 (break above sloped lined). If waiting for Entry 2 (break above high of pattern), then Stop, Entry 2 is ideal. Unfortunately the trade would be have been stopped out using this level. These things happen; get back on the horse and re-enter if the price moves back above the pattern, which it did here.

To get the target for the trade, calculate the distance between the lows and high of the pullback(s) and then add that distance to the top of the pattern. This gives you a target for the trade.

For more on trading chart patterns and other forex trading strategies, check out the Forex Trading Strategies Guide for Day and Swing Traders eBook, by Cory Mitchell, CMT.

The Final Word

Double tops, triple tops, double bottoms and triple bottoms are some of the most popular reversal chart patterns. They are easy to spotwith a bit of practiceand the traditional method for trading these patterns is relatively straight forward. If the moves are sharp through the breakout zone, the challenge can be finding a stop loss levela swing high in the case of topping patterns a swing low in the case of bottoming patterns. If there isnt an appropriate area to place a stop, skip the trade, there will always be others.

Practice spotting these patterns, and testing out the strategy and your implementation of it, in a demo account. Knowing something and being able to act in real time are completely different things. Practice and prepare yourself.

You May Also Enjoy:

Anticipating Chart Pattern Breakout Direction A non-traditional approach to trading charts patterns. It requires skill in being able to read the market, but provides a better entry price–providing lower risk and greater profit potential.

How to Trade the Head and Shoulders Chart Pattern Price often displays certain patterns signalling a reverse is a underway. The head and shoulders chart pattern (H&S), and inverse head and shoulders, are such patterns. Here’s how to trade them.

The Diagonal – A Pattern that Signals the Start of Opportunity The diagonal chart pattern (wedge) precede a dramatic change in trend. And, when they end, prices tend to retrace the entire pattern, or more, and fast.