How to Set Trailing Stops

Post on: 26 Май, 2015 No Comment

The lesson for today deals with one way that traders can overcome the issue of letting their profits run (while cutting their losses). What we see among many retail traders is that they cut their profits and let losses run and run until they get to unsustainable levels. This is why today we introduce a tool located on the trading platforms and especially Forex4yous MT4 platform, the trailing stop. We can look at the different ways that trailing stops are used in the forex market.

USING THE DEFAULT TRAILING STOPS

A trailing stop is used to lock-in profits when the traders position has moved into profitable territory. The simplest example of a trailing stop is what is known as the FIXED TRAILING STOP. This is called fixed: because when the trade is moving in profit territory, the stop tags along behind the price but then becomes fixed when the market starts to retreat against the traders position, thus locking in the profit between the entry price and the trailing stops position. Usually, the MT4 platform will allow a minimum of 15 pips as the distance between the trailing stop and the market price as the position becomes more profitable. Other platforms will have their own trailing stop settings. If the price retreats enough to meet the stop, the trailing stop will ensure that the trade is closed automatically so that the retreating price does not eat into the profit already made.

A trailing stop can only be set when the trade is active, and not before that. It is therefore not possible to set a trailing stop for pending order.

USING VOLATILITY INDICATORS TO SET TRAILING STOPS

Another way that traders can use a trailing stop is to use any of the volatility indicators to set a trailing stop to prevent the trade from becoming affected adversely by market noise.

In deciding how to use volatility indicators to set trailing stops, three factors must be considered:

a) There are several volatility indicators. Which of them would be the best to use to set a good trailing stop?

b) What determines the method of stop placement?

c) How does the whole concept of a volatility stop work?

The Best Volatility Indicator to Use

The best volatility stops are those based on the following indicators:

a) ATR

b) Gann Angles

c) Highest Highs or Lowest Lows

d) Swing charts

a) Average True Range

One very good volatility indicator to use in setting a trailing stop is the Average True Range (ATR) indicator. Such a volatility stop would require that the trader adds or deducts from the closing price, a value represented by a multiple of the ATR (either the ATR or 2 times the ATR). The resultant figure is what is then used to set the stop. Unlike the conventional stop loss derived from the ATR which stays fixed throughout the trade and is located below the entry price in a long trade and above entry price in a short trade, a volatility stop moves higher in an uptrend and heads lower in a downtrend.

For instance, in a short trade made with the 2 times the ATR + the candlestick high as trailing stop, we see that this volatility stop moves down when the market is making lower highs, and never heads back up even if the price top does so. Due to the fact that the ATR stop never moves higher, it does not give up as much profit as other trailing stops, making it a good volatility stop.

b) Gann Angles

A Gann Angle moving at a uniform rate in the direction of the trend can also be used as a volatility indicator in setting a trailing stop. This Gann Angle trailing stop is predicated on the fact that the Gann angles arise from the highest candlestick high that immediately precedes the trade entry. The Gann angles move down at a uniform rate of speed. As the market moves up or down, the distance between the lines that make up the Gann angles increases. Simply put, the Gann Angles diverge. The trader must choose the correct angle to use as the reference point to set as a trailing stop so as not to leave large open profits on the table, or worse still, get stopped out prematurely.

c) Swing Charts

Swing charts follow the market trend as defined by a series of lower tops and bottoms as formed by the candlesticks. If the current top is lower than the previous top, or the current bottom is higher than the the previous bottom, the trade will remain active. Once a trend top is crossed in a short trade, the position is stopped out. If a trend bottom crossed in a long trade, the position is also stopped out.

d) Highest Highs/Lowest Lows

Using the highest highs and lowest lows work almost in a similar fashion to the price action on swing charts, but have a tendency to give back a lot of open profits to the market. They are therefore the least desirable of the four volatility stops.

A disadvantage of the trailing volatility stops based on swing charts is that the large amounts of open profits are given back to the market, especially if the swings are large. The advantage though is that larger moves can be followed by the trader, thus offsetting the disadvantage.

Determining the Method of Stop Placement

The best way to set a trailing stop is to use a price that is based at a predetermined level under a reference point such as a moving average, price swing or trend line. A violation of the pre-set reference point is therefore an indication for the stop to be triggered. It is not easy to determine the exact level at which to set the reference point. Such must be determined by extensive practice and running backtests.

The advantage here is that such stops are set in a logical manner, based on carefully derived price levels. They are not randomly placed, and so leave lesser profits on the table and do not get triggered prematurely.

Trades that are set with default trailing stop settings on the platform as described in the first paragraph have a snag. They are done randomly and so get triggered with no pre-determined basis. In addition, such trailing stops do not consider the individuality of the volatility of each currency pair. One size never fits all feet. The end result is that most times, these stops then get triggered prematurely and give back a lot of profit to the market, especially on very volatile assets with large price ranges.

Market noise must also be considered. The use of multiples of the ATR value helps in keeping the trade out of the market noise. Once out of the noise area, the trade position can remain open for a longer time, allowing the trade a greater chance of succeeding.

So volatility, price ranges and market noise are factors that will determine how a trailing stop is set.

Trade Example

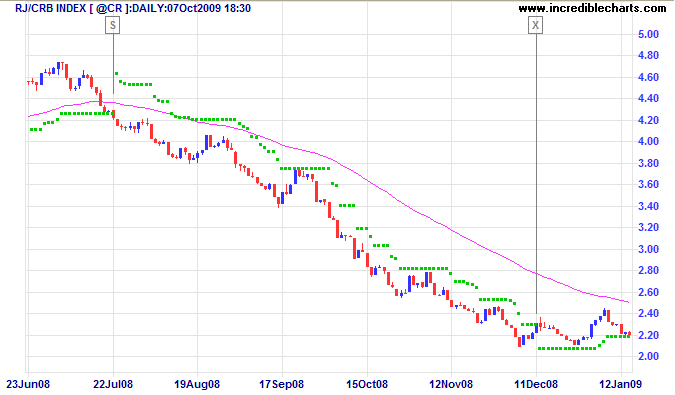

We now go on to demonstrate how to set a volatility stop on a currency pair which is trending to the downside. In the chart below, we see the four volatility stops applied to the charts.

The green arrows indicate where the trailing stops would have been triggered as the trade progressed.

The 20-day Highest Highs trailing stop is the slowest and gives back the most profits.

The 20-Day 2 times the ATR PLUS the High (because the currency pair is in a downtrend) moves down with the trend if the currency pair is making lower highs. It gives back less profit to the market than all the other three trailing stops, but can trigger an early close of the position.

The Swing Chart will keep pushing lower until the currency pair turns to breach the top in that trend, stopping the trade out. It gives back large profits to the market.

The Gann Angles widen as the currency pair heads lower. The proper angle must be chosen to prevent early closure of the position.

Conclusion

Trailing stops will always give back some profit to the market. The fine balance is always between locking in as much profit as possible, and leaving as little profit to the market as possible. The best way to achieve this is by using volatility trailing stops. These trailing stops that are based on volatility rather than the default, random trailing stops found on platforms, perform both functions. The extent to which profits are locked in or given back to the market can be worked out through testing and experimentation, so as to optimize the settings for each of the four volatility trailing stops discussed above.

Volatility trailing stops work best in trending markets where there are defined highs and lows. Thus superior results can be obtained when trend indicators are used. Moving averages, swing charts or trend line not only determine the trend of the currency pair, but can be used to set the volatility stops in such a way as to cut out whipsaws and all manner of market noises. Volatility trailing stops will not work well in choppy market conditions.