How to Scalp Profitably

Post on: 26 Апрель, 2015 No Comment

Scalping refers to a technique of trading currencies in which the trader places trades that last for a very short time, usually in a matter of minutes. Positions are opened and closed within a few minutes of each other, and orders are usually of the market entry variety.

The thinking behind a scalp trade is to pick out trading opportunities for making quick profits as they occur in the market, rather than subject the trades to the uncertainties of the market by leaving them open for long. Some traders just cannot stand the psychological stress of opening a trade and having to watch it from start to finish (for the chart watchers). Some others cannot have peace of mind using the set and forget strategy. Yet others may want to profit from small moves with large money positions. These categories of traders are those who will prefer to use scalping as a form of trading as opposed to intraday trading, swing trading or position trading. Scalping is used to profit from short price movements in a particular direction, as opposed to leaving trades open for longer periods and subjecting them to market vagaries.

Scalping makes sense in situations that predispose to market uncertainty. The truth is in forex, nothing is certain. Outcomes of trades cannot be said to be 100% guaranteed. Ask those who were caught out by the SNBs surprise minimum peg announcement on September 6, 2011, or those who were on the wrong end of the Fed Reserves extraordinary meeting that produced an unexpected interest rate decision on January 22, 2008. In both cases, the Swiss Franc and US Dollar were strongly trending, and the moves by the respective central banks completely reversed those trending positions in a matter of seconds. The moves were sudden, unexpected, unannounced and decidedly brutal, completely reversing any gains that traders in the opposite direction had made. This is why there are traders who prefer to take whatever they can from the market while they can, and run away with what they have to be able to trade another day.

How Scalps Are Done

Some traders simply look at the price ticks, or the direction a candle seems to be assuming, and then scalp in that direction. This is plain guesswork and is a wrong method of trading.

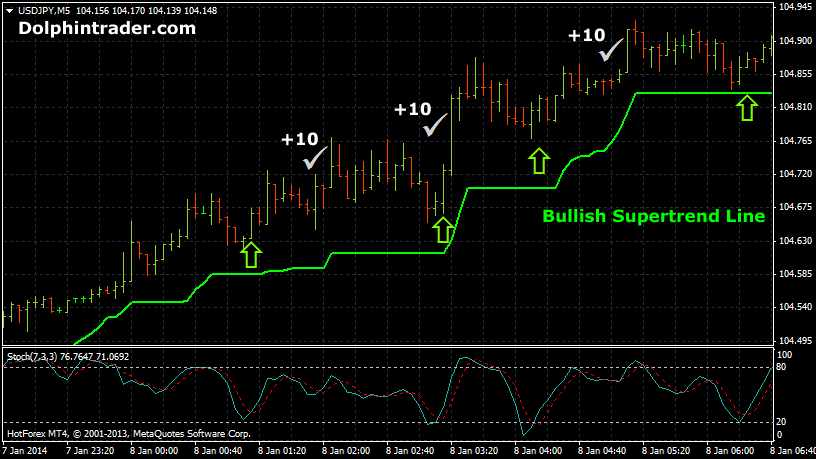

Scalping works best when the trader is able to pick out a period when the markets direction can be determined in the term trend. Scalping will not work when the short term trend is one of consolidation, choppiness and whipsaws. What will work for the scalper is to pick clear opportunities when small profits can be taken and then built up over time with successive scalps to produce bigger profits.

A Scalping Strategy That Works

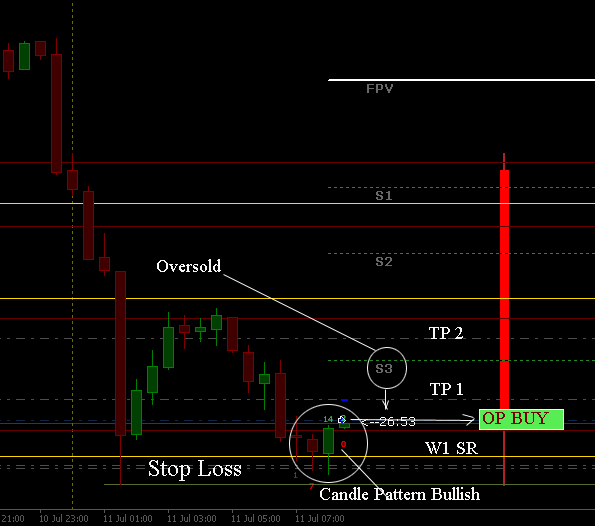

One very good way of ensuring that a scalp trade will end up a winner is to use the most recent highs as points of resistance and the most recent lows as areas of support. If the trader is taking a long scalp position, then the trade should take off from the support (or very near to it) and end at the resistance. The stop loss can then be set a few pips below support and the take profit points set at the resistance. Generally speaking, the risk-reward ratio for this trade should be 1:1. No attempt should be made to go for higher rewards, or to use more risk at the expense of reward in terms of increasing stop loss settings. If the trader will use 20 pips as the stop loss, then 20 pips should be used as the target.

In the same vein, if the trader is going to assume a short scalp position, then the trade should commence at a resistance and profits taken at a support level. The stop loss should be set above the resistance and take profit set at the support area. As before, the risk-reward ratio should be 1:1.

Entries at the support (for long scalps) or at the resistance (for short scalps) should not be made blindly. There has to be some extra credence to the trade. A Stochastics cross or a candlestick pattern supporting the move is a good way to go.

The chart above is a 30-minute chart for the EURUSD. Let us focus on the blue line which is the recent low serving as the basis for our support level for long scalp trades A and B, and the resistance line which serves as the basis for the targets C and D and also as a basis for a new support long scalps E and F, since the broken resistance at E automatically makes that level a new support.

There is a recent low, which is the support for a long scalp trade at point A. We can see that a pinbar formed at that support level, giving credence to a long trade at the open of the next candle. The next candle made a slight pullback before taking off. The trade is opened at the open or low of this candle and the profit target set at point C, corresponding to the area of the recent high (marked by the first red line of resistance).

The EURUSD then beat a retreat back to point B, where another pinbar has formed and provided basis for yet another scalp with point D as target. Eventually, after the resistance was tested by three candles, price broke through that level to form a new area for a long scalp at point E. Further down the road, price came back down to the same new support area at point F, marking an area for another long scalp trade.

Using this strategy, it is possible for a trader to continually pick out up to 10 trading opportunities on several currency pairs in a day. The principle is the same. Buy at support, sell at resistance using supporting candlestick formations or indicators of price movement.

A typical scalp like this will favour traders with healthy account sizes. For instance, a trader who uses a Standard lot for such a scalp trade will be assured of making $10 a pip. Even if the trader decides to use 10 pips as profit target, that equates to $100 a trade. Ten of such trades a day will produce $1000 in profit. Scalping is not just for those with big accounts. Even traders with smaller accounts can use this scalping strategy. The most important thing is that the position size for the trade must never exceed the recommended risk management exposure limits. This way, a bad trade does not ruin the trading account. Recall the example we gave about how one trade from the scalping EA without a stop loss lost 540 pips, ruining the effort of 20 trades? If a stop loss had been used to keep losses down to 20 pips maximum, the owner of the EA would be smiling to the bank.

Conditions for Profitable Scalping

a) The scalping strategy is most likely to succeed when there is no fundamental influence that could sway the market. Fundamental events are unpredictable. They could cause a market trending in one direction to take a full 360 degrees swing. When scalping therefore, you do not need such distracting influences.

b) In addition, a trader should now scalp in a market that is choppy and experiencing whipsaws. Many of these whipsaw situations occur following news releases when the numbers do not confer any specific direction on the currency pair.

c) A stop loss should always be used even in a scalp trade. Not using a stop loss is like trying to poor water into a leaking basket, or a container without a bottom. When the bottom falls off a trade, there is no way to predict how far a trade can go against a trader. I once tested this principle on a scalping EA which someone submitted to me for testing. The EA was programmed without a stop. After 20 consecutive profitable trades of a maximum of 20 pips each, a single bad trade went 540 pips to the negative in three days. The position was left open and kept losing and losing and losing, and without a stop loss to stop the madness, a single trade wiped out the profits from 20 consecutive trades. This is something I tested myself, so this point is made with all sincerity and should be taken with all the seriousness it deserves. NEVER TAKE A SCALP TRADE WITHOUT A STOP LOSS.

d) Some brokers hate scalping with a passion and do not allow it, with penalty of account closure and confiscation of all funds in the account. It is not difficult to see why this is the case. Market makers act as the counterparty to any positions held by a trader, so a consistently profitable scalper is surely bad business for such a broker. Therefore any trader who attempts a scalping strategy on a brokers platform must find out ahead of time if scalping is allowed on that brokers interface. There is no remedy if a mistake occurs in this regard because even if the matter gets to the desk of regulators, it will be likely that this proviso was included in the terms and conditions and the trader probably did not read it, leading to a resolution of such a case in favour of the broker. Always stick to the rules.

Remember: a broker has the right to reject or accept scalpers on their platform. If they do not allow scalping, they are not breaking any laws. It is their platform you will be using to trade, so do not go contravening your brokers rules simply because you want to scalp. If your current broker does not allow scalping, find one who does and use trading techniques that your present broker is comfortable with.

Scalping just like any other trading method, will only succeed when it is practiced with sound risk management techniques. A careless scalper will lose money. It is that simple. Stick to the entry and exit rules. Do not force the market. Do not force issues. Do not contravene your brokers rules. Stay safe, scalp wisely and you will make money at the end of the day.

Attention!

The author’s views are entirely his or her own.