How to range trade using pivot points

Post on: 1 Февраль, 2016 No Comment

To trade profitably within ranges utilizing pivot points, forex indicators must be deployed within the established parameters. Range trading offers to the forex buyer and seller pre-set limits within forex charts that can result in profitable buying and selling.

That results from the pivot point being established with the trading ranges to control the buying and selling based on the preferred set of forex indicators.

Pivot points are the price level that can be used to calculate estimated support and resistance for the trading market for whatever period is desired. From the pivot points, forex charts can set up the trading range. That enforces risk management for the range trader, which is critical for all investing, not foreign currency buying and selling.

As pivot points are derived from the previous high, previous low, and the closing price, a trading range can be accurately set up and continually revised based on new market conditions. The pivot point is very useful in the foreign exchange market due to the size of the market. The depth and breadth of the foreign exchange market is a barrier to manipulation, which is critical for the range trader as parameters are set with forex charts for buying and selling foreign currencies. Distorting the market through manipulation should destroy the trading ranges, resulting in huge losses.

Range trading is very useful for those looking to profit from buying and selling foreign currencies as it is a form of risk management. Establishing trading ranges for a foreign currency that is derived from forex indicators and forex charts will prevent larges losses, if followed.

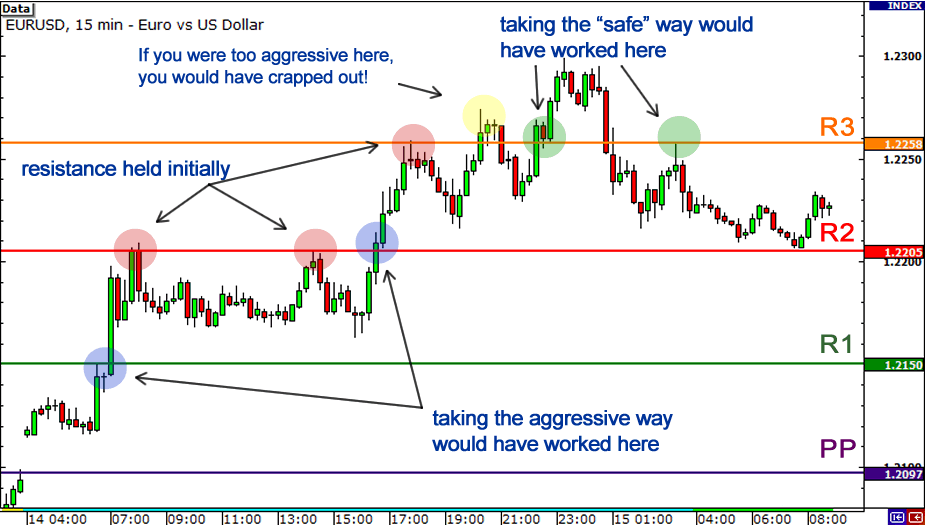

Risk management results from the pivot points in range trading. These dictate to the forex trader when it is time to buy and sell based on the levels of resistance. While nothing is 100% in any financial exchange, adhering to the ranges set up for traders will prevent getting rolled from a change in the market direction. Rather than sensing new opportunities, the disciplined trader will recognize from the forex charts set up by the forex indicators that the trading ranges have been pierced, which means the position should be liquidated, hopefully for a profit.

The pivot points are critical for alerting the forex trader that it is time to buy or sell. Just as vital is that the forex trader remain faithful to the pivot points that have been developed for that trading range for that currency, or transaction. If a forex trader is going to buy and sell based on the ranges established by forex indicators and forex charts . then these must be followed. That form of risk management utilizing risk management derived from pivot points, while missing some opportunities, will prevent the massive losses that can wipe out a forex trading entity.