How To Profit From Interventions In The Forex Market

Post on: 22 Май, 2015 No Comment

How would you like to make $1,287 in 10 minutes? Well, if you had purchased a $100,000 lot of U.S. dollar/Japanese yen on Dec. 10, 2003, at 107.40 and sold 10 minutes later at 108.80, you could have. It would have worked like this:

1. Bought $100,000 and sold 10,740,000 yen (100,000*107.40)

2. Ten minutes later, the USD/JPY increases to 108.80

3. Sell $100,000 to buy 10,880,000 yen, to realize a gain of 140,000 yen

4. In dollar terms, the gain would be 140,000/108.8 = $1,286.76 USD

So, who was on the other end of the trade taking the huge losses? Believe it or not, it was the central Bank of Japan. Why would they do this? The act is known as an intervention, but before we discover why they do it, lets quickly review the economics of the currency markets.

A Brief Economics Lesson

The entire foreign-exchange market (forex ) revolves around currencies and their valuations relative to one another. These valuations play a large role in domestic and global economics. They determine many things, but most notably the prices of imports and exports.

Valuation and the Central Banks

In order to understand why interventions occur, we must first establish how currencies are valuated. This can happen in two ways: by the market, through supply and demand, or by governments (i.e. central banks). Subjecting a currency to valuation by the markets is known as floating the currency. Conversely, currency rates set by governments is known as fixing the currency, meaning a countrys currency is pegged to a major world currency, usually the U.S. dollar.

Thus, in order for a central bank to maintain or stabilize the local exchange rate. it will implement monetary policy by adjusting interest rates or by buying and selling its own currency on the foreign-exchange market, in return for the currency to which it is pegged. This is called intervention. (To learn more about a central banks role read: How do central banks inject money into the economy ?)

Instability and Intervention

Since currencies always trade in pairs relative to one another, a significant movement in one, directly impacts the other. When a countrys currency becomes unstable for any reason, speculation, growing deficits. or national tragedy, for example, other countries experience the aftereffects. Normally, this occurs over a long period of time, which allows for the market and/or central banks to effectively deal with any revaluation needs.

There becomes a problem, however, when there is a sudden, rapid and sustainable movement in a currencys valuation, which makes it impractical, or even impossible, for a central bank to immediately respond via interest rates, used to quickly correct the movement. These are times in which interventions take place.

Take the USD/JPY currency pair, for example. Between 2000 and 2003, the Bank of Japan intervened several times to keep the yen valued lower than the dollar, as they were afraid of an increase in the value of the yen making exports relatively more expensive than imports, and hindering an economic recovery at that time. In 2001, Japan intervened and spent more than $28 billion to halt the yen from appreciating and in 2002, they spent a record $33 billion to keep the yen down.

Trading and Interventions

Interventions present an interesting opportunity for traders. I f there is some significant negative catalyst, such as national debt or tragedy, this can indicate to traders that a currency they are targeting should be fundamentally valued lower. For example, the U.S. budget deficit caused the dollar to fall rapidly in relation to the yen, whose value, in turn, rose rapidly. In such circumstances, traders can speculate on the likelihood of an intervention, which would result in sharp price movements in the short term. (For more read: When the Federal Reserve Intervenes (And Why) .)

This creates an opportunity for traders to profit handsomely, by taking a position before the intervention and exiting the position after the effects of the intervention take place. It is important to realize, however, that trading against a fast-moving trend and looking for an intervention, can be very risky and should be reserved for speculation traders. Furthermore, trading against a trend, especially when leveraged. can be extremely dangerous as large amounts of capital can be lost in short periods of time.

The Intervention

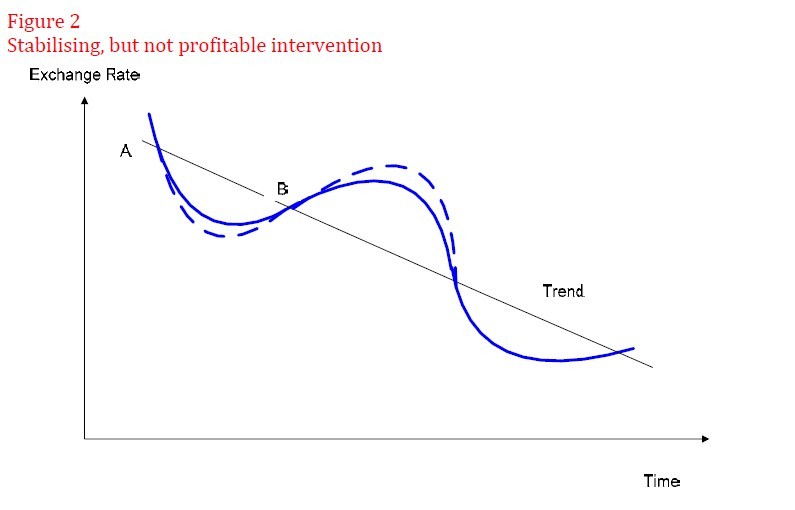

Now, lets take a look at what the intervention looks like on the charts:

Figure 1: Effect of Bank of Japan intervention 2000-2003

Source: Forexnews.com

Here we can see that between 2000 and 2003, the Bank of Japan intervened several times. Please note that there may have been more or less interventions than shown here, since these interventions are not always made public. It is usually easy to spot them when they occur, however, because of the large short-term price movement, such as the one mentioned in the beginning of this article. (To find out how this can help you, read: Taking Advantage Of Central Bank Interventions .)

Knowing these can help you determine when an intervention is likely to occur. Here is some advice for trading when an intervention is occurring:

- Gauge the expected price levels by locating previous intervention movements. Again, we can see that most of the major interventions in the USD/JPY pair amounted to 125.00 or so, before resuming a downward course again.

- Always keep a stop-loss point and a take-profit point to lock in gains and limit losses. Make sure to set your stop-loss at a reasonable level, but leave enough room for the downside before an intervention occurs. Take-profit points should be set at levels previously attained by interventions.

- Use as little margin as possible. Although this lowers you potential profit, it also reduces the risk of getting a margin call. Since you are trading against the long-term trend, margin calls become a significant risk, if an intervention doesnt occur during the time you plan.

The Bottom Line

Interventions occur as a result of central banks intervening by using their reserves in order to stabilize the value of their currency. Although they can be extremely profitable, trading them is mostly for speculators. There are several ways to try and gauge when an intervention is likely to occur, but it is always a good idea to be prepared by using low, if any, leverage and smart money management. All in all, they present an interesting opportunity for any forex traders looking for ideas to profit. (For additional information, take a look at our Forex Walkthrough . it goes from beginner to advanced.)