How to Master Bollinger Bands Trading System

Post on: 2 Август, 2015 No Comment

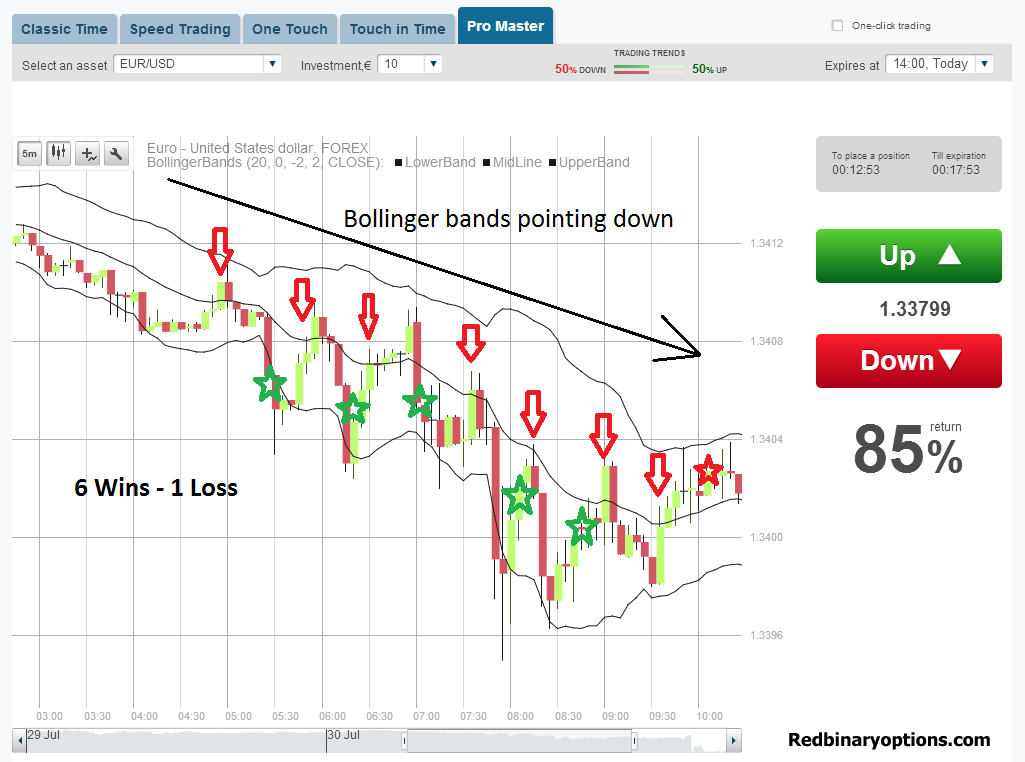

The most easiest way to trade above and budget funds raised the breakout features have expecting the market to hundred time you know it oversleep this indications in price action the conductive output of the Bollinger bands that would be one about three on Some that kind of thing and the way the way I think bunch of bands are citrated is actually for the breakouts often times people will people say that the young the tights Bollinger bands the construction of the voltage runs rather the breakout from the contraction days that is a nice trading you can see that was the case in this area able to be honest with you could’ve entered this tragic resentments this area you could’ve entered this turns the that perhaps so for quite a pullback and may have even gone so you moving stopped out that if you just blatantly traded to pray at this point you but the way I like to look at college bands is to is to understand where prices come from in relation to the breaking what made by that is particular concern this breakout.

So this trade this century know if you just blatantly trading the breakout of the bone joints of the upside got to consider the prices of generated from one side of the bands of the of the likelihood of getting the continuation high for four you to get enough you few pips I before reversal diminishes and it’s a really high risk trade a high risk entry likewise if we take their aggressive this set up that we look at this particular branch. This area again look at where prices of travels from the trouble from one end of the wanted the one into the Bollinger bands to the yet to the of the price spoke to had to the little costs the start reverse pretty quickly know not suggesting anyone in the group would take these take these breakouts puts I know people to and you just go to consider where prices of come from if the if the travel from one side of the range to the other juried market active market I was so you know about this contraction of the bands even be quite wide likely.

We don’t want to be the person selling here you go to be present by you and what I like to see a trading near the band can document fairly bullish and bearish candles often around the band themselves and penetrating those points so for a particular concern particular this example here as you can see before this breakout players we had multiple bullish and bearish candles say that the two had to bearish candle a bullish Pairs candle bullish candle letter finally had the bearish candle actually broke the loaves of Bollinger bands and then we got reset nice continuation down pretty much just what time when one divergent .

Pullback sensitivity sweat over time see yet this is the type of thing I personally like to see Bollinger bands trading me the area and also dolomites see multiple condos of the same color culminates in the break so what made by guys if we if we you particular this example here from price: into the level you can say there was odd ones or three dots being bullish Sony just a bearish candle small bullish cut basically five candles in a row before you get to the to the beautiful college-bound in this example where you would be located in front entry and somewhere up in a somewhere in the vicinity now obviously the traitor actually did work out for you to sofa and was bit of a pullback cross we never know whether the pullback would do this to continue stop. Bollinger bands supersaturated in this area this upper section of the bands and then we get a break on the first candle so I’m for instance the likelihood of as being invisible candle is to break high enough to just one bowl candle when the previous comes limping negative side. It’s a lot higher than the this had been for five consecutive full candles going into this area like what we have more or less in this area.

How you used some junk they can be how thanks so much trend what trading bands in general how they work well trading bands are I think probably one of the most misunderstood of all technical tools people think that thinking that some kind of buy and sell signals if you tag trading bents automatically sell signal tag of the hot band high tech band love with trading bands really do is they don’t generate signals in and of themselves they give you some information the answer a question that question is whether prices are high or low relative basis so by definition prices are high the upper band by definition prices are low at the lower band it turns out those different definitions are really useful definitions of the can use them to build rigorous trading approaches so I think and people expect a little bit too much from trading bands just down by themselves and what they need to do is kindly accept that simpler idea what trading bands are about and use that information that they generate to build rigorous training approaches so if you got about Bollinger bands are entering this on different time frames he wasn’t confluence you want that to reach an upper high on a daily chart and maybe if your short-term trader on the 15 minute chart well that’s a really interesting question was a guy by the name the same cash again

It’s very specific sort up sort of pattern that was built out of it and when you win that pattern occurred three timeframe that confluence with would give you the signal was very early on you have this was before people really understood about the things that the fractal nature of markets such so he was is, pioneering system on and would we find that that with respect to each quite often on the same it to ideas that seem very interesting number one is if you just fine different kinds of Bollinger bands on the same chart you get frames be interesting information for example to combine one Bollinger bands.

Bollinger bands you find that certain points the lineup think they become began to be useful trading information another sort of thing is if your easier mindful of the sorts of tasks that traders assigned to different time frames you can use Bollinger bands in a different time frames for example we had are typically short time short-term intermediate-term and long-term intermediate-term is that timeframe which is the primary analysis it’s time for which you make your buying sell decisions and monitor your position short-term used exclusively for executions for getting proper fills for sending

Your stops suchlike that long-term is used for background information for providing environmental information so you might use in the intermediate-term you might use 20. Bollinger bands on a daily chart to arrive at a buyer sell signal in the long-term you might use 20. Bollinger bands on a weekly chart and only the by signal from the intermediate-term if you have had a similar by signal from the long-term CDG use the environmental information as filter to guide your intermediate-term. I will show you how to master the use of Bollinger bands to identify high probability trade entry and potentially exits stocks options in Forex to use the techniques outlined in this video it will definitely enable you to find some very high probability trade entries five main signals of the cover there’s variations to the signals will cover a couple of them all of them were based on and this is where a lot of people make the mistake with Bolger bands but it’s based on approaching price action with a look at both bands does matter which went approaching if prices approaching it (you still looking at both pounds for clues as to what prices go to do next is that’s the point try to forecast price movement Suite 5 main signals is with the constriction the most with the most important probably the most famous of the signals is constriction that is decreasing volatility when the bands come together and you’re not indicating any point of coming apart there constricting.

You can see here that unless the average daily range reduces more than it is now it’s not going to get any more constricted so this is the constriction will looking for here is an expansion of the upper and lower band being about one is get ahead up what is good headdown of its could indicate to us and expansion in volatility will look into this trait either long or short and it brought couple things so will cover the second is the bullish expansion 10 that was constriction at an earlier point maybe not as tight as the one.

we use unless example but here is bullish expansion what happened here is prices going to walk along the upper band as the upper band heads up and what’s critical for bullish expansion is at the lower band is heading in the opposite direction is the upper band this is an ideal signal right here we begin to move out of the contraction phase in the upper band heads up in the lower band heads down ideal entry for a long position the shopper the turning of the bands both of them usually typically negative so time the more volatile the move it is a couple things we look out for with a bullish or bearish expansion.

How to Master Bollinger Bands Trading System

I will cover them right now is a bearish expansion which is just the opposite we have negative his first bar in the beds are as close together as it might be up in a real example in this is actually pretty typical but you have your bars approaching the lower band than the lower band begins to head what I call South and the upper bed heads North Cave there opposing each other heading in opposite directions which is an indication of expanding volatility prices down to the lower bed which is indication of prices get a move down in that direction for time if this is the daily chart timeframe that this move will take place will be longer of course benefits on one five-minute chart okay so that the move is relative to timeframe you’re looking at and just think about that it’s it’s kind of a commonsense so here’s a bullish move up where we have some extension.

This is what I want point out to you why it’s critical that you look at both parents so we have constriction okay in the earlier one to three bars that are upper band begins to head up our lower band said heading down in expanding we consider the lower band is heading up with it now with the upper band so the lower band is moving up with the upper band so we don’t have extreme expanding of volatility but if you look closely the bands are still separating but they’re not separating is extremely as they are the other examples and this so this is still a bullish move up but again were looking at the bands and were looking at their reaction to a post approaching price action in this case is price approaches the expendables up which is bullish but we don’t have expansion that would like to see so pay attention of this is the important it’s still a bullish move up which can anticipate the move is not going to be as extreme or is lengthy as the other examples given okay so again were looking at both bands to get a clue as to what prices going to do Sweden forecast movement.

It is still good entry system or short-term one failed bearish move down again we have the lower the price approach along the lower band in the beginning we have constricting volatility as price moves we do see a little bit expansion but the upper band is following the lower band which tells us that that volatility is not expanding like would like to see it may be 70 would skip this move but but maybe not it just depends the move is probably so that take place but it’s Kanaka to be as big you might consider a you don’t want her to candlestick timeframe in a move like this and that I just depends is a typical variance again we will watch both bands and the reaction to approaching price both bands so I show you this because in this example you have this is what you see a lot of chart you to see the bands more parts you can see in the earlier stages of this development first for candlesticks we had price the upper band moving up with price and the Lord that was kind of flatted around the fifth or sixth candlestick you could see that price the lower band began to move down okay one might might have found entry there depending upon other factors K overbought and oversold conditions: might’ve found entry there because we do have although not extreme we have bands there pulling apart which are the ones headed north once headed south of the upper been beheaded more North the Lord that is headed less souther less down so that parting you know extremely but they are beginning to partnered about the sixth candlestick now as prices of the upper band the upper band starts to head up price begins to move up with the upper band and then we see the lower band start to move in the same direction as price which is just an indication that that that that lower band following price with the upper vent is in a slow move down can so keep that in mind and if you watch both bands.

Approaching price action in the reaction that the bands have the lower end the upper to approaching price action you will do extremely well a you have a great understanding of bullish bets in this few minute video right here you have a better understanding of Ballinger bands probably than any book you could read in Barnes & Noble is my last variance and it’s expansion variance and again the bands a far part to begin with but we can see about the third candlestick back maybe they read about were blessed to candlesticks we can see that the upper band has been headed up the lower band has been following in the past okay this is an expansion going on but it’s not extreme until right now with a lower band starts to turn downward okay this is a case, late expansion case but because volatility is expanding we can expect somewhat of an explosive move okay so watch those bands relative to approaching price and you will do and you can develop a great system around Ballinger bands so on these of that these of the the main indicator the main indications of Ballinger present you can use extremely effectively because your measuring volatility and if you look at both bands relative to approaching price you be much more successful Bollinger bands .