How to Create Your Own Forex Trading Strategies Foreign Exchange Daily

Post on: 12 Апрель, 2015 No Comment

When you trade on the forex market you will be confronted with a number of forex trading strategies . If you cannot find one that suits your trading style and personality then you should consider creating your own forex trading strategies. There are a number of points that you have to consider when you look at the forex trading strategies.

The Timeframe Being Used

The first aspect of forex strategies that you need to consider is the timeframe they are working in. The timeframe you will be using when you create your trading strategy should coincide with your trading style. There are three different timeframes that you should look at and they are short, medium and long-term. Each of the timeframes offer different types of trades and require different types of analysis.

Forex Trading Strategies and Currency Pairs

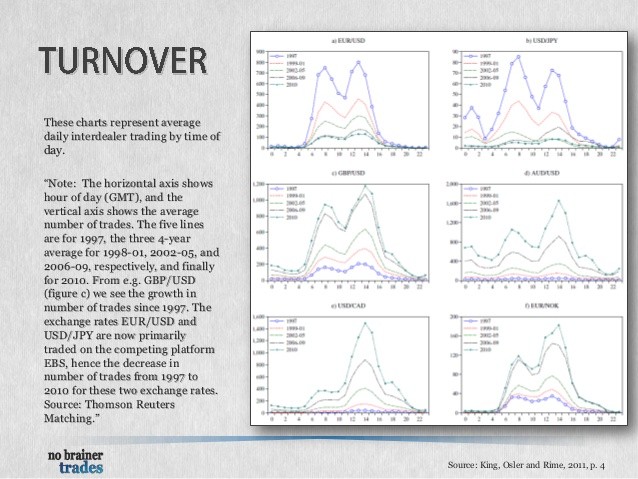

There are certain currency pairs that trade better over the long-term. There are also other pairs that trade better over the short-term. When you create your own trading strategy you have to consider which currency pairs you are looking at. You should also consider whether they fit into long or short-term trading.

Highly volatile pairs are better for short-term trades. Pairs that range for prolonged periods are better for long-term trades. The best way to identify which currency pair you should be using is to look at what other strategies are using. You can also see what pairs expert traders recommend for the different timeframes.

The Analysis Method

When you create your trading strategy you should not just choose between technical and fundamental analysis. You also have to look at the tools you will be using for the technical analysis and the impact of the fundamental data you are going to use. It is recommended that you have a combination of technical and fundamental analysis to ensure that you know exactly what could happen on the market.

If you are going to be using fundamental analysis you have to note all the news releases you are going to use. You should also think about the fundamental tools that you need. For fundamental analysis you are going to need a news feed and a forex calendar. You should also have some idea about how the market has react to news in the past.

If you are using technical analysis then you should consider the tools you will need. You have to see which analysis methods are going to work for your overall strategy. Should you be using a MACD histogram or Bollinger Bands or a combination of different tools? When you choose the tools you need you have to keep it as simple as possible. The more complicated you make the strategy the more likely you are to make bad trades. It is not easy to locate the weak points in a complicated strategy.

The Testing of the Strategy

Once you have created your trading strategy you will need to test it. Using a demo trading account is the best way as it simulates the market. When you test this you have to trade according to the strategy. You also have to take certain aspects of the demo account into consideration like the slower execution of trades when you trade live.