How to Build Your Own Forex Trading Plan » Learn To Trade

Post on: 12 Апрель, 2015 No Comment

How to Build Your Own Forex Trading Plan

I get a lot of emails from traders regarding Forex trading plans, and from reading these emails I have found that most traders either do not have a trading plan, make their trading plan too complicated, or don’t know how to build one. So, today’s lesson is going to provide you with some insight into exactly why you need a Forex trading plan and then I am going to give you an example trading plan so that you know how to build your own. Let’s get started…

What a trading plan is and why you need one

First, a trading plan should be thought of as a template for trading the markets. Perhaps an even better way to describe a trading plan is that it is a check list. This check list will contain each aspect of making a trade in a logical step by step sequence that acts as your objective guide to trading the markets. In essence, a trading plan will state your overall short and long-term goals as a trader and will provide you with a clear check list of how to achieve them.

Note: Do not think your check-list / trading plan has to be ridiculously long or detailed. After you have mastered an effective trading strategy like price action trading. you will be able to consolidate all aspects of your trading method into concise components. Once you do this you will have created your check list / trading plan that acts as your guide to decide if you should enter a trade or not, your check list can contain words and images and we will see an example of one below.

The reason why you need a Forex trading plan is because you need a way to make sure you do not trade based on emotion. Trading can be an intensely emotional profession, and if you do not follow an objectively constructed trading plan that pre-defines all of your actions in the market, you are almost certainly going to become an emotional trader, also known as a trader who loses money.

Perhaps the most beneficial thing a trading plan does for you is that it keeps you out of second-rate / uncertain trades and uncertain market conditions. This will naturally lessen the amount of losing trades you endure which will improve your overall winning percentage. Many traders end up ‘running and gunning’ in the markets instead of learning to trade Forex like a sniper. and the reason they do this is because they haven’t set aside the time to create their own effective trading plan. I am telling you right now that the fastest route to increasing your profits is to trade with less frequency and with higher quality, a trading plan will naturally aid you in this endeavor, now let’s look at the various components of an effective Forex trading plan:

Components of a Forex trading plan:

These are the necessary components of a Forex trading plan, you can add more if you like, but don’t get too carried away otherwise your plan will become too long and complicated for you to follow. I will give you examples of each of these in the section that follows:

• Begin your trading plan with a positive affirmation that you read aloud

• State your short-term and long-term goals in trading the markets

• Define your trading strategy and all aspects of how you will analyze and trade the markets

• Define your money management strategy, this includes things like risk and reward per trade; what reward is realistic given the market conditions? What dollar amount am I OK with losing per trade? What’s my long-term strategy for withdrawing money from my account…how much money do I want to withdraw each month after I become profitable?

• Miscellaneous components to check: things like, major currency pair, trading time, news events, etc

• Make yourself double-check everything before entering the trade, and ask yourself this question “Is this trade jumping off the chart at me basically telling me I’m stupid if I don’t trade it, or did I have to think about it for an hour and justify the setup by reading 20 different Forex blogs?”

• End your trading plan / check list with another positive affirmation.

An example Forex trading plan:

(Note: this is a hypothetical example, the numbers are arbitrary, but you can use this as a template to make your trading plan. These are not the personal details of my trading plan but do reflect the general layout of my trading plan. You may wish to add other components to your checklist as this is just a general example of what one might look like.)

Forex Trading Plan

• Daily trading affirmation:

“I will never enter a trade without first consulting my trading plan, because my trading plan is what keeps me objective and eliminates emotion from my trading, and that is what will make me consistently profitable over the long-term”

When I enter a trade, I will not touch the trade or edit the trade, removing all emotions and remaining firm on my initial observations

I will never trade over my risk threshold and will stick to my pre-determined $$ risk amounts

• Trading goals:

Short-term trading goals: To make consistent profits each month and supplement the monthly income from my job. To be a patient and disciplined trader who follows my plan.

Long-term trading goals: To build my trading account up to $25,000 through mastery of my trading strategy, patience, and the discipline to follow my trading plan every time I trade.

To avoid over trading, be patient, remain disciplined and stick to my plan always.

• Forex trading strategy:

This is the process I will use to scan the markets for potential price action trade setups:

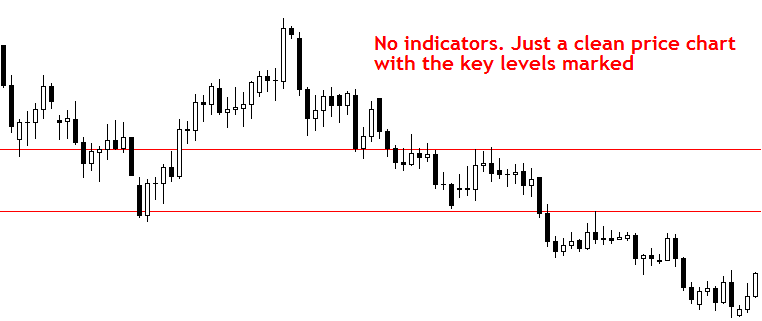

1) Analyze the market conditions: is the market trending or consolidating? You need to first determine what condition the market is in. I teach traders how to identify trending and consolidating markets in my trading course, but, basically you just need to identify the general direction a market is moving and try to trade with that direction. We are looking for higher highs and higher lows in an uptrend and lower highs and lower lows in a downtrend, also, I teach how to use the daily 8 and 21 EMAs to identify near-term market momentum. For consolidating markets we are looking for a market that is consolidating between an obvious support and resistance level. So, in your trading plan you might have a picture like this or similar to remind you of what you generally should look for:

2) Determine the core daily support and resistance levels and draw them on the charts: After you determine whether the market is trending up, down, or consolidating sideways, you need to draw in the core support and resistance levels on the chart. These are going to be the confluent value areas that you watch for price action strategies to form near to trade back in the direction of the dominant market momentum, or in the case of a consolidating market, towards the opposite boundary of the range.

3) Look for price action signals that have formed at confluent levels in the market, make sure to trade only very obvious and confluent setups: - You have to know exactly what price action strategies you are looking for before you build your trading plan. Below we see an example of a bearish pin bar strategy in a down trending market. You should have images of ideal examples of each trade setup you plan to trade within your trading plan, this will help to remind you what high-probability setups should look like.

• Money management:

4) What is the most logical stop placement on the trade setup? What dollar amount am I 100% OK with possibly losing on this trade setup. Remember, we want to always calculate risk based off dollars, not pips or percentages, to read more about this point, check out my article on measuring risk reward in dollars .

5) What is the most logical exit strategy or reward placement on this trade setup? Is a risk reward of 1:2 or greater logically attainable given the current market conditions and nearby core support and resistance levels?

• Other considerations:

6) What currency pair am I considering trading? Is it a major pair: EURUSD, GBPUSD, AUDUSD, USDJPY, EUJPY, GBPJPY, USDCAD, USDCHF, NZDUSD? (see this article for the best forex pairs to trade )

7) What trading session did this setup form during? Did it form during the European or New York trading sessions which are the most important, or did it form during the quieter Asian session (see this article for the best times to trade Forex )

8) Did I check Nial’s daily members’ market commentary to see if I am analyzing the markets in-line with what he teaches? Also, did I check Nial’s important upcoming economic news to see if an important release like Non-Farm payrolls is about to be released?

• Double-check the trade setup:

9) Make sure you only trade obvious setups - “Is this trade jumping off the chart at me basically telling me I’m stupid if I don’t trade it, or did I have to think about it for an hour and justify the setup by reading 20 different Forex blogs?” – Ask yourself this or a similar question before you hit the buy or sell button

I hope you now have a better idea of how to build your own Forex trading plan, how it can be structured and what types of components it should contain. There really is not much else I can say to reinforce the notion that creating and using your trading plan will allow you to achieve your goals in the market much quicker than if you don’t have one. You really have to believe me on this and stop trading without a trading plan. You would not start or run any other business without a proper business plan in place, so why do you think you can trade successfully without a proper trading business plan?

Once you put your own trading plan together you must ensure that you actually use and follow it each time you interact with the market, this will work to reinforce positive trading habits like patience and discipline, and it is these habits that will make you money over the long-term. If you have not yet mastered an effective trading strategy like price action to forge your own Forex trading plan from, you should check out my price action Forex trading course and members’ community .