How To Backtest The Forex Carry Trade Strategy

Post on: 4 Сентябрь, 2015 No Comment

Someone emailed me recently and noticed that I havent talked about the carry trade for a long time. The primary reason is that it is not a strategy that really resonates with me. But if you know what you are doing, it can be a strategy that provides a hands off income for the lifetime of the trade.

But what doesnt work for me may work for you. If you want to find out how it works without risking any money in the market, you can easily backtest it.

If you have never heard of the carry trade, I will start by defining it. Then I will give you the exact steps you need to backtest it.

Definition Of The Carry Trade Strategy

This strategy is called a carry trade because your goal is to make money on the interest or the carry. It takes advantage of the difference in interest rates between two financial instruments.

For example, if you could borrow money at 3%, then turn around and invest it in something yielding 6%, you would want to keep that trade as long as possible because you are making an easy 3% without doing anything and without putting up your own money.

In a similar way, you can take advantage of the positive rollover interest that some currency pairs pay. When you take a Forex trade, you are essentially borrowing one currency to buy the other in the pair.

If the difference between their interest rates is high enough (minus broker fees) you can actually get paid interest for holding the position. To find the pairs that pay the most interest, you can check out central bank interest rates on sites like FXStreet .

Here is what interest rates currently look like

The two highest interest rate countries:

- New Zealand (3.5%)

- Australia (2.5%)

The three lowest interest rate countries:

- Switzerland (0%)

- European Central Bank (0.05%)

- Japan (0.10%)

Therefore, you want to trade one of the highest interest rate countries against one of the lowest. One of the best carry trade pairs is the AUDJPY. To learn more about trading this pair, you can read this post .

Before we move on, keep in mind that although these are the interest rates that countries set, brokers charge a fee that reduces the interest rate that you get paid and increases the amount you pay. It is a spread, just like with trades. So the interest rate on the charts isnt necessarily the rate you will get.

How To Set Up Your Backtesting

The first thing that you have to do is find out the interest rates that your broker uses. This should be available on their site. Since I use Oanda, I will use them as the example. If you cannot find it on your brokers website, contact the help desk to find out their current rates.

Oanda has a great calculator that I have provided at the end of this post. Since the AUDJPY is a common carry trade pair, lets use that as the example pair.

Using the Oanda calculator, Ill set the pair to AUDJPY and the interest rate type to trade . Since the AUD is the higher interest rate currency, a buy will generate positive interest.

This is what it would look like when I set it up after I clicked the Calculate button. The important fields to notice are the Lend Rate and Borrow Rate fields. They are filled in for you by the calculator, so you dont have to worry about it. This will give us everything we need to setup our backtesting.

Just for fun, I entered some theoretical numbers so you can see how the calculator works. I used 10,000 units because that is a common lot sizeotherwise known as a mini lot.

Then I ask the calculator to calculate the interest for one day, so I put 24 hours into the Hours Held field. When I click on the Calculate button, I get a total interest payment of $0.45.

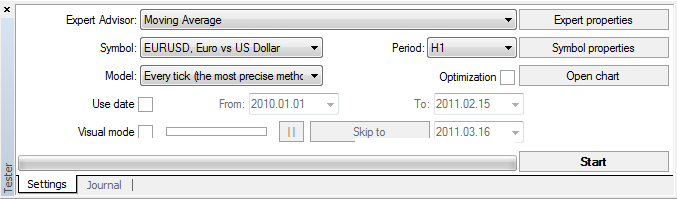

Now, lets move over to our backtesting software. Since I use Forex Tester 2. Ill use that as the example.

If you need instructions on how to import data and setup the basics of Forex Tester 2, read this post . After you have read the setup, come back here.

To setup the correct interest rate, go into the symbol properties for the AUDJPY pair and change the Swap Long to the difference that your broker uses.

In this example, this is the difference calculation:

Borrow Rate Lend Rate = Swap Long Rate

1.95% 0.0625% = 1.8875%

So you would set the Swap Long rate in Forex Tester to 1.8875.

Dont worry about calculating the short swap because you wont be using that in this example. The positive carry is only earned on long positions, so you will never execute a short. Now generate the ticks again and setup your charts in Testing Mode .

One word of warning before you proceed with your backtesting. If you execute a demo trade to double check the interest against Forex Tester 2, it wont be the same . This is because the rollover interest calculation takes the current price of the currency pair into account.

If you want the complete calculation explanation, you can read this post . To see this in action, simply change the quotes in the calculator at the bottom of this post.

In addition, leverage doesnt matter for carry trade backtesting purposes. This is because the interest calculation takes into account the amount of currency that you control, not the amount of margin you put up. The margin is only your good faith deposit.

For example, if you control 10,000 currency units of AUDJPY at 1:1 leverage, your margin requirement will currently be $8,696.5. But if you use 50:1 leverage, your margin requirement will be $173.93. To see what I mean, you can use this margin calculator .

In either case, you will still be controlling 10,000 units and will be paid interest on that amount. Your return on margin will be much higher with higher leverage, but that is not what we are concerned with in this tutorial.

Now that you understand the technical aspects of the carry trade, lets move on to the actual backtesting.

Start To Backtest The Forex Carry Trade Strategy

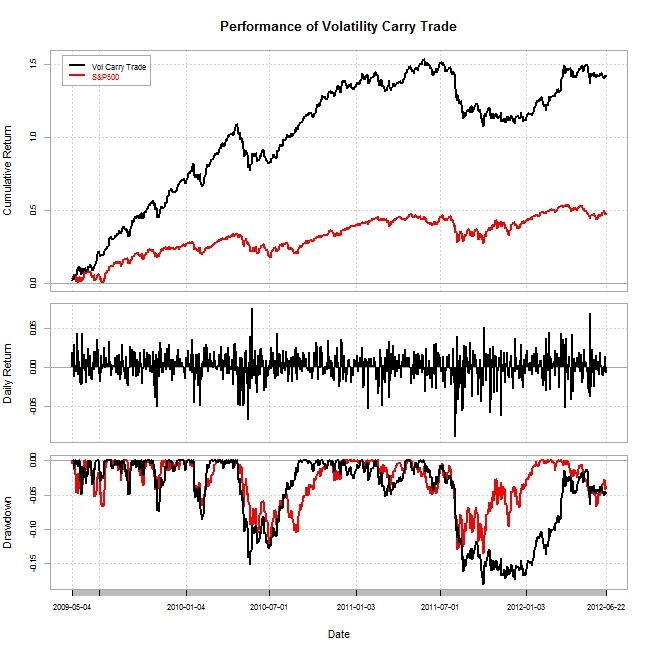

When implementing the carry trade, rollover interest should be your secondary concern. Trade risk is going to outweigh carry profit by a large margin.

So you need to implement a strategy that takes minimizes trading risk. There are many ways to do this, but the most obvious is to only buy at multi-year or multi-month lows or highs. Doing this gives your trade the best chance of accumulating he most interest possible.

There are many other possible strategies, so find the ones that appeal to you and test them out. Whatever system you test, pay attention to the trading risk that you are incurring versus the interest payout reward.

Backtest as far back as possible to make sure that your strategy works in different market conditions. Also be sure to have a chart of historical interest rates to be sure that you are not trading trading the pair when the interest rate spreads where not optimal.

Conclusion

If you are interested in trading the carry trade, you should backtest it and make sure that you understand your true risk and reward potential. It may sound really easy to accumulate interest without doing any work, but remember that there are no free lunches.

Before I end this post, let me give you a couple of things that you can try. First of all, you can test taking small initial positions around monthly or even yearly highs/lows instead of putting your entire position on at once. This allows you to be flexible and take small losses when you are wrong.

Second, dont get too focused in interest alone. Think about taking some trading profits off the table to help yourself stay in the trade. You can also day trade or swing trade around your long-term carry positions.

I hope that this tutorial helped and if you have any questions or comments, let me know in the comments below.

Calculator

Here is the interactive Oanda calculator. It allows you to adjust values and see what your interest payout would be. Play with it and