How the Stock Market Analytical Tool Dmi

Post on: 17 Апрель, 2015 No Comment

Purpose

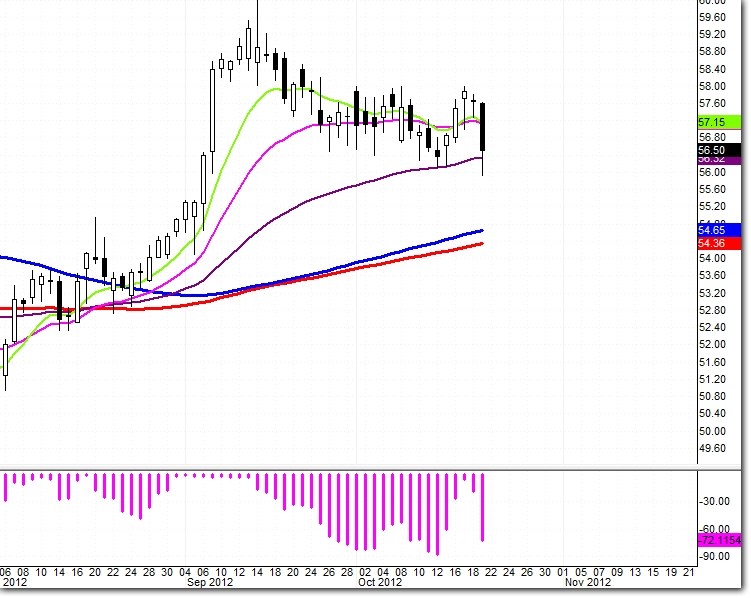

The DMI/ADX tool is a technical indicator that measures the strength of a price trend. A trend is a momentum in the stock market that tends to continue in a specific direction indefinitely. An up trend leads to higher prices over the duration of the trend, while a down trend causes share prices to drop consistently until the trend ends. In strongly trending markets, it is possible to profit by simply trading stocks in the direction of the trend. Thus, the DMI/ADX helps investors recognize when a strong trend is under way so they may confidently buy shares.

DMI

The Directional Movement Index, or DMI, is a tool comprising two lines that appear beneath the price chart. One line is the positive indicator, and the other is the negative indicator. While the formulas used to compute these lines are complicated, the application of the tool is relatively straightforward. Most investors view these two DMI lines and buy shares of stock when the positive line crosses above the negative line. Then, when the crossover occurs in the opposite direction, this suggests the trend may reverse, which leads some traders to sell their shares.

ADX

While the use of the DMI or another technical indicator can be helpful, sometimes it is necessary to first identify the strength of the current trend before trusting these tools. The ADX takes the mathematical calculations of the two DMI lines further to provide a single line that quantifies trend momentum. The ADX rises in response to a strong trend, whether that trend is up or down. Traders typically associate specific levels of the ADX line as the threshold for trend recognition. If the ADX is more than 40, the trend is strong, while a low reading of less than 20 suggests no trend.

Strategies

References

More Like This

How to Read Stock Market Graphs

What Does Futures Mean in Relation to the Stock Market?

What is Needed to Start a Business in Texas?

You May Also Like

We've all seen Julia make this demi-glaze and it seems so easy — Right? Well actually it is. A demi-glaze is nothing.

Since laptop computers have various uses, manufacturers equip them differently and offer them in various price ranges. Some laptops are set up.

The DMI indicator combines the ADX line with two additional lines — +DI and -DI. When +DI is above -DI, the trend.

Businesses operate in an economic environment that is constantly moving, requiring management to review its operations for needed improvements. Many companies use.

Most Accurate FOREX Indicator. The ADX line measures the strength of the trend and the -DI and +DI lines tell you.

The stock market is in the news every day; the overall value of the market experiences precipitous falls and wild surges upward.

How the Stock Market Analytical Tool Dmi/Adx Works; Investment Industry Analysis; How do I Calculate Stock Value? ehow.com. About eHow; eHow Blog;.

The stock market in Dubai is as active as any other in the world. (ADX) also trades stocks from other companies.

Where Can I Find Historical Stock Prices? How to Find the Value Per Share. high quality shares, real-time stock quotes.