How Much Capital Should I Trade Forex With

Post on: 5 Август, 2015 No Comment

Summary: Research shows that the amount of capital in your trading account can affect your profitability. Traders with at least $5,000 of capital tend to utilize more conservative amounts of leverage. Traders should look to use an effective leverage of 10-to1 or less.

In looking at the trading records of tens of thousands of FXCM clients, as well as talking with even more traders daily via live webinars, Twitter. and email, it appears that traders enter the Forex market with a desire to cap their potential for losses on their risk based capital. Therefore, many newer traders choose to start trading forex with a small capital base.

What we have found out through the analysis of thousands of trading accounts is that traders with larger account balances tend to be profitable on a higher percentage of trades. We feel this is a result of the EFFECTIVE LEVERAGE used in the trading account.

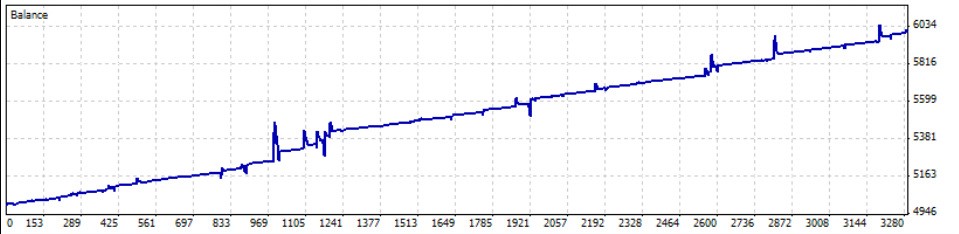

Figure 1

Since many smaller traders are inexperienced in trading forex, they tend to expose their account to significantly higher levels of effective leverage. As a result, this increase in leverage can magnify losses in their trading account. Emotionally spent, traders then either give up on forex or choose to compound the issue by continuing to trade in relatively high amounts of effective leverage. This becomes a vicious cycle that damages the enthusiasm which attracted the trader to forex.

No matter how good or bad your strategy is, your decision (or non-decision, as the case may be) about effective leverage has direct and powerful effects on the outcomes of your trading. Last year, we published some tests showing the results over time of the same strategy with different leverage. You can read it in the article Forex Trading: Controlling Leverage and Margin.

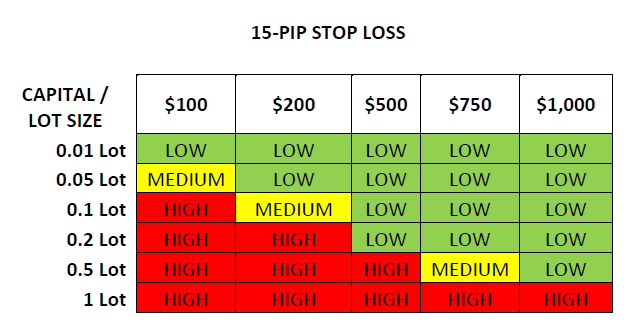

Figure 2

In figure 2, we have modified 2 elements of the chart in figure 1. First, we renamed each column to represent the highest dollar value that qualified for the given column. For example, the $0-$999 equity range is now being represented as the $999 group. The $1,000 — $4,999 equity range is now being represented as the $4,999 group. And likewise, the $5,000 — $9,999 range is now being represented as the $9,999 group.

The second change made was that we calculated the average trade size of each group and divided it into the maximum possible account balance for that group. In essence, this provided us a conservative and understated effective leverage amount. (A larger balance reduces the effective leverage so the red line on the chart is the lowest and most conservative calculation of the chart.) For example, the average trade size for the $999 group was 26k. If we take the average trade size and divide it by the account equity, the result is the effective leverage used by that group on average.

As the effective leverage dropped significantly from the $999 group to the $4,999 group (red line), the resulting proportion of profitable accounts increased dramatically by 12 basis points (blue bars). Then, as further capital is added to the accounts such that they moved into the $9,999 category, the effective leverage continued to incrementally drop pushing the profitability ratio even higher to 37%.

Game Plan: How much effective leverage should I use?

We recommend trading with effective leverage of 10 to 1 or less. We dont know when the market conditions will change causing our strategy to take on losses. Therefore, keep the effective leverage at conservative levels while using a stop loss on all trades. Here is a simple calculation to help you determine a target trade size based on your account equity.

Account Equity X Effective Leverage Target = Maximum Trade Size of All Combined Positions

10. 1 Leverage Calculations