How Moving Averages Work Simple Exponential and Weighted Moving Average in Forex

Post on: 23 Июнь, 2015 No Comment

How Moving Averages Work: Simple, Exponential and Weighted Moving Average in Forex

admin on August 19th, 2008

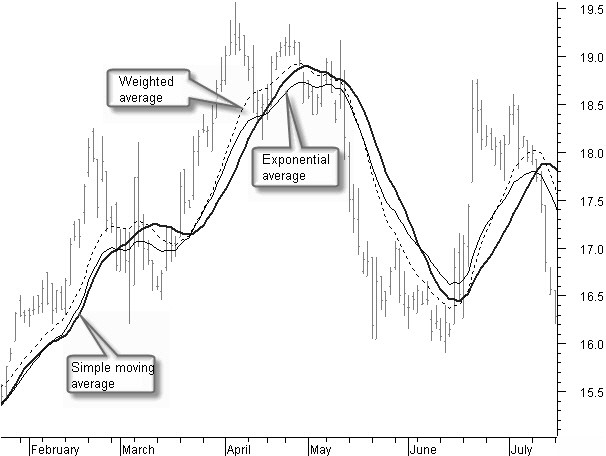

In technical analysis, moving averages are mathematically derived indexes that play a fundamental role as effective momentum indicators, helping the trader spotting and confirming a newly started trend in any given currency pair.

Simple Moving Average

The Simple Moving Average (SMA), also known as n-SMA , is simply the average of the bid prices in the last n candlesticks. The parameter n is configurable: when its set to a big number, lets say over 20, the line tends to change quite slowly: this has the advantage of spotting well the overall trend, but doesnt keep much into consideration the most recent data.

Conversely, when the parameter n is below, say, 10, changes in the index become quite fast, which makes it predict and confirm future trends earlier, but also with less reliability with respect to the last example.

Exponential Moving Average

The exponential moving average (EMA) is an index very similar to SMA, but with the advantage of keeping in greater consideration the most recent candlesticks, applying weighting factors that decrease exponentially. See the picture below:

Credits: Wikipedia

In the graph, the X axis represents the distance in time (0 is the present), while the Y axis is the weighting.

Of course, since the formula to calculate this average will be something like

with a parameter ∝ below 1, you can decide how much the exponential is compressed by controlling both this parameter and n, which has the same role here as in the simple moving average.

If youre not too good at maths, dont worry about this last paragraph as long as you got the meaning behind the previous graph. What really matters is to understand that EMA is highly influenced by the latest candlestick values, which makes this index subject to rapid changes in direction, allowing you to spot new trends early (but with a high percentage of false positives).

Weighted Moving Average

A weighted moving average is simply an average whose weights are calculated in an arbitrary way which is not that of SMA or EMA. There are no rules as to how the values can be assigned, although its always very important to know (at least roughly) what such weights are if you want to use this kind of index, in order to understand its actual meaning.

How to Combine Two Moving Averages: Index Crossovers

One of the most interesting things that can be done with moving averages is to combine two averages of different kinds, usually with a different parameter n too. For instance, you can build what is commonly referred to as a moving average crossover by using two indexed, an EMA and a SMA, and decide to open or close a trade whenever the two cross.

Its very important to experiment different parameters and candlestick graphs until you think youve found the setting that feels best for you. You can find out common EMA and SMA settings with a quick Google search, but always remember that they need to be right for your specific trading conditions.