How is a Hedge Fund s Performance measured

Post on: 16 Март, 2015 No Comment

Hedge fund managers use a variety of statistics to inform investors of the funds progress, as well as to lure new investors by showcasing attractive returns. Graphs, numbers and charts are all used in the marketing process and will appear on the hedge fund s website for all accredited investors to see.

Here are just a few of the statistics used to measure the performance (or lack there-of) of a hedge fund:

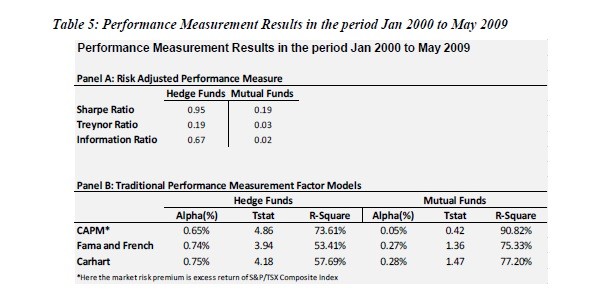

Sharpe Ratio – Measures return/risk. Return is the numerator and is defined as the incremental average return of an investment over the risk free rate. Rate is the denominator and is defined as the standard deviation of the investment returns.

Sortino Ratio – Measures return/risk. Return is the numerator and is defined as the incremental compound average period return over a Minimum Acceptable Return (MAR). Risk is the denominator and is defined as the Downside Deviation below a Minimum Acceptable Return (MAR).

Sterling Ratio – Average Annual Return / Maximum Drawdown

Beta – A measure of the hedge funds volatility, or systematic risk, compared to the market as a whole. A beta of 1 indicates the fund will move with the market. A beta of more than 1 means that the fund is more volatile than the market. A beta of less than 1 means the state of the market does not have as much impact on the fund.

Skewness – Describes a hedge funds asymmetry in relation to a normal distribution.

Kurtosis – Describes trends in charts. A high kurtosis means the chart has fat tails and a low, even distribution. A low kurtosis means the chart has skinny tails and a distribution concentrated toward the mean.

Covariance – measures the degree in which asset returns move in correlation to each other. A positive covariance means that asset returns move together, while a negative covariance means that asset returns move in the opposite direction of each other.

Standard Deviation – used to measure the funds volatility. Also known as the historical volatility.

Treynor Ratio a risk-adjusted measure of return based on systematic risk. It is similar to the Sharpe ratio, with the difference being that the Treynor ratio uses beta as the measurement of volatility.

Calmar Ratio A ratio used to determine return relative to drawdown risk in a hedge fund. Usually, the higher the ratio, the better.

R – Also called the linear correlation coefficient, r measures the strength and director of a linear relationship between two variables.

R2 – A statistical measure that represents the percentage of a fund or securitys movements that can be explained by movements in a benchmark index.

Alpha – Represents the value that the Portfolio Managers either adds to or subtracts from the fund. A positive alpha of 1% means the fund has outperformed its benchmark index by 1%. A negative alpha indicates an underperformance of 1%.

Compound Annual Growth Rate (CAGR) – The year over year growth rate of the hedge fund. The CAGR is not the actual return, but rather a number that portrays what the fund would have grown at if it grew at a steady rate.

Loss Deviation – standard deviation of a down month

Growth of 1000 – tracks the monthly performance of a hypothetical $1000 investment.

Downside Deviation – measures left tail risk, but gives an acceptable threshold of return.

Maximum Drawdown – The % decrease in investment value from its peak to its trough. It is the largest drawdown that has ever occurred within a specific time frame.

Fund Cumulative Returns vs. Benchmark – Comparing the hedge funds cumulative return with a standard in the industry.

Rolling Performance – performance of the fund for the past 12 months