How Financial Advisors Get Paid Feebased advisor

Post on: 16 Март, 2015 No Comment

Whenever youre working with or interviewing a financial advisor of any kind, there are a couple of key questions you want to ask.

One deals with the question of how the advisor is compensated. Its important to know and understand that because it can help you understand some of the motivation and thinking that might go into how the advisor manages your investment assets.

Financial advisors generally get paid in one of three ways: commissions, hourly fees and ongoing fees as a small percentage of assets managed. How theyre paid also impacts on the type and level of service you receive.

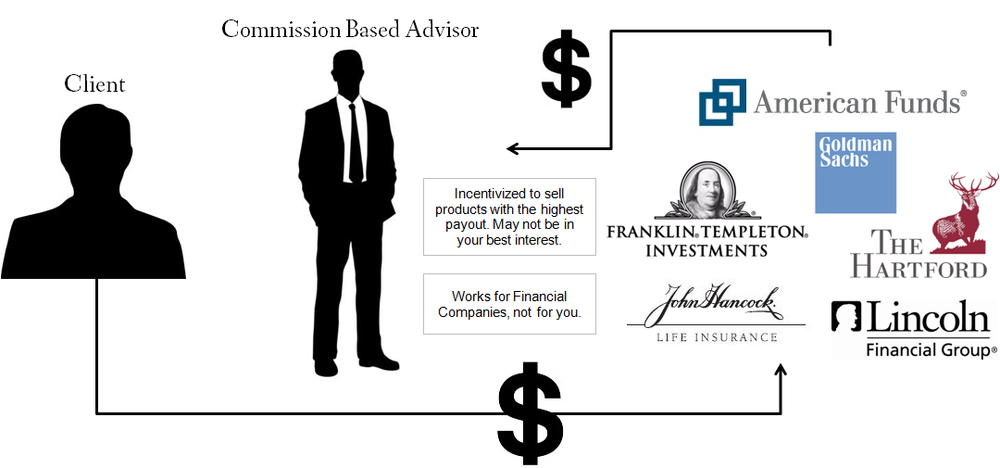

Commission-based individuals (also known as brokers or registered representatives) earn income from transactions in your accounts. They sell you securities that are suitable for you at the time, but arent obliged to monitor your assets after the transaction.

Whether youre buying or selling assets, commission-based representatives earn income on the transaction. If you buy something, they get paid. If you sell it, they get paid again. If you reinvest that money in something else, they get paid again. If you buy something good and hold it indefinitely, they dont get paid.

That may not be an ideal system because the potential exists for a conflict of interest. Every time they make a recommendation, you may need to figure out if its best for you or your broker. Even if your broker is not engaged in churningotherwise known as excessive tradingyou may be in a position where you have to question the motivation. Commissioned brokers would rather do well for you than poorly, but you have other alternatives.

Another way a financial advisor can get paid is by a simple hourly fee.

In this instance, the advisor may charge you an hourly rate while analyzing your financial situation to come up with some recommendations. These advisors normally dont manage your assets. They leave that to you after giving you a recommendation. This arrangement may not be best for you.

The other primary way an advisor can receive compensation is on a fee-basis. These advisorsalso known as investment advisors charge fees based on the value of your assets. In this case, it doesnt matter if the advisor does one transaction a year in your accounts or 100, the fee is exactly the same.

The only way a fee-based advisor can earn additional money while offering advice to you and managing your assets is when your portfolio increases in value. In that situation, the advisor gets the same percentage of a bigger number and both sides benefit. This may be the fairest way for an advisor to be compensated. In exchange for an annual fee, you receive ongoing advice and asset management from an advisor who has a fiduciary responsibility to act in your best interest. That includes developing a portfolio that aligns your investment goals with your risk tolerance.

So the next time you interview an advisor, be sure to ask how they make their money.