How Banks Influence the Forex Market

Post on: 22 Май, 2015 No Comment

The forex market involves the trading of currencies. Currencies can be traded on a spot basis (the conventional forex trades done on platforms), or they can be traded as swap transactions, currency options or forward contracts.

One of the major players we have in the forex market are the banks. Banks and other institutional traders have a profound impact on the currencies traded in the forex market. But exactly how do banks exert their influence on the forex market? That is what we seek to show in this article, which will demonstrate the what, when and how of the influence banks have on the global currency trading market.

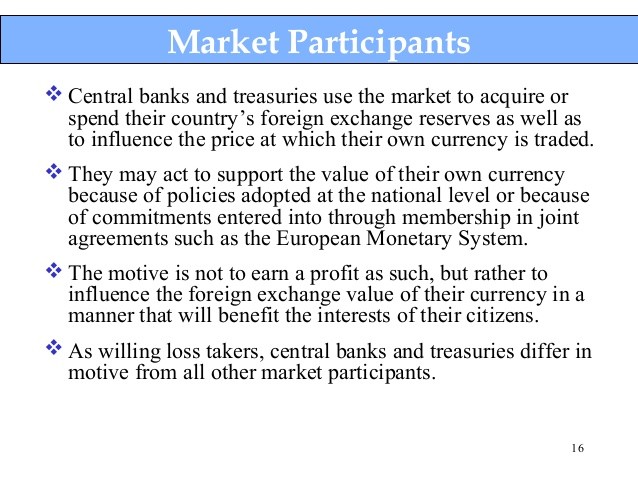

Central Banks

Central banks are very key players in the forex market, and they play several roles in the forex market space.

a) Devaluation

One function that central banks play in the forex market is that of devaluation. Devaluation is a deliberate policy of a countrys central bank to carry out a structured and deliberate reduction in the value of the national currency. There are several reasons why a countrys central bank may want to devalue a currency. In some countries, it is desirable to keep the value of a currency as low as possible so as to make the exports from this country cheaper and more desirable to foreign consumers. When all other tools to achieve this aim have been exhausted without the desired results, the countrys central bank may decide to engineer a process of flooding the market with local currency and using it to buy up foreign currencies. Japan is one country that operates this model and the Bank of Japan has had cause to jump into the markets twice in the last four years to engineer this process. Switzerland is another country that used another mechanism known as a minimum peg to achieve this. Under this policy, the Swiss National Bank (SNB) set a minimum peg of 1.2000 for the exchange rate between the Swiss Franc and the Euro. In order to do this, the SNB sold massive amounts of the Swiss Franc and bought Euros, the US Dollar and other major currencies, engineering price movements of up to 1,500 pips on some pairs in a space of 15 minutes.

For some other countries such as those of the developing world, central banks intervene occasionally to devalue the domestic currency, by buying up foreign currencies using large amounts of the domestic currency, often using other counter inflationary pressures to augment the process. Here the reasons are much different. The French African Confederation (CFA) was forced to devalue the CFA Franc by 100% against the French Franc in 1994 at the prompting of the French government.

The exact mechanisms by which the central banks perform these devaluations are not usually made public, but it is easy to guess how this whole thing works. By flooding the market with local currency, supply is vastly increased, causing a drop in the value of the local currency. By buying up large amounts of foreign currency, a sudden great demand is placed on the foreign currency and when a pairing of both currencies is seen in the market, there is bound to be an upside move in the foreign currency and a corresponding downside move in the local currency.

b) Interest Rates

In most countries, the responsibility of setting interest rates lies with the central banks. Interest rates are very important economic indices. They determine the bond rates in the country, and serve as one of the inflationary control measures available to central banks. They also serve as a benchmark for local lending rates among commercial banks. Usually, the interest rate is the rate at which the commercial banks borrow from the central bank, and commercial banks now lend to customers at a mark-up.

Interest rates also determine the inflow of foreign direct investments into a country. Generally speaking, there will be more inflow of investments into a country when interest rates are higher than when they are lower. Foreign direct investments create jobs and boost consumer spending, which enhances the Gross Domestic Product (GDP) of a country. More jobs, increased consumer spending, increased retail sales and an enhanced GDP are all positive for a countrys currency. This is why any time interest rates are increased, there is an increased buying interest in that nations currency. So interest rate adjustments are another way that central banks influence the forex market.

c) Quantitative Easing

The term quantitative easing is associated with any unconventional monetary policy action used by the central banks in order to boost market confidence and to prop up the markets, when all other conventional monetary policy economic stimulants have become ineffective. The terminology became popular in 2008/2009 as central banks struggled to save the worlds financial system from total collapse as a result of the global financial crisis of 2008.

Quantitative easing works in several ways and is used by different central banks accordingly. One of the ways in which quantitative easing is used is when the central banks actively purchase government bonds. The European Central Bank (ECB) was forced to adopt this measure as a means of saving the Euro from a monumental collapse in 2012. The markets craved it, investors desired it and when it came, the effects were dramatic.

The US Federal Reserve, the Bank of England and Bank of Japan have all used quantitative easing at one point or the other. The quantitative easing programs of the Federal Reserve and the Bank of England are still in effect. These days, one of the fundamental indicators traded in the forex markets is on whether the central banks in question would either expand the easing programs, or start scaling back. There has been a lot of speculation about the US Federal Reserve scaling back on is quantitative easing program, though this is yet to materialize. But when it eventually happens, we can expect a massive movement in the price of the US Dollar as traders react to this news, especially as the US Dollar plays a massive role as the global reserve currency used in international transactions.

Central banks also serve to provide liquidity in the forex market, especially when there is a move to either switch its foreign reserves from one currency to another, or when it intends to increase its holding of foreign reserves in another currency. Central banks usually hold their foreign reserves in several currencies, and the shifts in the holdings from one currency to another require forex transactions which serve to flood the market with money and keep the liquidity levels ramped up.

Commercial and Investment Banks

Commercial and investment banks constitute another class of banks that are active in the forex market. A ready example is Goldman Sachs, which is classified as one of the too big to fail banks. Banks like Goldman Sachs influence the forex market in many different ways. Investment banks affect the forex market in the following ways:

a) Interbank Trading

The highest volumes of trading in the forex market occur in the interbank foreign exchange market. As the name implies, interbank forex trading is forex trading between banks all over the world. It does not matter whether the bank is too big to fail or whether the bank is some obscure bank in some corner of the world. Commercial and investment banks need foreign exchange in order to get this across to their clients who conduct international trade. They also need foreign currencies to carry out their own investment activities. So it is beneficial for banks to trade currencies among themselves through electronic communication networks.

Some countries have strict foreign exchange purchase laws, in which citizens are restricted in the amount of forex they can buy. At other times, the restrictions may be in the form of citizens being able to buy foreign currencies through their banks. Banks take such orders from their clients, collect money from these clients in the form of local currency and then bid on their behalf from other banks in the interbank market. Usually there is a bid and ask price, allowing the banks to profit from such transactions with the bid-ask price differences (spread).

Banks also make a large part of their income from speculative trades in forex, commodities and other derivative products. These all require foreign currencies to execute. By conducting such speculation on the forex market, a bank can increase its revenue base dramatically. Usually funds for such activity comes from money deposited in savings and fixed deposit accounts by bank customers. A portion of the profits from such speculative trades are then paid out to these category of interest-bearing accounts, while the bank retains the bulk of the profits. These interbank trading activities will definitely impact the value of currencies at one point in time or the other, especially when there are heavy order flows in one direction.

b) Liquidity Provision

The forex market is the most liquid market in the world. It is more liquid than the bond market, the commodity market or the futures markets. The liquidity levels in forex can be chiefly ascribed to the role of the major banks in this process.

Banks act as liquidity providers in the online forex trading system. Banks such as Goldman Sachs. Deutsche bank. Barclays. Citi Group and UBS all act as liquidity providers. Liquidity providers are able to turn transactions into cash, providing for very fast order executions and quick settlement of trades. In an ECN environment, all trades by market participants are fulfilled by liquidity providers, who also provide direct market access pricing to market participants. Even in a dealing desk environment, the market makers are able to compensate for the low liquidity status of their clients by ramping up liquidity. This they do by buying up positions from the liquidity providers, and splitting these into smaller chunks for their own traders to take up. Without the banks who are actually the custodians of most of the money in circulation in the forex market, the forex market will lose its liquidity advantage over other markets.

Conclusion

In this article, we have demonstrated exactly how banks affect the currency market. With this information, traders will be better informed as to how the market really works and will be able to understand better why it is the best policy to trade in tandem with the order flows generated by this group of traders. It is also pertinent to note that some of the big market moves that traders see in the market (such as central bank interventions) can be traded as well. Yours truly traded the BoJ intervention as well as the SNB interventions, and the massive moves that exceed 500 pips mean that even if a trader gets in late, he or she can still pull away with at least 100 pips of profit.

Attention!

The author’s views are entirely his or her own.