Holding Period Return

Post on: 16 Март, 2015 No Comment

DEFINITION of ‘Holding Period Return/Yield’

The total return received from holding an asset or portfolio of assets over a period of time, generally expressed as a percentage. Holding period return/yield is calculated on the basis of total returns from the asset or portfolio – i.e. income plus changes in value. It is particularly useful for comparing returns between investments held for different periods of time.

Holding Period Return (HPR) and annualized HPR for returns over multiple years can be calculated as follows:

where t = number of years.

Returns for regular time periods such as quarters or years can be converted to a holding period return through the following formula:

Thus, HPR = [(1 + r1 ) x (1 + r2 ) x (1 + r3 ) x (1 + r4 )] – 1

INVESTOPEDIA EXPLAINS ‘Holding Period Return/Yield’

The following are some examples of calculating holding period return:

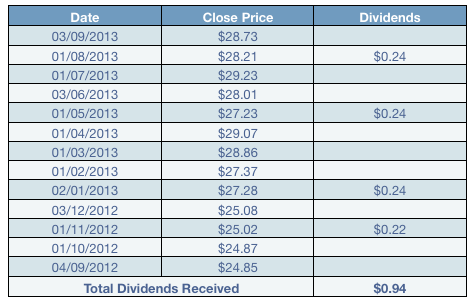

1. What is the HPR for an investor who bought a stock a year ago at $50 and received $5 in dividends over the year, if the stock is now trading at $60?

HPR = [5 + (60 – 50)] / 50 = 30%

2. Which investment performed better? Mutual Fund X that was held for three years, during which it appreciated from $100 to $150 and provided $5 in distributions, or Mutual Fund B that went from $200 to $320 and generated $10 in distributions over four years?

HPR for Fund X = [5 + (150 – 100)] / 100 = 55%

HPR for Fund B = [10 + (320 – 200)] / 200 = 65%

Note that Fund B had the higher HPR, but it was held for four years, as opposed to the three years for which Fund X was held. Since the time periods are different, this requires annualized HPR to be calculated, as shown below.

3. Calculation of annualized HPR:

Annualized HPR for Fund X = (0.55 + 1) 1/3 – 1 = 15.73%

Annualized HPR for Fund B = (0.65 + 1) 1/4 – 1 = 13.34%

Thus, despite having the lower HPR, Fund X was clearly the superior investment.

4. Your stock portfolio had the following returns in the four quarters of a given year: +8%, -5%, +6%, +4%. How did it compare against the benchmark index, which had total returns of 12% over the year?

HPR for your stock portfolio = [(1 + 0.08) x (1 – 0.05) x (1 + 0.06) x (1 + 0.04)] – 1 = 13.1%

Your portfolio therefore outperformed the index by more than a percentage point (however, the risk of the portfolio should also be compared to that of the index to evaluate if the added return was generated by taking significantly higher risk).