HFT Strategies

Post on: 16 Март, 2015 No Comment

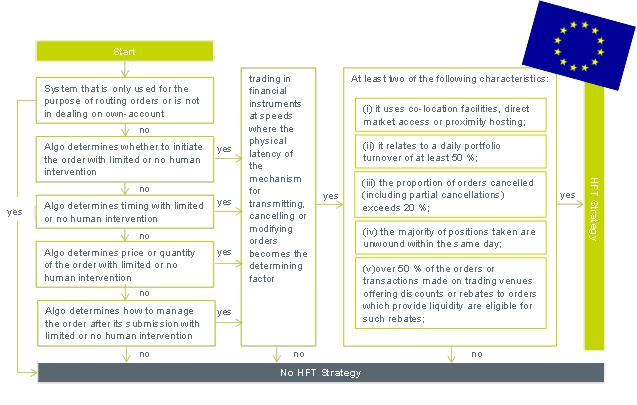

Variable economic conditions and highly diverse characteristics of various securities require a range of dynamic high frequency trading strategies. High frequency trading (“HFT”) entails executing huge volumes of securities trades in millionths or billionths of a second. Mathematical algorithms are the primary means by which such stunning financial feats are accomplished efficiently and profitably.

As proprietary computer programs, internal algorithmic specifics are closely-guarded trade secrets. The basic concepts underlying all high frequency trading strategies are well-known, however. They can be reduced to a handful of basic methodologies.

Securities prices change significantly in response to unanticipated events. Investors attempt to capitalize from this circumstance by predicting the likely impact on securities markets. A common component of HFT platforms is continuous scanning of news databases to discern and adjust for imminent impacts caused by certain events. Examples of significant occurrences include the initiation of adverse litigation against a firm or appointments of new corporate managerial staff.

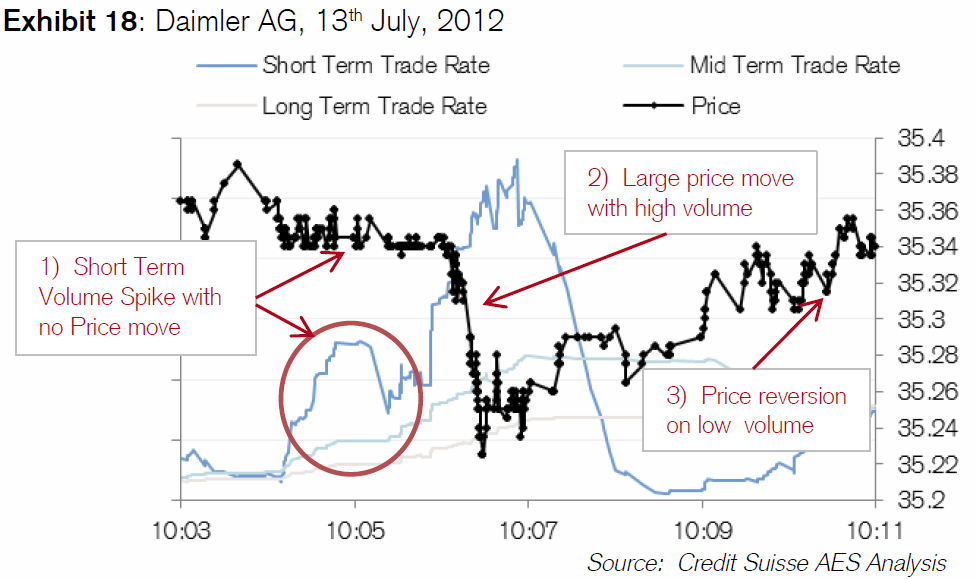

Market analysis derived from charts and graphs are called “technical” strategies. Trend identification is the modus operandi of technical HFT strategies. Following predominant marketplace patterns while anticipating likely deviations is what technical investing strategies are all about.

This investment strategy involves in-depth analysis of a single security’s issuer. The underlying rationale is that a stock’s prices directly correlate with its issuer’s performance and long-term economic prognosis. If a corporation is doing well, so will its stock.

Large, nontraditional investors such as wealthy celebrities often utilize this strategy. Macro-level HFT strategies analyze the performance of an entire market segment rather than that of a single issuer within that segment. Quite often, a personally favored industry is monitored and routinely analyzed.

This investment strategy entails buying a commodity in a given market and immediately reselling it at a profit in another market. Arbitrage facilitates efficiency and inter-market price convergence.

Firms with HFT capability are shown new orders a tiny fraction of a second before non-HFT traders know about them. This, of course, affords a huge marketplace advantage. Nonetheless, this competitive advantage of high frequency trading strategies erodes over time, necessitating the constant alteration of HFT firms’ micro level strategies. There are two basic reasons for this.

First, HFT depends upon very exact marketplace interactions and price correlations. Thus, programming codes and algorithms must be constantly adjusted for subtle shifts in market dynamics. Secondly, counterintelligence of competitor trading firms is highly-attuned. This makes all HFT strategies vulnerable to reverse stratagems that may turn high profits into high risks very rapidly.