Hedge fund institutional investor due diligence

Post on: 16 Март, 2015 No Comment

The goal of many hedge funds is to reach a point where they can start attracting investments from institutional investors. Many hedge funds (especially those with pedigreed managers) are able to start with backing from institutional investors while others (including many start up hedge funds) will need to develop a track record before seriously courting these types of investors. This article describes institutional investors and details some of the hedge fund due diligence procedures which institutional investors will put a fund through prior to investing.

What is an institutional investor?

Institutional hedge fund investors include state and corporate retirement and pension plans, endowments (non-profit and educational), banks, insurance companies and other types of corporations and companies. Sometimes there are very large hedge funds which will themselves invest in small and start up hedge funds in such instances the large hedge fund will be acting as an institutional investor and will require many of the same due diligence materials. Institutional investors are important for the hedge fund community because they provide a very large potential base for investments.

What is hedge fund due diligence?

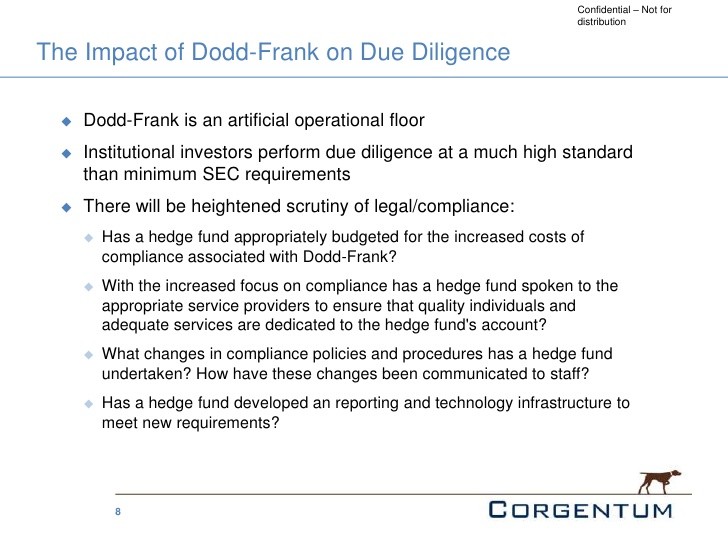

Hedge fund due diligence is the process that an investor goes through in order to vet a potnetial investment in a hedge fund. Due diligence will include the following:

- background checks on all of the managers and employees of the management company

- thorough review of all of the hedge fund offering documents

- review of the management companys risk management procedures

Due diligence document request

The timeline for an investment by an institutional investor is likely to be much longer than the time an individual investor will take to invest in your fund. Typically an investment will need to be approved by the managing director in charge of investments or alternatives; then the institutional investors compliance department will typically make a request for certain documents and/or other information. A sample list of the documents requested might look like the following:

Please provide the following information:

- Brokerage Agreement with [name of hedge fund broker]

- Copies of the executed partnership agreement(s)

Depending on the nature of the institutional investor, you will see different levels of analysis of the actual trading style and returns of the fund. A sample reqest for information might include the following:

A detailed information on the trading program including:

- list of investments

- execution

- frequency

- diversification

- liquidity

A detailed examination of historical returns including:

- weekly/monthly/annual returns (best/worst/average)

- sharpe ratio

- sortino ratio

- standard deviation

- VaR

- drawdown analysis

While I have hit upon most of the high points, any one institutional investor may have requests which are completely different from the items requested above. If you have any questions on the due diligence process or an investment into your fund from institutional investors, please dont hesitate to contact me directly.