Hedge Fund Formation

Post on: 13 Апрель, 2015 No Comment

Riveles Law Group has extensive experience representing managers of hedge and private equity funds in organizing and structuring private investment vehicles in both the U.S. and offshore jurisdictions.

Our Holistic Approach to Fund Formation:

- Investor Profile

- Strategy Focus

- Liquidity Expectations

- Tax Law

- Regulatory Compliance

- Marketability

With this approach we can work collaboratively with each manager to determine the optimal fund structure. Simon Riveles guides fund managers through all aspects of the fund formation process ; from creating a fund structure most likely to attract target investors (while retaining manager flexibility) to developing a compelling strategy description and facilitating introductions to leading administrators, auditors, brokers, and marketers.

RLG has represented managers in the United States, Canada, South America, Asia, and the Caribbean. These managers operate private funds with assets under management from $1 million to $300 million in connection with strategies including:

- Long Short Equity

- Futures/Forex

- Global Macro

- Sector Focused

- Value Investing

- Quantitative/Statistical Arbitrage

- Options

- Fund of Funds

- Tax Lien and Deed Certificates

- Hybrid Hedge/Private Equity

- Credit

- Factoring/Cash Advance Payments

- Real Estate

- Multi-strategy/Series LLC

Who do we Advise?

- Manager’s seeking to attract taxable U.S. investors with a traditional domestic fund structure;

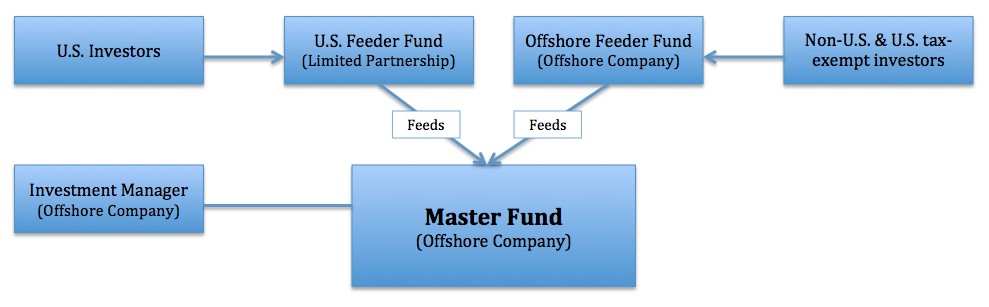

- Manager’s seeking to attract offshore and or U.S. tax exempt investors through the establishment of U.S. and offshore structures, including “master” and “mini-master” feeder structures, in offshore domiciles such as the British Virgin Islands and Cayman Islands;

- Manager’s establishing funds in jurisdictions where investment adviser registration is required or an exemption to investment adviser registration must be obtained;

- Manager’s establishing funds with over $150 million in regulatory assets under management required to register as investment advisers with the Securities and Exchange Commission;

- Established managers seeking to add fund structures in order to, for example, accommodate off-shore and tax-exempt U.S. investors or new investors under side letter agreements, establish relationships with third party marketers, solicitors and finders that comply with securities laws.

What Services do we Provide?

- Advise on fund structure, including compensation and liquidity provisions, valuation procedures, subscription requirements, etc.

- Preparing private placement memoranda, limited partnership agreements, subscription documents, and manage operating agreement for domestic and offshore entities.

- Collaborating with fund managers to formulate investment goals and strategy descriptions;

- Assisting fund managers with SEC and State investment adviser registration and managers of futures and forex funds with CFTC registration .

- Preparing SEC Form D and state “blue sky” filings.

- Advising on state and federal laws affecting hedge funds.

- Advising on new rules regarding the general solicitation of hedge funds under Rule 506(c) of Regulation D and the accredited investor verification requirements related thereto.

- Advising on UBTI, UBT, franchise tax and relating tax matters relevant to private funds.

- Facilitating the establishment of relationships with hedge fund administrators, accountants, brokers, and other service providers.

- On-going advising and compliance services.

For specific information about your jurisdiction’s regulatory requirements, the fund formation process and any other questions you may have, contact Riveles Law Group. We are happy to provide a free consultation and explain our flat fee transparent pricing and personalized approach to start your own hedge fund.