Head & Shoulders Forex Reversal Pattern Trading Strategy

Post on: 24 Май, 2015 No Comment

Head and Shoulders top and bottom chart patterns are commonly used to identify turning points in the overall trend. They are quite profitable in the forex market if applied correctly. Lets start exploring the top reversal pattern.

Head and Shoulders Top Reversal Components

- Left Shoulder: Forex bulls push prices upwards making new highs; then currency price retreat to find support creating a first bottom (S1).

- Head: Forex bulls make another run higher now creating the head of the pattern; then currency price retreat again creating the second bottom (S2).

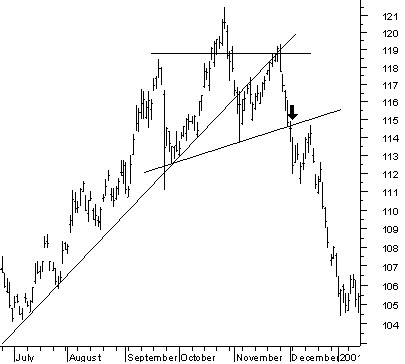

- Right Shoulder: The forex bulls push higher again, but this time fail to make a higher high above the head of the pattern. Price falls below the down trending slope line (neckline) which now creates a short entry trade in the market. (see USD/CAD example below)

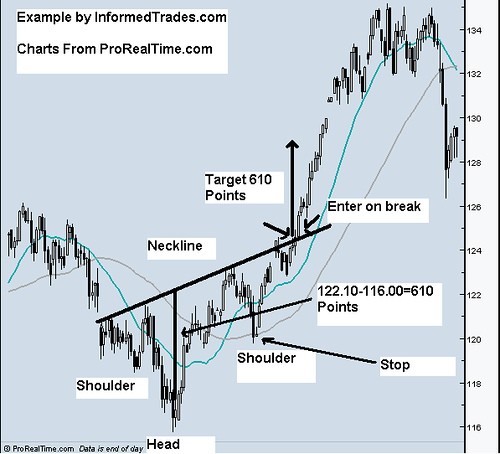

USD/CAD 1 Hour Head & Shoulder Top Reversal Pattern Example

We can easily identify an head & shoulders top reversal pattern in the above picture.

How to trade H&S reversal patterns (see USD/CAD example)? Go short USD/CAD on a sessions close below the rising neck line. Place stop loss above the right shoulder and use reward to risk ratio 1.5 or better. This particular trade already gained 120 pips of profit. It is now recommended to move stop loss to break-even point. This creates a risk free short trade on the USD/CAD.

Forex Reverse Head and Shoulders Pattern

The opposite of the Head & Shoulders top pattern is the Reverse Head & Shoulders bottom pattern.

Reverse Head and Shoulders Pattern Components

- Left Shoulder: Forex bears push prices downwards making new lows in the market; then currency price rallies to find resistance creating a first top (R1).

- Head: Forex bears make another run lower now creating the head of the pattern; then currency price rallies again creating the second top (R2).

- Right Shoulder: The forex bears push lower again, but this time fail to make a new lower low below the head of the pattern. Price rallies above the up trending slope line (neckline) which now creates a long entry trade in the market.