Gold Forex Tips Bond Spreads A Leading Indicator For Forex

Post on: 8 Апрель, 2015 No Comment

Thứ Ba, ngày 06 tháng 4 năm 2010

Bond Spreads: A Leading Indicator For Forex

The global markets are really just one big interconnected web. We frequently see the prices of commodities and futures impact the movements of currencies, and vice versa. The same is true with the relationship between currencies and bond spread (the difference between countries’ interest rates): the price of currencies can impact the monetary policy decisions of central banks around the world, but monetary policy decisions and interest rates can also dictate the price action of currencies. For instance, a stronger currency helps to hold down inflation. while a weaker currency will boost inflation. Central banks take advantage of this relationship as an indirect means to effectively manage their respective countries’ monetary policies.

By understanding and observing these relationships and their patterns, investors have a window into the currency market, and thereby a means to predict and capitalize on the movements of currencies.

What Does Interest Have to Do With Currencies? To see how interest rates have played a role in dictating currency, we can look to the recent past. After the burst of the tech bubble in 2000, traders went from seeking the highest possible returns to focusing on capital preservation. But since the U.S. was offering interest rates below 2% (and going even lower), many hedge funds and those who had access to the international markets went abroad in search of higher yields. Australia, with the same risk factor as the U.S. offered interest rates in excess of 5%. As such, it attracted large streams of investment money into the country and, in turn, assets denominated in the Australian dollar.

These large differences in interest rates led to the emergence of the carry trade. an interest rate arbitrage strategy that takes advantage of the interest rate differentials between two major economies, while aiming to benefit from the general direction or trend of the currency pair. This trade involves buying one currency and funding it with another, and the most commonly used currencies to fund carry trades are the Japanese yen and the Swiss franc because of their countries’ exceptionally low interest rates. The popularity of the carry trade is one of the main reasons for the strength seen in pairs such as the Australian dollar and the Japanese yen (AUD/JPY), the Australian dollar and the U.S. dollar (AUD/USD ), the New Zealand dollar and the U.S. dollar (NZD/USD ), and the U.S. dollar and the Canadian dollar (USD/CAD ). (Learn more about the carry trade in The Credit Crisis And The Carry Trade and Currency Carry Trades Deliver .)

However, it is difficult for individual investors to send money back and forth between bank accounts around the world. The retail spread on exchange rates can offset any additional yield they are seeking. On the other hand, investment banks. hedge funds, institutional investors and large commodity trading advisors (CTAs) generally have the ability to access these global markets and the clout to command low spreads. As a result, they shift money back and forth in search of the highest yields with the lowest sovereign risk (or risk of default). When it comes to the bottom line, exchange rates move based upon changes in money flows.

The Insight for Investors

Individual investors can take advantage of these shifts in flows by monitoring yield spreads and the expectations for changes in interest rates that may be embedded in those yield spreads. The following chart is just one example of the strong relationship between interest rate differentials and the price of a currency.

Figure 1

Notice how the blips on the charts are near-perfect mirror images. The chart shows us that the five-year yield spread between the Australian dollar and the U.S. dollar (represented by the blue line) was declining between 1989 and 1998. This coincided with a broad sell-off of the Australian dollar against the U.S. dollar.

When the yield spread began to rise once again in the summer of 2000, the Australian dollar responded with a similar rise a few months later. The 2.5% spread advantage of the Australian dollar over the U.S. dollar over the next three years equated to a 37% rise in the AUD/USD. Those traders who managed to get into this trade not only enjoyed the sizable capital appreciation. but also earned the annualized interest rate differential. Therefore, based on the relationship demonstrated above, if the interest rate differential between Australia and the U.S. continued to narrow (as expected) from the last date shown on the chart, the AUD/USD would eventually fall as well. (Learn more in A Forex Trader’s View Of The Aussie/Gold Relationship .)

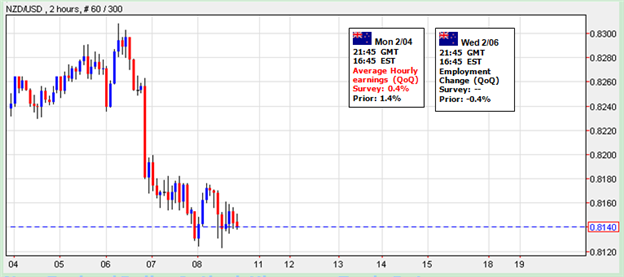

This connection between interest rate differentials and currency rates is not unique to the AUD/USD; the same sort of pattern can be seen in USD/CAD, NZD/USD and the GBP/USD. Take a look at the next example of the interest rate differential of New Zealand and U.S. five-year bonds versus the NZD/USD.

Figure 2

The chart provides an even better example of bond spreads as a leading indicator. The differential bottomed out in the spring of 1999, while the NZD/USD did not bottom out until the fall of 2000. By the same token, the yield spread began to rise in the summer of 2000, but the NZD/USD began rising in the early fall of 2001. The yield spread topping out in the summer of 2002 may be significant into the future beyond the chart. History shows that the movement in interest rate difference between New Zealand and the U.S. is eventually mirrored by the currency pair. If the yield spread between New Zealand and the U.S. continued to fall, then one could expect the NZD/USD to hit its top as well.