Gap Trading Online Stock Trading Guide

Post on: 16 Март, 2015 No Comment

You may have heard about Gap Trading before, but what exactly does this refer to? How can we try and take advantage of these potential trading opportunities when they come about?

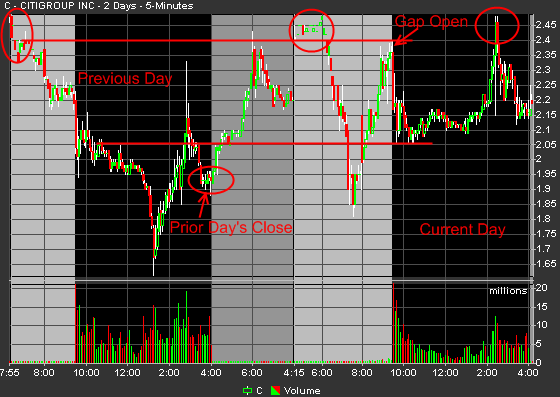

I’ll go over a few ideas and things that I look for myself below. I’ve been meaning to write this article for a few days now, and todays price action in the stock market gave me a perfect chart example to use.

Before we begin, let’s go over a brief description of what Gap Trading refers to: Taking advantage of opening prices that are abnormally higher (or lower), than the preceding days regular trading session closing price, typically from extremes in optimism or pessimism. (or it can be whatever the particular time frame on the chart you are looking at).

A couple of things to note as we move along:

- I mentioned the previous days regular trading session closing price. Some people use the extended trading sessions to determine gaps, others, the regular trading session. To me, any abnormal, or considerably large move from one day to the next, qualifies for me to take a closer look for a potential trading opportunity. There are different types of gaps. Here are a few: Breakaway Gaps, Continuation Gaps, Exhaustion Gaps, Common Gaps. Gaps may or may not get filled. Understanding why the Gap has occurred will help determine which way to trade.

The example below is for a Gap trading down scenario using SPY that occurred Tuesday May, 25, 2010. The chart is displaying a 3 day time period (I know it says 2 days, but trust me it’s 3 days).

The mood surrounding the stock market during this Gap down was filled with uncertainty and fear of a multitude of different things. There were also key prior support levels in the area of the opening price.

With a Gap down in prices, extreme fear plays a key role. When a large number of people are fearful, selling occurs and at some point, can become over done.

You can see on the chart above that prices opened up near 105-105.35 and then moved lower to approx. 104.30 within a few minutes into the regular trading session. Then, prices began to move higher in a choppy fashion, but continued higher throughout the day and closed at the highs.

You’ll also notice that prices closed not just at the high of the day, but just about exactly where prices closed the previous day. This is a great example of a Gap being filled.

A great trading opportunity existed here (for intraday traders) and this same type of price action occurs many times throughout the year. If you think about it, the pattern makes good sense:

If you have a group of 1000 people and a certain number of those people are scared, say 500, and they decide to sell as early as they can, what happens when they are done selling? No more selling, and potentially, the remaining people increase their buying to take advantage of the lack of continued selling once the sellers dry up. Prices then move higher.

As prices move higher throughout the day, some of the people who sold early, start to think twice about what they did and start buying again also.

Once prices begin to reach the previous days closing price, many of the buyers who bought early during the gap down, may begin to start selling (to the people stepping back in buying who sold earlier), taking their profits. This is why Gaps that get filled are not necessarily a good sign, but possibly just experienced traders taking advantage of the price action.

The next chart below is of the same as above, with both premarket and extended hours trading (from the previous days) added.

I have included this chart because there are important price levels that should be noted in these added trading sessions. I use the price levels during pre-market and the previous days extended hours as potential support and resistance levels while I trade.

You’ll notice that during the pre-market trading session on the Gap down, prices found support near 104.50 3 times, with one of those times spiking down briefly near 104.25. Now look where prices found support when the regular trading session opened? Near 104.35. Pretty darn close.

Had prices moved decisively below 104.25, the Gap down may not have been filled at all. Instead, a continuation of the downtrend may have resumed.

How can we try and take advantage of a Gap Trading scenario like this?

Using this as an example (and I’ve seen this same type of example occur over and over again), here’s what you could have done: 1) Wait for the regular trading session to open, 2) allow the panic sellers to exit their positions — which, since they are panicking, occurs fairly quickly in most cases, 3) watch the pre-market support levels and wait for a reversal to begin off the same price level, 4) enter against (fade the gap) the direction of the gap (long in this case).

This type of trading takes strong nerves and is not for everyone. In this example, if prices continued lower through 104.25, they very well may have accelerated, making it hard to get out of some positions, not just emotionally, buy physically as well. Be sure and use some type of Stop Loss.

Another way to trade this type of Gap Down, is to wait for the Gap to get filled, and then go short, expecting the previous downtrend to continue.

For me personally, I feel we are in an overall downtrend in the market so I would rather look for shorting opportunities. On this particular day I placed 7 trades (I usually place 1-3 trades each day lately, but I felt strongly with my decisions today). The first trade I made was a long position playing the move higher from the morning lows.

My remaining 6 trades today were all short positions, entering on each new spike higher, as I felt the reasons for the market selloff to begin with, are still here. 4 of the trades were done by 10:30 a.m. with the other 3 scattered up through about 3:30.

So, Gap trading can be done either in the direction of the gap itself, or against the direction of the gap. Before you decide which, you have to try and determine why the Gap has occurred to begin with. I’ll be adding more examples of different types of Gap trading scenarios such as one’s due to earnings or news releases, in the near future.