G20 Clears Way for Further Yen Weakness; Seasonal Trends at Odds

Post on: 23 Июнь, 2015 No Comment

G20 Clears Way for Further Yen Weakness; Seasonal Trends at Odds

Fundamental Forecast for Japanese Yen: Bearish

What a difference one week makes. After the briefest of reprieves, the Japanese Yen was bank in the gutter, weakening across the board in the second full trading week of February, but for against the British Pound, which it gained +0.92% against. The meteoric rallies in the EURJPY, NZDJPY, and USDJPY continued, with the Yen-crosses rallying by +0.85%, +2.02%, and +0.88%, respectively. From Tuesday through early Friday, it appeared that the Yen may have bottomed; the G7 issued a statement seen as condemning Japan for its policies that have placed significant downside pressure on the Yen, marked by excessive volatility in FX.

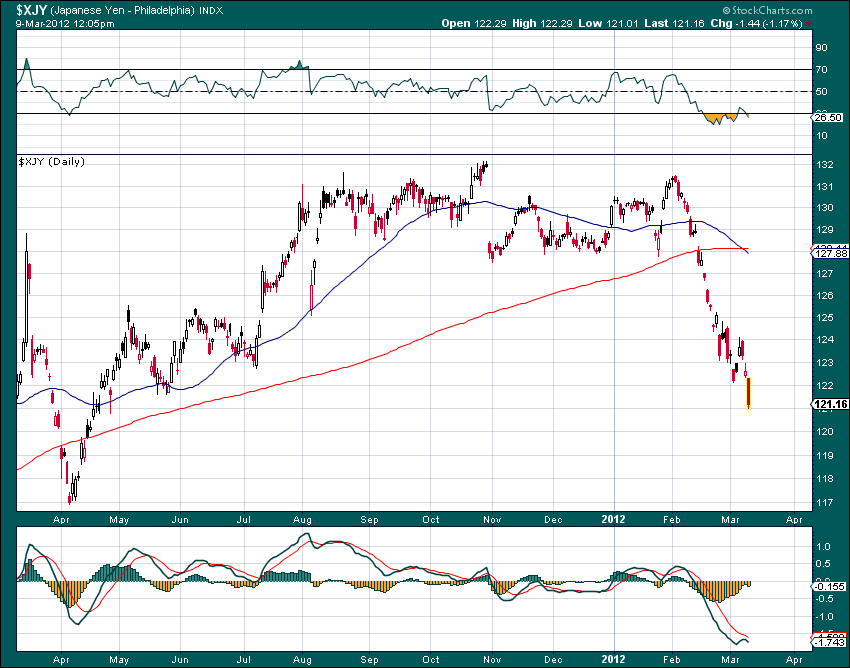

And for a while there, it appeared that the G20 was ready to back up the G7s statement, with Russian officials leading the charge forward against outright currency manipulation after all, the G20 meeting was held in Moscow. To be more specific: the G7 made it clear that they do not believe central banks should target exchange rates; the G20, however, said that they believed Japans loosening monetary policy was a domestic policy decision. While this is at odds with what some Japanese government officials have said both the economic and finance ministers on separate occasions have said they believed a USDJPY rate at 95 or 100 would be appropriate if none of the major players in the market are going to stop the Yen slide, it may not be over yet. And with international pressure off the table as a possible impediment to further Yen weakness, we must retain a bearish bias.

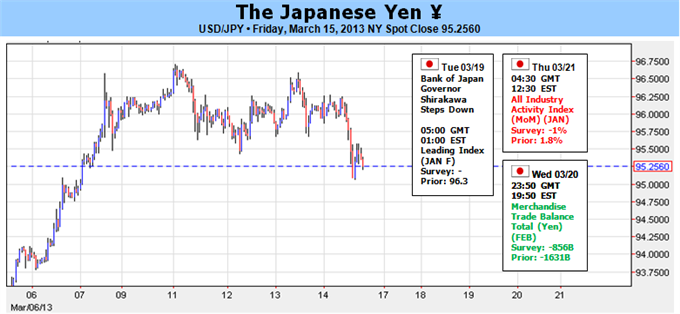

Looking ahead to the next week, this overhang is likely to continue to guide the Yen with little major event risk on the docket. In all, there are two events on the schedule that could provoke additional volatility. On Tuesday (Wednesday in Japan), the Merchandise Trade Balance Total for January will be released, and is expected to show a whopping deficit of -1.384 trillion, from -643.3 billion in December. This would be the first trillion Yen deficit since January 2012 and that kicked off significant weakness in the Yen during the 1Q12. Unless the figure surprises and shows a smaller deficit than in December, any Yen strength resulting from the print should be short-lived, if there is any strength at all. Also due on Tuesday, the All Industry Activity Index for December, offers a different, more optimistic perspective of the Japanese economy: the gauge is expected to have expanded by +1.6% m/m from -0.3% m/m in November. No doubt, this brighter print is a result of the weakening Yen in December; it should not materially change the Yens trajectory.

With the major theme remaining in place Yen weakness as the economic minister has called for a Nikkei 225 target of 13000 by the end of March (currently at 11173.83) we must point out that some interesting seasonal trends are coming into play. From now to mid-March, the USDJPY tends to weaken; from mid-March to the end of April, the USDJPY tends to strengthen. This is due to the fiscal year ending in Japan in March, but we suspect it could be muted over the next four weeks, especially now that the G20 is out of the way, so to speak. If there is a point at which the Yen could strengthen, it has a small chance to happen now, especially as our proprietary sentiment indicator, the Speculative Sentiment Index, is showing that retail investor sentiment is turning. But without a major catalyst, there is little reason to expect anything else but continued weakness in the Yen for the time being. This begs the question; at what point in time will the Yen be weak enough for Shinzo Abe? Or will he lose control and is the Yen only in the beginning stages of a complete collapse? Time will tell. CV

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.