Futures Trading Tips Help You Capture More Profits

Post on: 10 Июнь, 2015 No Comment

with these Futures Trading Tips

What tips on commodity trading? you ask.

When it comes to futures trading, EVERYONE has futures trading tips. Tips in forums, your neighbor. even the mailman may have some advice for you.

You might hear Get into Gold, it’s safer than the dollar,

or, Oil futures are king! Or, FOREX — now you can make a killing there!

But, when it comes to sorting out quality futures trading tips and information, whom if anyone, do you trust or listen to?

This section covers the topic of select trading tips:

- Evaluating ‘Industry’ Tip Sources

- Planning Your Own Conservative Strategy

- Filtering the Gems from the Noise

- Timeless Futures Trading Tips

Futures and Options Commodities

Tips of the Day

A hot trading tip? A truly genuine can’t miss commodity trading tip? REALLY??

Hold the phone. Don’t leap too fast!

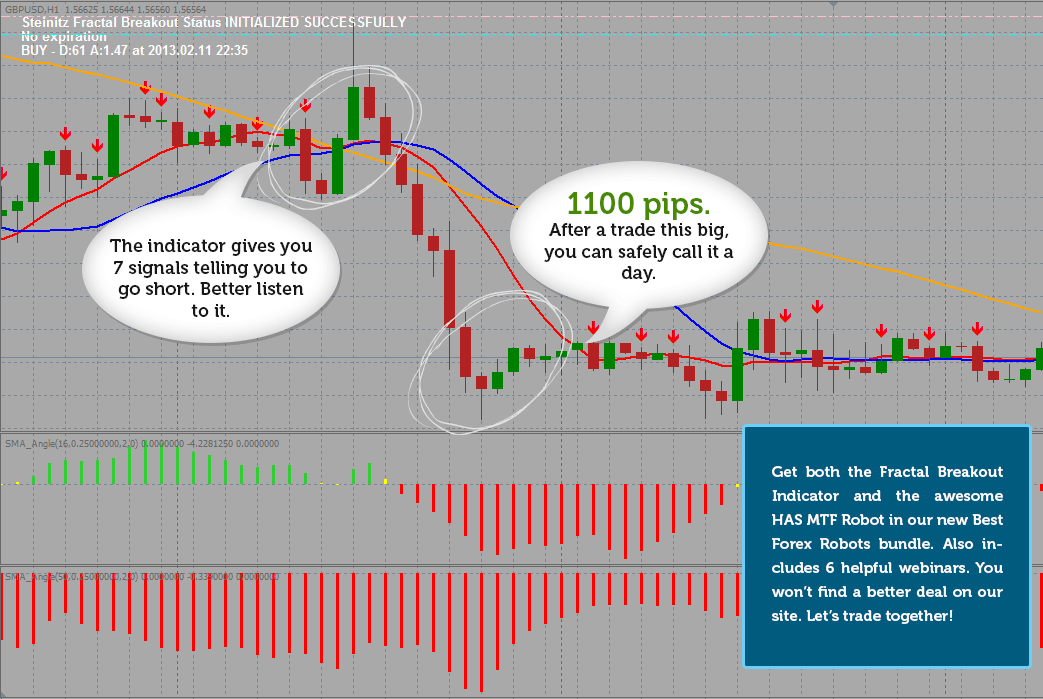

Trading signal services — a fairly prevalent source of commodities trading tips — and there are many of them — often provide futures(and options) commodities tips of the day.

This is particularly true for those interested in very short time period trading like day trading or micro trading.

Many of these very short time period signal services post hot futures trading tips several times throughout the day depending on what the market is doing.

That’s not to say there are not good signal services out there providing solid futures and options commodities tips of the day — there are.

But, on any and all futures and options commodities tips of the day, specials or hot tips from signal providers. you need to evaluate each of these tips within the context of your trading style and your own unique trade money management approach.

Do this BEFORE you decide to enter a trade. and see if the commodity futures tips in question make sense for you, your risk tolerance level,

your trading and money management strategy, etc.

Jump on the bandwagon without doing your proper ‘due diligence’,

and you’re begging for trouble.

Do what you want, but until you really know your way around the markets and have a strong handle on all the key futures trading basics.

. you may want to consider other types of futures trading tips or other

types of trade analysis with which you may feel more comfortable.

The bottom line regardless of the source of your futures trading ‘tips’

or information. if you aren’t comfortable with it, those signals or that info won’t do you much good.

Why? Because you won’t trust them 100% and will be prone to

There will always be some guessing — rarely do you get a 100% confidence factor in your trade analysis — 99% maybe .

But you never want to be second guessing all the time.

It’ll drive you right out of trading and into the nut house.

Plan Your Work and Work Your Plan

commodities trading tips that haven’t been properly ‘vetted’ yet.

This approach definitely requires more time. You need to take time to learn

about various trade indicators and methodologies, choosing the ones

that make the most sense to you.

Then build a solid trading plan/strategy around them.

These methodologies, info sources, indicators and analyses, need to,

in your evaluation, provide value in helping you pinpoint and assess

trading opportunities and show a reasonable capability for generating

positive trades and ROI for your trading efforts.

And please — — regardless of how you come by your trading strategy — — — and before running with it using live ammo in realtime futures trading.

PLEASE take the time in practice paper trading and/or perhaps back-testing, to see how it performs/may perform.

Futures Trading Tips

Filtering Out The Noise

NEWS FLASH — — — Some of the most successful traders may have a low trading win ratio of only around 30%.

That’s right, less than 1/3rd of their trades may be winning trades.

But, one of the reasons they’re so consistently successful — is by catching the big moves while exercising sound trade management on all of their trades.

And part of sound trade management is that consistently profitable traders have taken the following several futures trading tips to heart, making them a key part of every trade and their overall trade strategy.

Stop listening to all the chatter for a few moments — and instead

listen to those successful commodity traders who really ARE making money

day-in, day-out, over many years in the futures markets.

Very simply, listen to their wisdom, distilled into some real gems

of mini commodities trading tips below.

Timeless Futures Trading Tips

- BE CONSERVATIVE — Successful swashbuckling, aggressive risk-taking behavior in the world at large can be pretty impressive to watch.

But in the futures trading world it can destroy and crush your world -

- in minutes.

There have been some really impressive futures traders down through the decades, but even some of them have fallen victim to their own successes and/or believing their press clippings.

Be conservative. Be humble. Keep your feet on the ground and your head out of the clouds. Have respect for trading and it will respect you.

- DO YOUR HOMEWORD — Unless you prefer to go the route of a managed futures trading account, with a CTA or other certified futures trading professional handling your trading account decisions. always, Always, ALWAYS. take the time to do your homework on any potential futures trading tips and opportunities.

Better to pass on a trade that smells a bit funny to you, than to

go into a trade half cocked or blindly following some tip.

- NEVER CHASE A TRADE — There will ALWAYS be another trade.

Never feel like you MUST get in a specific trade.

The minute you do so, you give away your control to the markets. This can be like taking your hands off the steering wheel of your car for awhile — not a very smart thing to do.

It doesn’t matter how tempting futures trading tips look.

Whenever you feel yourself getting too emotionally involved

and caught up in the moment. that’s Mr. Greed talking into your ear.

STOP! Take a deep breath, and walk away. Take a break.

If you come back and the opportunity is still there and it makes sense, fine.

If not. and if the trade took off. we’ll. just say to yourself.

That’s interesting. And move on.

That can be tough, especially if a big move takes place. But not even the best of commodity traders catches every move.

Sure as the sun rises tomorrow, there WILL be another trade.

You will catch your share of them. Let that be enough.

- ALWAYS TRADE WITH A STOP LOSS — Relatively few of most futures traders succeed. Fewer still are those who successfully trade without using stop loss orders on their trades.

They may use mental stops. or have such large financial resources

at their disposal, that they can afford the everyday market fluctuations

when their positions may drop into the red when price action moves against their open trade positions.

For the rest of us, PLEASE. It is strongly suggested you consider using the safety net of the stop loss.

The stop loss order is there to help you — to protect your trading account, to help minimize your losses and keep youin the trading game.

Take advantage of that protection. Learn how to use them.

Practice futures trading with stops. And use them when putting your

trading capital on the line.

Sure, you’ll have your share of being stopped out of trades prematurely. Yes, you’ll miss some futures trading tips. You’ll have that distinct ‘upset stomach’ feeling when you see a market retrace, take out your stop, then take off and make a big move, with you sitting on the sidelines.

But, remember. Don’t get greedy. Remain cold, detached and unemotional.

And take solace that in price moves against your position, that you are protecting your capital, minimizing your losses, andliving to trade

another day.

This concludes the section on futures trading tips.

Return to Home Page from Futures Trading Tips page

FUTURES TRADING and FOREX TRADING DISCLAIMER:

Trading in Futures, Index Futures and Options of Futures involves substantial risk, may result in serious financial loss, and is not suitable

for everyone.

As with Future Trading, trading Foreign Exchange instruments carries the same substantial risk of financial loss, and is not suitable for many members of the public.

In trading any of the above mentioned financial instruments, only risk capital should be used.

The information on this website is provided purely for informational purposes only.

You should carefully consider whether trading is appropriate for you

in light of your experience, objectives, financial resources and other relevant circumstances.

Futures-Trading-Mentor.com expressly disclaims all liability for the use or interpretation by others of information contained in this site.

Decisions based on the information contained in this site are the sole responsibility of the visitor, and in exchange for using this site, the visitor agrees to hold Futures-Trading-Mentor.com harmless against any claims for damages arising from any decisions that the visitor makes based on such information.

While the information on this website is believed to be accurate at the time is is posted, we cannot give any assurances that the information is accurate, complete or current at all times.

None of the site content may be reproduced without expressed written permission.