Fundamental and Technical Analysis of the Forex Market

Post on: 8 Апрель, 2015 No Comment

Fundamental analysis is essentially the study of a nation’s overall economy. The idea of this Big Picture approach is that the strength of a nations’s economy will affect the supply and demand for its currency, which will in turn affect the price of the currency.

On the other side of the fence is technical analysis where the currency price is assumed to reflect all news and fundamental factors, and the charts are the objects of analysis. The core belief here is that prices tend to follow patterns and by analyzing past price patterns a trader can predict the future direction of the price.

This article will present some general discussion of both areas of analysis and summarize some of the more popular indicators used to predict currency movements.

First of all, employing fundamental analysis strategies requires a basic understanding of supply

and demand, which is the most elemental force behind all financial markets. Since the value of a currency comes from the economic health of its respective country, macroeconomic changes can have a significant impact on currency rates.

Several factors can have a strong influence on rates. Some of the more significant are: politics, economic strength, speculation, economic projections, inflation rates, capital movement,interest rates, and quotas and tariffs.

Fundamental analysis itself can be broken down into two broad subcategories: capital flows and trade flows.

A country’s capital flows are the net quantity of currency being traded through various investments:

capital, equity market, fixed income market, etc.

Trade flows measure the net of imports and exports of a particular country, and the resulting effects that such flows can have on a nation’s currency.

The reason that trade plays such a strong role in determining strength of a currency is that importers

are required to sell currency used to purchase goods and services which are exported.

A Country which has a positive trade flow (more exports than imports) runs surpluses that serve to increase their currency while the opposite is true for the net importer. Fundamental analysis of this factor is one of the more important.

Traders who perform Fundamental analysis study various economic indicators to evaluate economic strength.

Some of the more significant indicators include: The Gross Domestic Product (represents the total market value of all goods and services produced), Retail Sales (measures the total receipts of all retail stores), Industrial Production (shows the change in production of factories, mines and utilities), and Consumer’s Price Index (measure of the change in prices of consumer goods).

Although there are other significant indicators that may be monitored, these are the most common and provide a basic analysis of a country’s economic strength and hence currency stability.

These reports are released on a regular basis by various government agencies and non-government organizations.

A trader who utilizes fundamental analysis typically will have the report schedules on hand and closely monitor the reports as well as the effects they may have on currency prices. Following this for a period of time will help the trader determine better what impact on the currency prices each of the reports may provide.

Technical analysts quite often will use price charts and patterns to anticipate price changes in both direction and range.

Candlestick Charts are widely used by Forex traders.

Consisting of a rectangle that indicates the opening

and closing prices (candle) and the wicks that represent the highs and the lows, Candlestick charts allow the trader to find out a great deal about the market and to make effective decisions.

When conducting Technical analysis of the Forex Market, most traders utilize one or more technical indicators to evaluate market direction and strength.

Some of the more popular indicators are the following:

MACD (Moving Average Convergence Divergence) consists of two moving averages. When one moving average crosses over the other one, a change of trend for that currency may be expected.

Stochastics operates much the same way as the MACD. The two may be used together to confirm a trend change.

Relative Strength Indicator (RSI) provides information on whether the currency is overbought or oversold as well as whether it is likely in an uptrend or downtrend.

Bollinger Bands are somewhat unique. Consisting of three lines (the middle line is a moving average), this indicator can provide useful information on market volatility.

Fibonacci evaluation can provide a retracement projection. Unlike most other indicators, the Fibonacci analysis is a LEADING indicator yielding a determination of future market direction, not past.

Bond Spreads may also be useful as a LEADING indicator. A bond spread is typically viewed on the difference between the five year and ten year bonds of two currencies. The limitation of using Bond spreads as an indicator is it may take several months, even over a year for the anticipated currency change to actually take place.

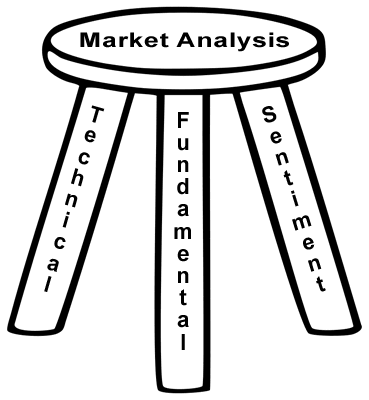

While both Fundamental and Technical analysis of the Forex market provide very useful information, they each

have their strengths and weaknesses.

The Big Picture of Fundamental analysis is good at identifying general long-term trends in price movement, but it does not give enough detail to provide entry and exit points for a trader.

Technical analysis on the other hand is typically more effective in predicting short-term trends (under three months),but it can suffer by being blind sided by significant price swings brought about by one or more fundamental factors.

Combining both Fundamental and Technical analysis of the Forex market may give the Forex Trader the best balance in his trading plan.

By monitoring various indicators on both sides of the fence over time, the trader may gain a better understanding of what will work best for his particular trading plan and style.