Fundamental Analysis v Analysis – Which is better

Post on: 16 Март, 2015 No Comment

Fundamental Analysis vs. Technical Analysis – Which is better? 5.00 / 5 (100.00%) 1 vote

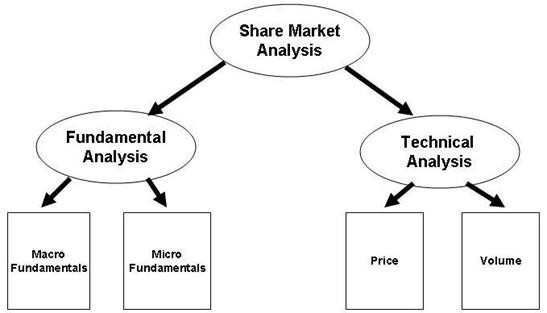

Fundamental analysis and technical analysis are the two main schools of thought in the financial assets market. Both methods involve looking at available information and projecting the future price of the asset being traded. There is a major controversy surrounding these two methods of analysis. Some traders consider fundamental analysis to be more effective than technical analysis, while some others consider technical analysis to be better at forecasting prices.

What is Fundamental Analysis?

Fundamental analysis attempts to calculate the intrinsic value of an asset by looking at diverse economic factors, known as fundamentals. Investment decisions are based on the fairly simple principle that if the price of an asset trades below its intrinsic value, it is a good investment. Fundamental analysts believe that asset prices will react to specific events in certain ways and that they can predict future prices based on these events. If a company were to receive regulatory approval for a new product or service, the fundamental trader will expect the companys stock price to gain. Contrarily, if a company gets engulfed in some financial scam, a fundamental trader would expect its price to decline. Fundamental analysts need access to a wide variety of data, and conduct complex mathematical calculations. As such, fundamental traders are often large financial institutions with big support teams, rather than individual traders.

What is Technical Analysis?

Technical analysis anticipates investor demand for an asset by looking at predictable price patterns and mathematical indicators. Technical traders use graphical price charts of various time-frames to form their trading bias. They believe that all information about an asset is already ingrained in the price, so they do not need any other fundamental data to forecast its price movement. Technical analysts use many different charts types and mathematical indicators. With the advent of modern computing technology, technical analysis has become automated to a large extent. Automated analysis removes the emotional component from trading, allowing traders to base their trades solely on technical signals. Individual traders are typically technical traders.

Differences between Fundamental and Technical Analysis

There are major differences between the two methods of analysis. Fundamental analysts focus on data such as gross domestic product, consumer price index, industrial production, trade deficit etc. While technical analysts look at trends, support-resistance levels, chart patterns and indicators. Fundamental analysis is useful for long term investment while technical analysis is very popular among short term traders. The different time-frames that these two approaches adopt are the result of the nature of the analytical framework to which they each adhere. Fundamental analysts maintain that it can take a long time for an asset’s intrinsic value to be reflected in the market. Technical traders ignore the “intrinsic value” of an asset and instead consider trends and patterns created by investors’ emotional responses to price movements.However, technical analysis has its fair share of critics. Much of that criticism emanates from academic circles, which cite the “efficient market hypothesis” to debunk its principles.

Which one should you use?

Although fundamental analysis and technical analysis are seen by many as poles apart, many binary option participants have experienced great success by combining the two. Fundamental analysis can help us find assets worth buying (or selling), and then technical analysis can pin-point the right time to enter the market using tools like trend lines, moving averages and breakouts. While purists might shudder at the thought of mixing the two methods of analysis, there certainly are benefits to at least understanding both schools of thought. Ultimately, what method one uses depends on his/her own personality and aptitude.