Fundamental Analysis_2

Post on: 7 Май, 2015 No Comment

Fundamental Analysis

Important: This page is part of archived content and may be outdated.

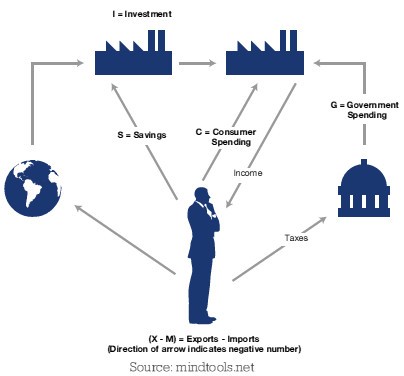

The basic premise of fundamental analysis is that the value of a currency is determined by the comparative strength and weakness of a countrys economy in relation to those of its trading partners. The stronger a countrys economy measured in higher GDP growth, lower inflation, higher interest rates, greater productivity, more political stability, etc. the stronger a countrys currency. Over time, these fundamental factors produce the long lasting price trends typical of the currency markets.

Many factors pertaining to a national economy are monitored, assessed and judged for the effect they have on economic growth and development. These trends are often large and complicated, and can be enacted over a long period of time. Another factor which affects a countrys economic status is its political system the balance between social welfare and individual competition, or the openness of an economy to foreign trade and capital. Other areas include the social and cultural makeup of a nation, such as the productivity, labor mobility, and entrepreneurship. Natural resources also play a part, such as oil or mineral deposits.

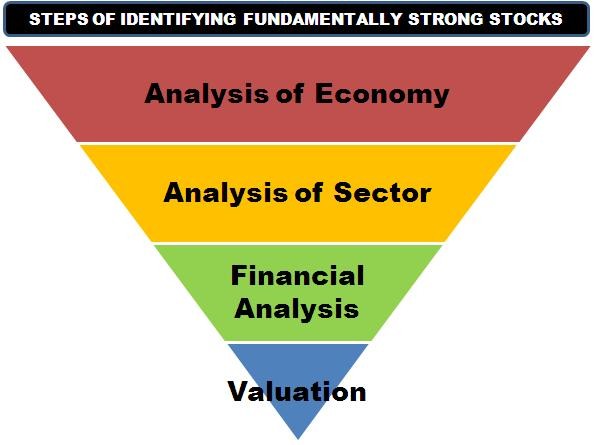

Fundamental analysis views an economy and its currency through economic statistics. These statistics often depict a particular sector of an economy rather than the economy as a whole. Because of this, different statistics may point in opposite directions; one area of an economy may be growing while another falters, or the importance of one industry declines as another rises. Most statistics are also retrograde, telling you what has already happened, but not necessarily what is to come.

In our interconnected and volatile world, political, military, human, and even natural events can have rapid, vast, and long-lasting repercussions. A fundamental analyst must take into consideration all this information to create an overall picture of an economy its strengths, weaknesses, vulnerabilities and, most importantly, its future potential and the likely future course of its currency. Personal judgment and experience come into play to complete the fundamental currency analysis.

Market Drivers

A Forex market transaction differs from a retail transaction. In a retail environment, the price is predetermined by the seller, and the purchaser measures his need for the item against the price asked and makes his decision to buy or not. In a market transaction, both the seller and the buyer continually adjust their price expectations to the information flowing out from the market to its participants and into the market from outside sources.

A seller who thinks that the price may be higher in a few minutes may choose to withdraw an offer hoping to get a higher rate. If enough sellers withdraw their offers at a specific level the deal price will rise to the next available offer. But if traders think the price may fall then they may lower their own offers until they find a buyer, in effect driving the market price lower.

When each participant in the market reacts to this changing information, the combined reaction results in the movement in price. It appears to an observer that the market traded lower only because the thousands of individual decisions that comprise the movement are not given separate life only the mass decision, the price, is represented. We often say the market reacted badly to the news or the market took profit today. But the common use of this market shorthand tends to obscure what is most important psychological point in understanding market behavior the market is a picture of the thoughts of its participants, a snapshot of our minds.

The difference between what the market participants assume will happen in the market and what reality proves produces market movement. When a particular economic statistic is released, and its at or close to the general opinion of what the result would be, then the trading reaction is muted. The statistic is said to be priced into the market, which means that many prior trading decisions assumed the state of the economy portrayed by the statistic and that has become reflected in the trading rate.

If the statistic proves to be different than this assumption, then most of those trading decisions will be immediately unwound, and result is price movements that reflect those changes. It is this tension between the opinion of the majority of market participants as reflected in the trading rate, and the economic, statistical or rate reality that dominates currency trading.