Free Forex Tips Forex Early Warning

Post on: 24 Август, 2015 No Comment

This page contains a comprehensive list of hands-on practical forex tips for trading the spot market. These free forex tips are dynamic and have been rewritten several times based on the input of our experienced client base.

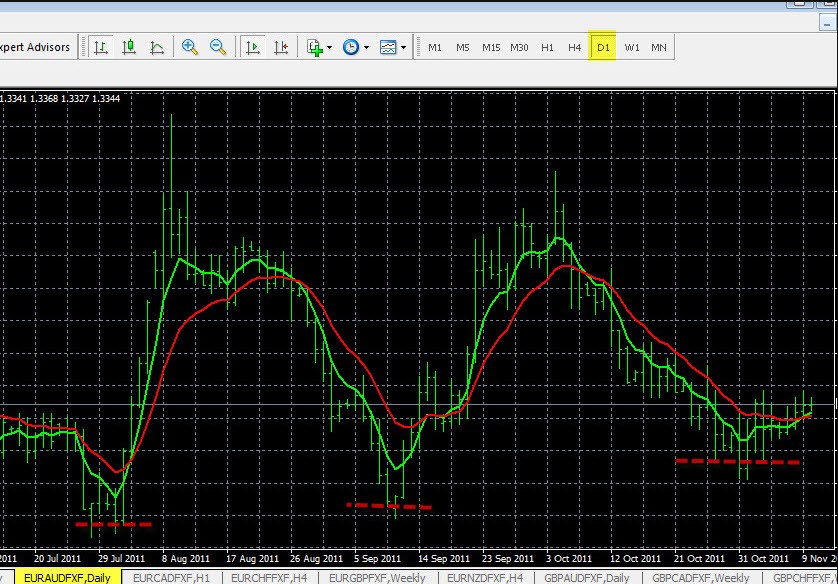

Tip 1 — Always trade in the direction of the trend. The foreign exchange is a large market and the trends, momentum, and movement cycles tend to last longer than other financial markets. If you don’t know the trends of the market or consistently trade against them it will cause pain and losses.

Tip 3 — Another forex tip is to know the currency pairs you trade. Most traders trade one or two pairs. Since we trade 28 pairs there is a bit of a learning process. Some currency pairs move fairly slow and some move extremely fast.

Slow moving pairs include the NZD/USD, AUD/NZD, NZD/JPY, EUR/GBP, AUD/CAD and CHF/JPY. The next group moves a little faster like the AUD/USD, EUR/CHF, and AUD/JPY. Intermediate volatility pairs include the EUR/USD, USD/CHF, USD/JPY, EUR/JPY, CAD/JPY and USD/CAD. High to very high volatility pairs include the GBP/AUD, GBP/CAD, GBP/USD, GBP/CHF, GBP/JPY, GBP/NZD, EUR/AUD, and EUR/CAD.

Tip 4 — After you enter a trade you can use these guidelines for initial stop order placement. Initial stops for slower moving pairs should be in the range of 20-25 pips. Just verify where the pair was trading as it was consolidating in the last few hours before the current movement started using a conventional bar chart found on most brokerage platforms. You can also check the free trend indicators .

Look at the recent lows and highs on the smaller timeframes on the free trend indicators established in the last few hours prior to the start of the movement. Initial stops for buys should be placed immediately below the recent lows as the pair was consolidating for the last few hours of trading prior to the upward movement starting.

Initial stops for sells should be placed immediately above the recent highs as the pair was consolidating for the last few hours of trading prior to the beginning of the movement to the downside. For more volatile currency pairs you can add 5-15 pips to your initial stop, initial stops on these pairs would be 30-40 pips. These are excellent guidelines for new traders but more experienced traders will modify these initial stop guidelines as they develop some experience.

Tip 5 — Always know your money management ratio or risk /reward ratio for each trade you take. This is a great tip. If a trade has 100 pips of potential and you enter the trade with a 30 pip stop at the outset, then the money management ratio is 100/30 or 3.3 to 1 positive. The higher the money management ratio, the better.

Everyone has losses. It’s going to happen. Just keep them small and manageable and with the proper ratio of wins and losses and the proper money management ratio and you will be fine. You will get stopped out at some point, its a fact of life and part of trading. But even with a 50% success rate and the proper money management ratio your account will grow. Some spot forex trades that we point in our trading plans have money management ratios of 15-20:1, which is excellent. We trade the forex using swing to position style and only take shorter term trades when the forex market conditions dictate this.

Tip 6 — As part of most ForexEarlyWarning trading plans we provide you with a price alarm point at a critical area of support and resistance on the currency pairs we track. Generally speaking this is the first level of support or resistance. The reason for this is that we want to intercept the price movements but spend less time in front of the computer. Please make sure you have access to price alarms prior to becoming one of our clients. Desktop and wireless price alarms for up to 28 pairs are available at no cost on almost all spot forex trading platforms, even demo accounts. You can set up our free trend indicators o n metatrader and desktop price alarms are built into the platform.

Tip 7 — Many forex traders try to do too much in their life and they lose a lot of sleep and it sometimes winds up costing them their health. Its not worth it to trade under these circumstances. Consider getting a trading partner and opening up a joint account with them. Make sure your trading partner likes trend trading also and that you both think alike. You can meet online in a chat room or Skype daily and discuss trades. Make the forex a great part of your life and keep a good balance. The forex should never be a chore. If you review Lesson 14 in our training package it tells you the best times to trade the forex market for efficiency.