Free Beginners Course Chapters 5 6 2ndSkies Forex

Post on: 11 Июнь, 2015 No Comment

Types of Forex Analysis and Trading

Successful trading in forex requires that a trader carries makes their trading decisions based on some type of analysis. The most preferred methods of analyzing the forex markets are via technical or fundamental analysis. Although both have their advantages, it is critical to become effective at one, and understand how that will affect your trading. I will start by describing the two types of analysis.

What is Fundamental Analysis?

Fundamental analysis of forex markets involves a study of how economic data affects the global financial markets including, specifically currencies. The news items to be considered are generally related to economic, political or social events. The most crucial economic events which influence short and long term movements in the market are interest rate announcements and Non-Farm Payrolls.

The general logic behind fundamental analysis is that the strength of a country’s economy at present and future has the potential to strengthen that country’s currency. If the economy is strong, it is bound to attract foreign investment and encourage more and more businesses into the nation. This in turn boosts the demand for the currency of that currency and results in its appreciation.

Some of the important economic events that have the potential of driving forex price movement are listed below. Government of each country announces data relating to these indicators and events on specific dates:

- GDP or the Gross Domestic Product:

Reflects the total monetary value of all goods and services produced by a country during a quarter or a year. This figure does not include international activity of a country. Figures relating to GDP form an important part of the fundamental analysis.

Play a key role in the movement of forex markets. The Federal Reserve analyzes the various economic indicators before taking a decision to raise, lower or leave interest rates unchanged

Are important indicators of inflation level in a country.

Provides key information about a country’s construction industry which plays a key role in determining the economic situation of the country. Good sales of existing homes indicate a strong economy while weak sales are an indicator of a sluggish economy.

Provides an idea about the spending habits of the people and its impact on the manufacturing industry.

Reflects the difference between the imports and exports of tangible goods and services by a country. This not only reflects the strength of a country’s manufacturing segment but also helps in determining the demand for a country’s currency.

The level of employment in a country is indicated by the employment rate, the figures for unemployment compensation which are declared on a monthly basis. A review of these provides a good idea about a country’s employment scenario and its impact on the currency.

What is Technical Analysis?

Technical analysis is the study of the price movement over time (also known as price action ). It can be done on any instrument, time frame, or environment.

In forex, this is done on either an intraday basis (short term), medium term basis (Daily & 4hr charts ) or long term position basis (weekly charts). The major benefit of technical analysis is that it helps the investors to predict future price movements based on past events.

Technical analysis is based on the assumption all current market variables are reflected in the real time price action of a currency pair, and a study of this movement is adequate for predicting the future direction, key support and resistance levels. and when the market is setting up a price action reversal.

The bottom line is the market is composed of traders, and traders have a memory. Technical analysis involves identifying patterns that are repeated, and the movement of the price action is based upon order flow, which is the total buying and selling of traders in the world.

Through technical analysis, you can also identify the support and resistance levels by studying charts, and then make your decision to trade or not

Although there are many forms of technical analysis, the most commonly used method are Price Action Strategies, wherein only the raw price is used for analysis. Traders identify high probability price action patterns that form regularly, and base their investment decisions on that.

I myself am a technical trader, and use both Price Action and Ichimoku Cloud. analysis to trade the markets both intraday and medium term momentum plays. In the next section, I will talk specifically about Forex Price Action.

Technical analysis is highly useful in presenting a complete picture of a market’s historical trends, current demand and supply situation, predicting future trends and taking informed decisions. Although both fundamental and technical analysis are highly useful in guiding an investor in taking wise and informed decisions, the best results can be obtained by using a combination of the two.

Chapter 6

Understanding Forex Price Action

Forex Price Action is the analysis of the price movement over time. By analyzing the price action of a market a trader can determine a market’s directional bias, as well as identify recurring patterns which communicate the trend will either continue or reverse. Price action analysis is done without indicators, just using the raw movement of price over time.

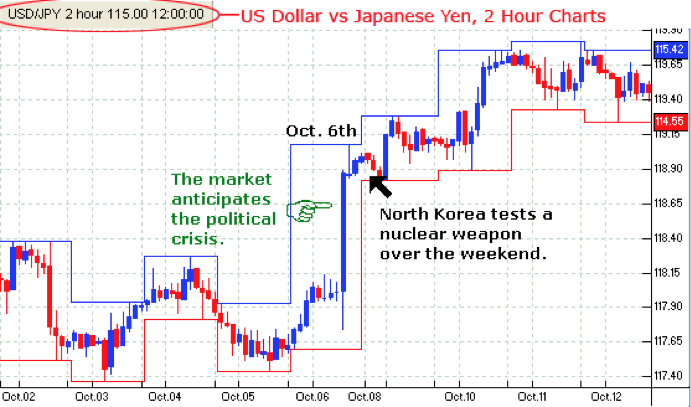

In reality, economic news or variable related information gets reflected in the price movement. This is because traders reactions to the news, via buying and selling, will be translated into the price action in real time.

This is why I prefer analyzing price action vs. economic news events, because the bottom line is the market moves via order flow – meaning the sum total of buying and selling. This translates into the price movement you see on the chart. When you learn to read price action in real time, then you can trade it successfully.

Trading price action allows traders to identify time tested price action setups which can then be used for making your trading decision. Regardless of the time frame, pair or environment, price always tells us something. A successful trader needs to identify what the market is communicating, and then trade based on that.

Price Action traders view a price chart to identify whether the market is in a trend or a range, then find the key support or the resistance levels to trade from there. When done correctly, this will help you identify high probability price action setups to trade both intraday and medium term 4hr and daily charts.

Examples of Price Action Setups

One example of a price action setup is called a pin bar, which is used to identify a reversal of the current price action. The most commonly used and successful price action trading strategy is to trade with the trend.

When you can learn to trade with the trend, you are trading with the order flow in your favor, as the larger players which move the market direct the trend. The pin bar setup allows you to both discover when a trend will reverse, or continue, via a with trend setup. An example of a pin bar is below:

Inside Bar Pattern

Another commonly used price action pattern is an inside bar, which is generally a with-trend continuation setup. When used effectively, this can help you to find a specific entry to get in with the trend. An example of an inside bar is below:

Impulsive and Corrective Moves

These are the most important moves to understand in reading and trading price action, for they communicate who is in control (buyers or sellers), when they are getting in, where they are getting in, and how you should be trading it.

When you can identify impulsive and corrective price action moves, then you will greatly increase your accuracy and success rate, for you are learning to trade with the larger players which move the market.

Now don’t get me wrong, it is critical to learn price action patterns and signals, but setups, price action and context have to be understood. What this means is price action patterns cannot be taken by themselves or the basis for trading price action.

Thus, beware of anyone teaching you three simple price action setups as the basis of trading price action as you have to understand the order flow behind the market and price movements.

Anyone not teaching impulsive and corrective price action is to be avoided as they are missing the most crucial aspect of how price action moves.

To learn more about impulsive and corrective price action, make sure to visit the two links below;

These are the base models and patterns for understanding price action.

In the next chapter, I will talk about the various types of forex charting.

Forex Price Action is the analysis of the price movement of a market over time. By analyzing the price action of a market an investor can determine a market’s directional bias as well as identify recurring patterns or patterns that depict changes or continuation of a particular sentiment. The price action analysis uses the natural or the raw price movement of the market as the base and decides all future investment actions on it.

All economic news or variable related information gets reflected in the price movement. So it is better to trade by using price action analysis rather than analyzing each and every information or announcement relating to an economic indicator. Trading based on price action is also becoming popular as traders acknowledge that trading based on technical indicators such as moving averages or RSI have a lagging factor which makes us enter into the market quite late that is when the move has actually happened. This is because technical indicators use the previous market action.