ForexCT Forex CFDs Introduction_1

Post on: 3 Апрель, 2015 No Comment

What is a CFD?

CFD is shorthand for Contract For Difference. CFDs that you may be more familiar with are commodities, indices and shares. The one characteristic that all of these instruments share is that they derive their value from the underlying asset. This means that derivatives traders never actually own the underlying asset rather, they trade on movements in the price of the asset.

A CFD is defined as an agreement to trade the difference in thevalue of an underlying asset between the time the contract is opened and the market value at the time that it is closed. If the value of the underlying asset goes up, then the buyer generates profit. If the value goes down, then they buyer incurs a loss. ForexCT offers OTC CFDs that exist as a private contract between ForexCT and the trader.

What is Forex?

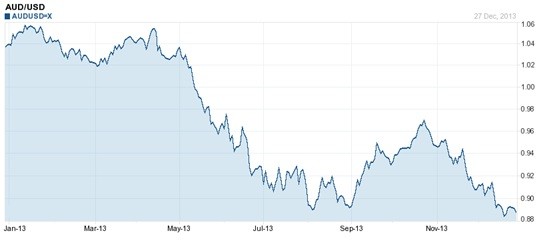

Forex is a type of CFD. Forex (or FX) is shorthand for foreign exchange. Forex trading involves the buying and selling of currencies. It is by far the most popular and massive global financial market, with daily turnover of around $5 trillion. The power and size of this market is extraordinary and it looms large over all of the major stock exchanges around the world. (See Chart 1)

In a Forex trade, you are buying one currency and selling another currency at the same time. Similar to the buy/sell principle in the traditional share market, the decision to buy or sell in Forex rests on whether a trader believes the currency will weaken (fall) or strengthen (rise).

As an example, let us consider the Hong Kong dollar and the US dollar currency pair (HKD/USD). If we expect the HKD to strengthen in value as compared to the USD, then we would purchase (buy) HKD (the stronger currency) and sell USD (the weaker currency). If the market behaves as we expect and the HKD rises in value, then we have generated a profit because we will now be able to purchase more USD with the same amount of HKD.

What is an exchange rate?

An exchange rate also known as the foreign exchange (Forex) rate is the rate at which one currency can be exchanged for another currency. Exchange rates are written as two currencies, where the first currency listed is the base currency. and the second currency listed is the quote currency. For example, in the GBP/USD currency pair, the pound sterling is the base currency and the US dollar is the quote currency.

The exchange rate itself is a number that represents how much of the quote currency can be exchanged in order to receive one unit of the base currency. Lets assume the GBP/USD is trading at 1.650. This means that for every 1 GBP of the base currency, you would receive $1.6650 of the quote currency (USD).

How do I read an exchange rate?

There are two ways to read an exchange rate a direct quote and an indirect quote. Most exchange rates are quoted directly against the US dollar. A direct quote represents the amount of foreign currency needed in exchange for one USD. However, an indirect quote is the opposite. An indirect quote for the USD would indicate how much USD is required in exchange for one unit of the foreign currency.

Direct quote: The price of the base currency in terms of the quote currency (e.g. in Japan, a direct quote for the USD would be 100.28 JPY = USD 1)

Indirect quote: The price of the quote currency in terms of the base currency (e.g. in the EU, an indirect quote for the USD would be USD 1.33 = 1 EU)

Keep in mind that all exchange rates have bid and ask prices. The bid price is the price at which a trader would sell the currency and either execute a short trade (sell) or close a long position. Conversely, the ask price is the price at which a trader would buy the currency and then either open a long position (buy) or close a short sell.

What is a pip?

Pip stands for Percentage in Point. A pip is the smallest value of measurement for Forex currency pairs. It is equivalent to 1/100 th of 1%. This is also known as a basis point. In general, currency pairs except for the Japanese Yen are quoted to four decimal places. A movement in the fourth decimal place is equivalent to one pip. For example, if the EUR/USD were trading at 1.3550, and the price moved to 1.3551, then the currency pair moved one pip.

What is a spread?

A spread is the difference between the sell and the buy price also known as the bid-ask spread. Spreads are measured in pips. For example, if the AUD/USD were quoted on our platform as trading at 1.0510/1.0512, then the spread is 2 pips.

In this example, the spread is 3 pips.

Spreads will naturally vary based on currency pairs. However, as a ForexCT client, you can rest assured that you will always receive fixed spreads. Our fixed spreads stay constant no matter what happens. This allows you to better strategise and control your transaction costs during volatile market conditions.

How do I use leverage?

Leverage trading lets you trade the market with a relatively small fraction of the notional value of a trade. This enables you to maintain the same level of exposure but without putting up the full value of the trade. We offer leverage of 200:1 for beginners and 400:1 for experienced traders.

Leverage trading can magnify your gains but also amplify your losses all traders should be aware of this. Lets look at an example.

You decide to open an USDJPYtrade.

Since you believe the USDis going up, the direction of your trade is BUY USD, SELL JPY.

The price is 102.20.

The contract value is $10,000.

Now that you have the trade specifications worked out, you want to know the margin amount you need to open the trade. Think of the margin as a form of collateral, where the amount of collateral needed is determined by your leverage. Lets assume that you have 400:1 (or 0.25%) leverage on your trading account.

After you have determined the specs of the trade, to the platform will calculate the margin amount necessary to open the trade. Remember that the amount of margin required to open a trade varies based on several factors: the size of the trade, the amount of leverage, and the underlying product itself.

For purposes of this example, assume that you have 400:1 (or 0.25%) leverage on your trading account. The necessary margin in USD for this trade would be:

Contract value x (Leverage %/100)

10,000 x (0.25/100) = $25

In other words, you would only need to deposit $25 in order to open a $10,000 USD/JPY trade and still receive full exposure to the full face value of the trade ($10,000). This is the main idea with leverage, you do not need a $10,000 deposit in your trading account to open this trade. You only need $25.