Forex Weekly Outlook for June 26 2014

Post on: 30 Апрель, 2015 No Comment

Weekly Outlook for June 2-6

As most of you already know, currency movements were pretty mixed last week to end the month of May. But, this first week of June looks to be a busy one as there are allot of new updates coming out. Rate decision in Australia, Canada, the UK and the Eurozone are all due alongside top-tier US events culminating in the ever-important NFP report on Friday. Lets have a closer look at all the highlights set for this coming week of June 2-6, 2014.

US ISM Manufacturing PMI Monday, 14:00. The US manufacturing sector activity edged up in April to 54.9 from 53.7 in March, which beat the forecast of 54.3 originally. This will be a good one to watch!

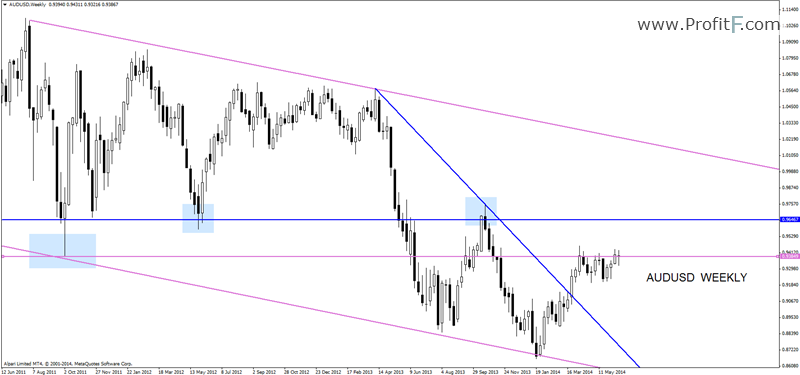

Australian rate decision Tuesday, 14:00. The Reserve bank of Australia signaled it would maintain low interest rates in the coming months as inflation is contained and the economy adjusts to fewer resource projects. No change is rates is really expected right now.

Australian GDP Wednesday, 1:30. The Australian economy expanded faster than expected last quarter. GDP edged up in the last quarter of 2013 and beat expectations for a 0.7% gain. Watch out for this one!

US ADP Non-Farm Employment Change Wednesday, 12:15. Private sector employment in the US expanded by 220,000 jobs in April following 209,000 in the prior month. Personally, I think there is a good chance May is going to reveal even more! Its expected to show 217,000.

US Trade Balance Wednesday, 12:30. The U.S. trade deficit contracted in March to $40.4 billion from $49.8 billion in February thanks to a nice rise in exports. Problem is, the bank left a door open for a rate cut. Rates are expected to remain unchanged at 1%.

US ISM Non-Manufacturing PMI Wednesday, 14:00. The U.S. sector service continued to advance in April, expanding to 55.2 from 53.1 in March. The strong release of that information indicates the US economy continues to advance and strengthen in Q2. Activity in the US private sector is expected to gain further momentum and reach 55.6.

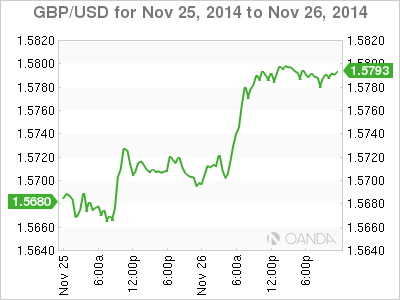

UK rate decision Thursday, 11:00. Stronger voices calling to raise rates were heard in the last BoE session back in May. This month rates are expected to remain unchanged at 0.50%.

Eurozone rate decision Thursday, 11:45. Press conference at 12:30. The ECB is more than likely going to act as promised by keeping the pressure on the euro.

US Unemployment Claims Thursday, 12:30. The initial number of jobless claims dropped last week to nearly the lowest level in seven years, hitting only 300,000 claims. Unemployment claims is expected to reach 314,000 this time.

Canadian employment data Friday, 12:30. Canadas unemployment rate remained unchanged in the previous month of April, at 6.9%. That is despite losses of 29,000 jobs compared to the month of March. The unemployment rate remained the same because labor force participation fell 0.2% to just over 66%. Canada’s labor market is expected to increase by 12,300 jobs with no change in the unemployment rate.

US Non-Farm Employment Change and Unemployment rate Friday, 12:30. The US labor market created 288,000 jobs back in April which was well above the consensus forecast of about 215,000. As of right now, the overall job market is stronger and consumer spending is also improving. The US economy is expected to show 219,000 job additions in May, while unemployment is expected to rise to 6.4%.

All times are listed in GMT and that pretty much covers all of the big Forex events hitting the mark in the coming week. Be sure to check back later this week for our next weekly outlook. If you havent already, look over the Forex Signal services and Forex software we offer above!