Forex vs Spread Betting

Post on: 9 Май, 2015 No Comment

Sharing centre stage with forex and CFD trading in recent years has been financial spread betting, helped on in massive part by growing interest in online trading amongst retail investors. Both forex and spread betting are regarded is risky but potentially lucrative ways to generate a return from the markets, and while both deploy a degree of leverage, albeit in different ways, their characteristics remain largely unique. So how can you come to understand when forex has the edge over spread betting, and are there any circumstances in which spread betting might be the more sensible path to take for generating returns?

Round 1: Market choice

Its clear from the outset that the range of markets on which you can trade with both trading styles is vastly different. With forex, youre limited to a finite number of currency pairings. This is both an advantage and a disadvantage. On the one hand, fewer markets means fewer places to look for trading signals, indicators and trends, yet of course this relieved burden comes at the cost of less flexibility in terms of the scope of what you can trade. Spread betting, on the other hand, offers you the chance to take exposure in a number of different markets, breeding in greater flexibility but also requiring a greater time and research investment from you to make it work.

Round 2: Leverage

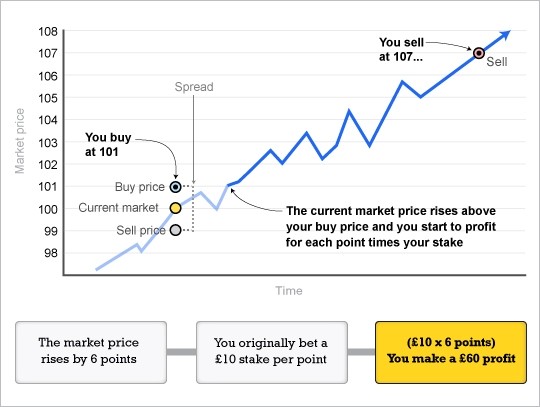

Both spread betting and forex trading are known for their high degrees of leverage, and in the whole this is what attracts traders to each investment type. While both deploy leverage, it happens in a much different way. In spread betting, the leverage is provided inherently by the structure of the transaction 1 percent equals 100% up or down. In this sense, spread betting can multiply up to deliver returns thousands of percent above the initial transaction size. Conversely, leverage in forex is provided as part of the transaction and in a ratio of up to 500:1, depending on the market and the broker youre trading with. This essentially means that both financial spread betting and forex trading pose substantial risks from the high degrees of leverage they involve.

Round 3: Transparency

When it comes to transparency, forex trading wins the day hands down. The forex markets rely on being the most numerous of any of the financial markets in terms of participants, and the most heavily traded of all the financial markets in terms of volume, in order to provide the liquidity that investors demand. The knock-on effect of this is a greater transparency and efficiency in the market, because there are very few distortions that can arise. Contrast that with the position in spread betting. Not only are there distortions that can arise in the underlying markets, but also at the broker end. Bear in mind that with spread betting, youre not actually trading anything physical, but trading on the numerical index on which your trade is based.

Verdict

When it comes down to it, spread betting and forex trading are very different. It is arguably the case that forex is seen as a more legitimate forum for knowledgeable traders, partially because the market is more transparency and more considerably leveraged, and partially through a persistent distaste for spread betting amongst some sectors of the financial markets. Be that as it may, the fact that both forms are capable of generating considerable capital returns over a short period of time makes them worthy of considerations as part of your wider investment portfolio.