Forex Trading The Risks And Rewards

Post on: 8 Июнь, 2015 No Comment

Awhile back I wrote a post about my introduction to forex trading. At that time, it involved setting up a play account for my international finance course and to make trades throughout the semester. It was an interesting experience trading forex and I was lucky enough to end up making some money. I say lucky because I had no clue what I was doing. After all, I am mainly a buy and hold investor.

Recently however, I was out with a friend and we got to talking about investing. He too is a passive investor but wants to set up a play account and start forex trading. In his case though, he will be using actual money. He knows that I am well versed in the investment industry and wanted to know what the risks and rewards were to getting involved in forex. I told him I would do some research on it and get back to him. Below are the risks and rewards I found when forex trading.

The Risks of Forex Trading

Losing Your Money: many people consider forex trading to carry with it a high amount of risk. Because of this, you have to be aware of how much you are investing at a given time and that you can afford to lose it. Some even suggest to never risk more than 2% per trade .

When I was playing in forex in grad school, I ended up making money. But there were many of my classmates that made one bad trade and they were wiped out within the first week. Make sure you use money that you can afford to lose.

Volatile: the forex market is volatile. If you don’t like wild price movements, then forex is not for you. It amazed me how much prices would change based on one piece of news that came out. Unlike the stock market where buy and hold makes sense, with forex you could get destroyed if you play this strategy.

Leverage: In the case of forex, the majority of users trade using leverage. Leverage allows you to trade more money than you actually have on hand, like a margin account for trading equities. While this can be good (we’ll see this below) it can also be very bad because if you don’t do the math, you can end up losing a lot of money very quickly.

Find A Reputable Broker: back when forex trading started to become mainstream, there were a lot of untrustworthy brokers out there. Many of these guys have faded away, but some do still exist. You have to pick a good, trustworthy broker.

While my broker comparison chart offers you a handful of great brokers, when it comes to forex, you are better served by going with a broker that deals primarily in forex, such as ETX Capital. This ensures that they have the tools and information you need to be a successful forex trader.

Understand Regulation: To take the above point one step further, make sure the forex broker you are dealing with is regulated to do business. This is a great way to lower the chances of dealing with a fraudulent broker.

The Rewards To Forex Trading

24-Hour Trading: the forex market is open 24 hours a day, from 5pm Sunday to 5pm Friday (Eastern Standard Time). This is great for those with a job or other commitments. They can still work, come home and trade all without feeling rushed.

Leverage: While leverage can do you in, it can also help you with your gains. It does this by allowing you to invest a small amount of your money and if you traded correctly, you could come out ahead big time.

Liquidity: on an average day, daily activity in the forex market often exceeds $4 trillion (USD). In other words, should something happen in the world, it won’t be hard to make a trade and get your money out.

Low Cost: with most forex brokers, they make their money on the spread, or the difference in the bid and ask price. There is usually not a commission on top that the trader gets charged.

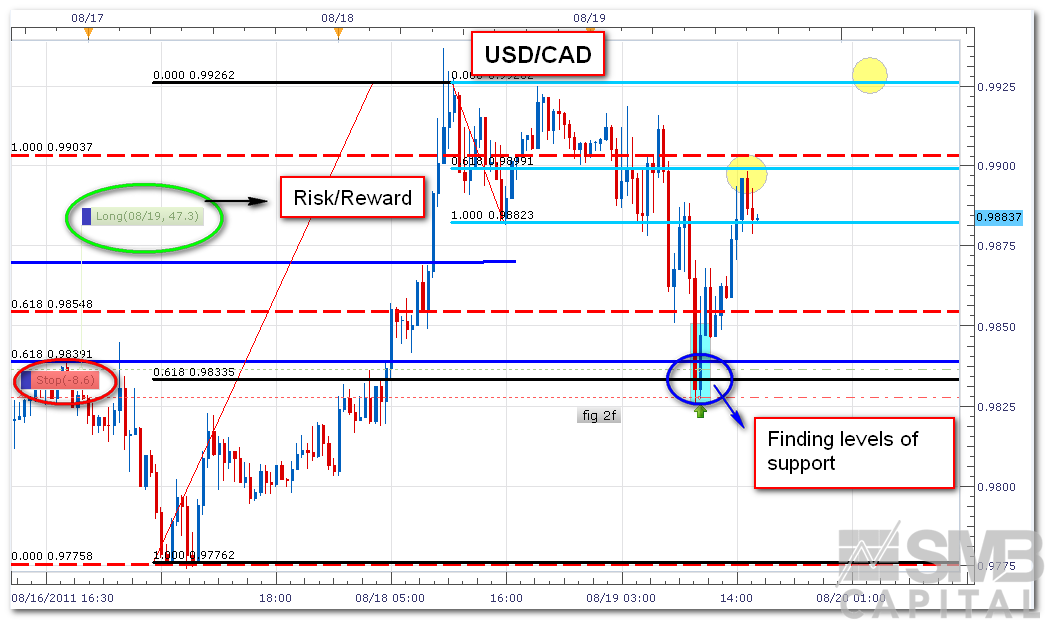

Many Strategies: There is a ton of information about trading strategies when it comes to forex out there. I am not going to get into all of them here. A basic strategy is simply using stop/limit orders to protect you from loses. Most strategies range from basic, like I just mentioned, to very complex.

Final Thoughts

Always remember, there are two sides to a coin. In other words, there are pros and cons to everything. This includes forex trading. For some readers, forex might bear too many risks over rewards and as a result, these investors should stay away from it. But others may just find that the rewards outweigh the risks.

For me, I think I will keep doing what I am doing and not get started with forex trading. My friend on the other hand, is neck deep in reading about the various trading strategies to see which one he will follow when he jumps in.

The bottom line is to take all of the risks and rewards of forex trading into account and then use this information to make the best decision for you.

Readers, I am curious is you think forex trading is right for you nor not?

[Photo Credit: epSos .de ]