Forex Trading Styles Forex Early Warning

Post on: 3 Июнь, 2015 No Comment

Introduction

Currency traders use three basic styles. Scalping, swing trading, and longer term trend trading.

Scalping

Almost all forex traders are scalpers. The general definition of scalping is generally entering a spot forex trade for less than 15 minutes to one hour looking for 10 or 20 pips of profit, sometimes even less. Any reasonable person knows that this level of profit is way too small for the risk of entry and we do not teach this style at Forexearlywarning for a multitude of reasons listed below.

Scalping is a defense mechanism for a lack of knowledge, lack of a trade plan, lack of an entry management system, lack of an effective system and compensating for ineffective technical indicators. The emphasis should be thorough market analysis along with a strong dose of logic. Traders without written plans and entry management systems scalp and the poor results are widely known.

Even scalpers do not like to scalp and they readily admit it has no future. Traders do not want to scalp, they want to make a lot of pips, but they scalp because other traders are doing it so it must be okay. It is not okay to scalp, it is wrong, and the money management and risk to reward ratio is low or even negative. If you know scalping has no future stop doing it now and start using the trading style you intend to stick with for the long term.

When you scalp the market your money management ratio is negative and eventually it will cause you to lose your funds. The money management ratio of any trade is the amount of pips you expect to make versus what you risk. The expected number of pips versus the initial stop is negative with scalping. For each pip at risk you are not trying to make more than one pip of profit. With scalping if you are right 50% of the time you will lose your entire account. Do the math. If you ask forex traders if they want to scalp they do not really want to do it but they do it anyway. This is greed and a lack of emotional control, or ego.

Scalpers do not know what they are doing, that is why they scalp, and some traders take on incredible financial risk with lot leveraging. Scalpers all wish they had something much better and a system that was effective. They know that the longer they scalp that at some point they will no longer be able to do it. It will wear them down mentally while position traders are hanging on to their trades for weeks at a time. Anyone who successfully trades the spot forex has to hold onto their trades longer, even scalpers know this (and so do the brokers) but some traders will not admit it.

Remember this: The longer you trade the forex, the less entries you will have looking for more pips per trade. If you know this right now then start behaving this way immediately, why wait? Just pull up your brokerage statement and look at it, it should be a reflection of your current style. Make changes as necessary. A lot of traders join Forexearlywarning because they are fed up with scalping.

Swing Trading

Swing trading is playing an individual trading cycle on the H4 time frame using the free trend indicators provided by Forexearlywarning.com. If you inspect many H4 time frames and cycles you will see that each 4 hour bar on the bar chart adds up to approximately 3 to 6 days of holding time possibly longer. Each time the H4 red and green trend lines cross you can enter the trade using The Forex Heatmap for entry verification. When the cycle is over and the H4 red and green lines converge you would exit the trade. This works on trending or oscillating pairs.

Currency Pair Oscillating on the H4 Time Frame

In order to have the proper money management ratio in any forex trade entry you must have a swing trading as a minimum objective or position trading objective as your trading style and hold on to each trade for days to weeks if the market condition and trends will support this style. This way when you take the time and effort to trade the potential reward is significantly higher.

Swing trading works in a trending or oscillating market. You can play the embedded H4 swing cycles within a longer term trend, or if a currency pair is oscillating on the H4 time frame you could wait for one cycle to finish then when the pair reverses catch the new cycle, similar to the photo above.

Swing Trade Example Number 1 A currency pair is oscillating on the H4 chart and is coming down, just let it finish the down cycle and stall then set a buy alarm at R1 for a buy and ride the new H4 cycle back up to resistance. This is a swing trade and the above chart is a good example of this, the chart example above also looks like a reversal.

Swing Trade Example Number 2 In this example the currency pair you want to trade is in a long term strong uptrend on the W1 time frame. On a significant support or resistance break you enter the trade with confirmation from The Forex Heatmap. You can then exit all or some of your lots at the next significant resistance or support.

Swing Trade Example Number 3 Lesson 32, Trade Setups . explains how a currency pair can move significantly against its primary trend and when it stalls you buy it back as it resumes movement back into the trend.

Currency Pair Swing Trade Cycle on the H4 Time Frame

Position Trading

Position trading is when you enter a trade when the D1 or W1 time frames red and green lines are crossing on the free trend indicators, guided by The Forex Heatmap. The red and green line crossing look similar to the chart above just on a larger time frame.

Money Management Ratio

The proper way to trade the spot forex is swing styleor longer term position and trends, and the risk reward ratios clearly support this. With swing to position trades your money management ratio starts around +3 and goes as high as +50. For each pip you risk you expect to make between 3 to 50 pips. At Forexearlywarning we write trade plans with a basis of swing and position style plans and always trading in the direction of the major trends on the forex market.

Other Trading Styles

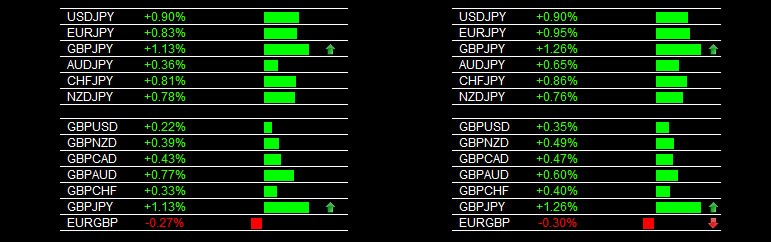

Many Forexearlywarning clients trade the market daily by observing The Forex Heatmap. If you enter a trade that is a slingshot, with one currency consistently strong and the other currency consistently weak on The Forex Heatmap, in the main session, a lot of pips are possible and you may be able to default down to the H1 time frame. This is not scalping but is clearly intra-day trading, and still within the boundaries of what we teach at Forexearlywarning.