Forex trading strategy #17 (Trading Off the Daily Chart)

Post on: 12 Июнь, 2015 No Comment

Submitted by User on March 23, 2012 — 07:49.

Submitted by Adam

Many traders love the allure of the volatility of the forex markets and prefer to trade intraday by opening and terminating positions within the hours of each other. Trading the daily charts is not very common because many traders lack the necessary patience to follow a trade for weeks on end to its logical conclusion. There are many things that a trader will gain by trading off the daily charts.

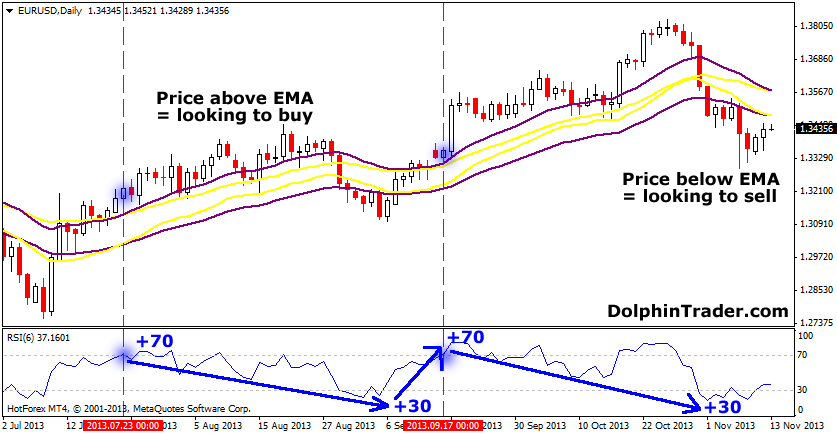

In the first instance, we must be very familiar with the saying that the trend is our friend until it ends. The only way to determine the true trend for a currency is to look at the daily chart. A typical daily chart snapshot will show the price action for weeks at a time. You can then tell just by looking at the chart to see whether the trend is up, down or ranging.

The chart above is the daily chart for the USDJPY. It is very clear from inspection that the currency pair is in a very strong uptrend after a long period of consolidation that lasted close to a year. Using short term charts will not give the true picture.

Trading off the daily chart will reduce the frequency of trades, but will also allow the trader more time to assess a trade setup and trade it with greater certainty. Trade targets are larger, and a trader can make money from a few trades that will far outstrip what he will make by chasing pips all over the place.

One trade I love to take off the daily chart is the retracement trade. Pullbacks are a normal part of trading because there will always be early bird traders who got into positions very early in the trend and will be looking to take some profits off the table. When they offload their positions, the price action of the currency will retrace.

Now I am usually interested in the continuation of the moves in the direction of the trend. For me to do this, I need to know where the retracement will come to an end. With 5 points to choose from the Fibonacci retracement tool, I need to get a clear idea of where to make my entry.

The tool I have found most useful is the Stochastics oscillator. When it crosses at overbought or oversold levels, it gives me a clear indication of exactly where to make my entries.

From this daily chart above, the Stochastics crossed at oversold levels of 24.1 at the 50% Fibonacci retracement line. An entry here would have produced 250 pips as at the time of writing this on March 20th 2012.

This is a simple strategy that works all the time. Trade the retracements off the daily chart.

This Forex trading strategy article was provided to us by Adam at ForexAccounts.net .