Forex Trading Journal

Post on: 19 Август, 2015 No Comment

A Forex Trading Journal to Track Your Performance

Creating and maintaining a Forex trading journal is one of the most important pieces of the puzzle of professional Forex trading. In todays lesson, I am going to give you a trading journal to log all your trades. I guarantee this will help your trading and mindset.

In last week’s article I discussed what a typical day in the life of a professional Forex trader is like. I am going to first explain to you why having a Forex trading journal is essential to becoming a professional trader, and then I am going to show you what my trading journal looks like so that you get an idea of how to make your own. By the end of this article you will be able to create your very own Forex trading journal, and this is a huge step in the direction of becoming a professional trader .

If Your Impatient and Cant wait to the end of this article. You can download my Forex Trading Journal here I Track All My Trades Using This Spreadsheet. Please Make a comment after reading this article and Click The Facebook Like Button, Pay it forward and share it around with other traders.

Why do I need a Forex trading journal Nial?

First off, you need a trading journal because you need to track your trading performance over time. Many aspiring traders get caught up on the results of each individual trade; however, the professional trader knows that their trading performance is measured over a long series of trades, not just one or two. So, it’s important to have a way to track your results so that you can see how you are doing over a series of trades, this allows you to not get caught up on any individual trade. You can think of your trading journal as a constant and tangible reminder that your trading performance is measured over a series of trades. Having this type of reminder is very important, especially early-on in your trading career, it helps keep you focused and it helps to remove any emotion you might attach to any one trade.

Next, developing a track record is something you should take pride and pleasure in doing. If you have a tangible track record that shows your ability to be consistent and disciplined over time, you won’t want to mess up this display of mental strength by committing emotional or stupid trading mistakes. In this way, a trading journal works to keep you accountable, you need something to be accountable to as you trade, because there is no boss looking over your shoulder threatening to fire you if you don’t do XYZ exactly right. If you don’t have a lot of money to trade with, creating a track record that shows consistent trading results over a long period of time is proof that you CAN trade, and if you have this proof you can find people to fund you. So, as we can now see, creating and maintaining a Forex trading journal is a key element to any effective Forex trading plan .

Finally, as we discussed in last week’s article about a day in the life of a pro trader, your trading should be a routine. Creating and maintaining a trading journal gives you the structure required to build your trading routine on and it also helps you examine and focus on each individual element of a trade, which we will discuss below. Essentially, Forex trading success is the result of doing a lot of things the right way every time you interact with the market, and a Forex trading journal helps you do everything the right way every time you trade.

What should my trading journal include and how do I make one?

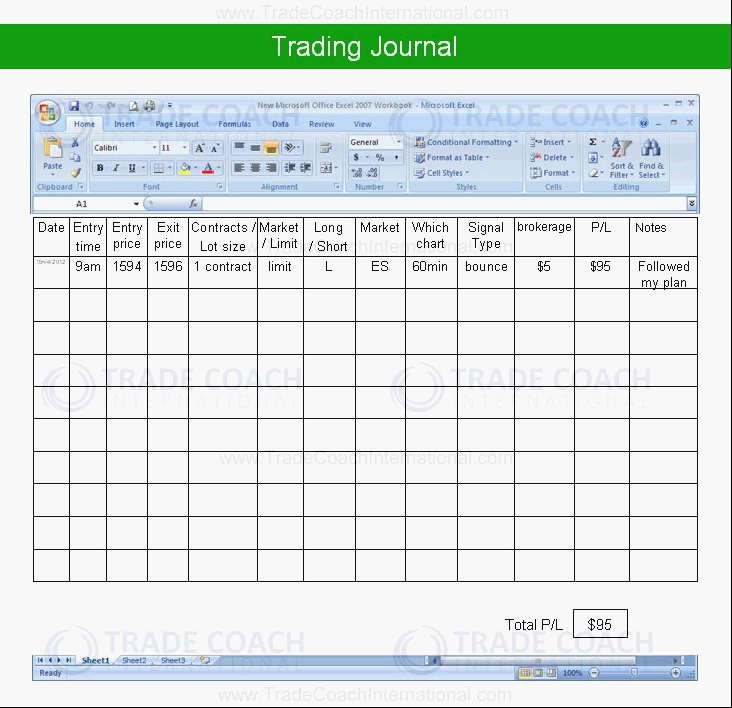

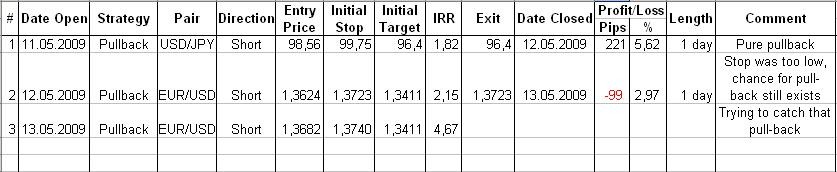

The images below are actual screen shots of my trading journal. I have entered example trade parameters below each heading just for demonstration purposes; it wasn’t an actual trade that I took, although it was a good price trading action setup. However, this is the same trading journal I use; you can use it too if you like, or tweak it to your desire.

- Entry date: This is self-explanatory; the date you entered the trade, the date you got filled is what you want here (if the order got filled). If the order never gets filled just delete it from you journal.

- Security / FX pair: The particular security traded, this will either be a currency pair or Gold / Silver for most of us. If you are unsure which currency pairs are best to trade, check out this article: best Forex currency pairs to trade?

- Entry B / S: Here you enter whether you bought or sold and record the specific level/price you entered at.

- Planned Stop and Planned Target: You will put your pre-determined stop and target price in these boxes. It’s very important to pre-define your stop level and target level. If you have pre-determined that you will trail your stop, you can just type something in this box describing your trail method, for example you might type; trail stop each time trade moves 1 times risk in my favor.

- Possible $ Risk: How much money can you lose on the trade?

- Possible $ Reward: How much money are you aiming to make on the trade?

- Position size (lots): Your position size on the trade, or the number of micro / mini / standard lots being traded. To learn more about position size click here: Forex position sizing .

- Exit Price: What price did you actually exit the trade at? To learn about exiting trades click here: Know When to Hold em, Know When to Fold em .

- Pips +/-: How many pips you gained or lost on the trade.

- Total P/L: How much total money you made or lost on the trade.

- Planned R:R : What was the pre-defined risk reward ratio of the trade?

- Actual R:R. What did the risk reward ratio actually end up being? This is important, if you aren’t achieving a risk reward of 1:2 or greater on your winning trades, you will see that over time it’s very hard to make money in the markets. Also, you will notice that if you take profits prematurely this greatly lowers your risk. reward ratio, and of course if you take a risk that is larger than what you had planned the same thing happens.

- Exit date: Date the trade closed.

- Setup: What was the setup / why did you take the trade? Did you trade a valid price action trading strategy ?

Final thoughts

Documenting your Forex trading results is a necessary component to becoming a professional Forex trader. As your trading journal progresses over a series of trades, you will start to see the significance of it more clearly. The power of risk reward and money management will become glaringly evident to you as you look over your trading journal after a few months go by. Having this tangible piece of evidence to explicitly show you how discipline and patience pay off over time, is a critical element to attaining and maintaining the proper Forex trading mindset. The reality of Forex trading is that at some point on your journey of learning how to trade, you absolutely have to figure out a way to become a disciplined and organized trader, otherwise you simply will not become successful in the markets. Creating and meticulously maintaining a Forex trading journal is the quickest and most effective way to develop into a disciplined and profitable Forex trader.

You can download the Forex trading journal that I use click here to download the forex trading journal spreadsheet excel file (you will need ms office to open this file).