Forex Trading in Relation to Currency Intervention

Post on: 22 Май, 2015 No Comment

Forex Trading in Relation to Currency Intervention

When trading in the forex market, you need to have currency intervention strategies. Currency intervention is actually essential when trading currencies. Traders would often look at these intervention strategies as a means of anticipating the market movements. The forex market is constantly changing and moving. Currency value may vary and change at a fast rate. The value of a particular currency when the market opens may not be the same value when it closes; and it may not be the same value when the market opens again the next day.

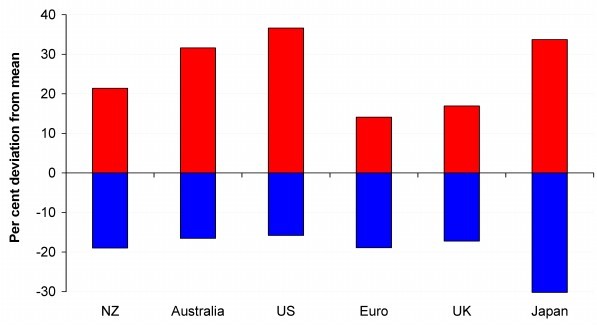

Currency intervention allows traders to anticipate the movement of the forex market. For example, assume that the United States government incurred a large debt as a result of which the country’s economy suffers; naturally, the value of the United States Dollar will drop. Now, when something like this happens in the market, experienced traders and forex brokers speculate that intervention may be likely or imminent. The government may have to adopt intervention strategies in order to allow the currency to rise or fall further. In fact, there was once a time when the value of the US dollar rapidly declined in comparison to the Japanese Yen. Now, as a result of this, the Yen value rises quickly as well. The government had to adopt measures in order to curtail the decline of the value of the US dollar.

Now, when this happens, traders and brokers know that significant effects in the forex market are likely going to happen. Good traders can recognize situations where currency intervention is needed. They can also anticipate the potential movement of the market as a result of these inventions. They can recognize the profit potential of the situation and will accordingly react. In order to be able to do this, however, it is very important that traders are updated with current events. They must know how the economy of a major currency is doing in the world market. Otherwise, they wouldn’t be able to anticipate interventions and act upon them.

Many people question the wisdom of trading in intervention events. Many traders and brokers frown at this. They believe that the trends can change quickly and it can be very risky to trade based on anticipations. They argue that the potential for huge amounts of losses is quite large for this kind of trading strategy in the forex market. To a certain extent, their arguments are valid. Yes, it is risky. Yes, you can incur huge losses. However, the profit potential of this type of trading is equally huge as well. Of course, this does not mean that it is easy. In fact, only a few traders can really pull this off. This few, however, are certainly financially benefiting from currency intervention trading.

There are many things that could affect the value of a currency. However, governments will always adopt intervention measures. You could make a lot of money from trading currencies in anticipation of these probable interventions.