Forex Trading and Schaff Trend Cycle

Post on: 23 Июнь, 2015 No Comment

Share this forex article:

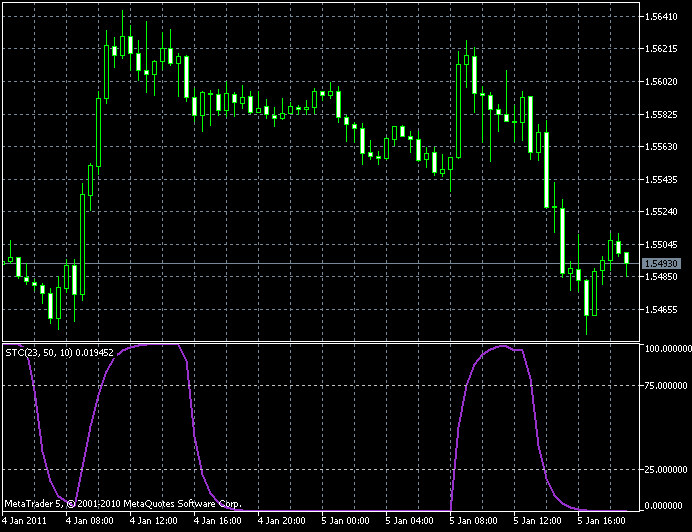

The Schaff Trend Cycle (STC) is based on the fact that a trend will be similar to a price as it demonstrates different patterns of highs and lows in repetitive manners. STC stands out as a combination of Slow Stochastics and MACD (Moving Average Convergence Divergence). MACD is a very good trend indicator but it has a slow signal line when talking about response. STC has a better signal line and will provide timely warning signs for traders so that currency trends can be detected faster.

Inputs in Schaff Trend Cycle

There are different inputs that are used by STC.

• SH: Default Value of 23 – Shorter term Exponential Moving Average

• LG: Default Value of 50 – Longer term Exponential Moving Average

• Cycle: Default Value of 10 – Half of the amount of the cycle length

How STC Works in Forex Trading

STC will identify low and high trends before MACD manages to do so. The Schaff Trend Cycle indicator will use the exact same EMAs in order to detect a trend but it will also add currency cycle trends as a used cycle component. You should know that currency cycle trends movements will take place on a basis that is linked with day numbers. STC takes this into account and offers highly accurate results that are more reliable than those shown by MACD.

MACD stands out as an exponential moving averages series that feature signal lines attached. It will feature 12 and 26 period EMA and the signal line is of 9 period. Due to the fact that STC shows improved indicator, it will show 23 and 50 period EMA, together with a 10 periods signal line. Traders can factor cycle trends on different numbers of days so you can easily access trend longevity when you measure in how much pips can be earned.

STC stands out as a very good indicator that is based on a really original concept. You should also be aware of the fact that the Schaff Trend Cycle was the first indicator to ever be created on the premise of receiving help from cycle indicators. In most cases indicators will use moving averages like EMAs so that calculations can be simplified. EMA will have a focus on the current prices and not on analyzing long-term closing prices data sets. Simple moving averages can achieve long-term analysis. The best traders in the world are always taking into account STC when they make trading decisions.

%img src=http://media.avapartner.com/banners/p491832567.gif?tag=2301&tag2=