Forex Technical Market Analysis FXCC Jun 17 2013

Post on: 29 Апрель, 2015 No Comment

Forex Technical & Market Analysis FXCC Jun 17 2013

Admin on Mon Jun 17, 2013 6:17 am

Forex Technical & Market Analysis FXCC Jun 17 2013

Dollar Outlook Next Week Hinges on Bernanke

The month of June has proven to be an extremely volatile period in the forex market as the U.S. dollar fell aggressively against many major currencies. Unfortunately we can’t expect the markets to calm anytime soon with a heavy dose of economic data expected from countries around the world. The U.K. and Australia will release monetary policy minutes, the Swiss National Bank will hold a monetary policy meeting and of course — we also have the Federal Reserve’s monetary policy announcement on the calendar. In addition to these event risks, Eurozone PMIs, New Zealand GDP, UK retail sales, US manufacturing data and Canadian retail sales are also scheduled for release. Yet there’s no question that of all these events, the most important will be the Fed meeting. Much of the volatility in the financial markets has been caused by the uncertainty of Fed policy. There’s been a lot of talk about tapering asset purchases, which has caused stocks to weaken but at the same time, central bank officials and noted Fed watchers have stressed that a reduction in Quantitative Easing does not equate to tightening. They are absolutely right and we think that the rest of the market is beginning to realize this connection as well but based on the reaction to Jon Hilsenrath’s article this week, there are still a subset who need convincing.

EURUSD .

HIGH 1.33573 LOW 1.33184 BID 1.33187 ASK 1.33191 CHANGE -0.16% TIME 08. 14:08

OUTLOOK SUMMARY . Neutral

TREND CONDITION . Sideway

TRADERS SENTIMENT . Bearish

IMPLIED VOLATILITY : Low

MARKET ANALYSIS — Intraday Analysis

Upwards scenario: EURUSD trapped to the consolidation phase. Local high at 1.3358 (R1) offers a key resistance level. Break here is required to take the pair towards to initial targets at 1.3379 (R2) and 1.3399 (R3). Downwards scenario: Penetration below the support level at 1.3294 (S1) might maintain a negative tone and prolong corrective action. Price devaluation would then be targeting our supportive measures at 1.3272 (S2) and 1.3250 (S3) in potential.

Resistance Levels: 1.3358, 1.3379, 1.3399

Support Levels: 1.3294, 1.3272, 1.3250

GBPUSD :

HIGH 1.57319 LOW 1.56927 BID 1.56935 ASK 1.56944 CHANGE -0.02% TIME 08. 14:09

OUTLOOK SUMMARY . Up

TREND CONDITION . Sideway

TRADERS SENTIMENT . Bearish

IMPLIED VOLATILITY . Low

Upwards scenario: GBPUSD is approaching our next resistive barrier at 1.5737 (R1) on the upside. Surpassing of this level may initiate bullish pressure towards to next visible targets at 1.5768 (R2) and 1.5799 (R3). Downwards scenario: If the price failed to overcome our next resistance level we expect market easing below the support level at 1.5671 (S1). Loss here would shift our intraday outlook to the bearish side with expected targets at 1.5639 (S2) and 1.5606 (S3).

Support Levels: 1.5671, 1.5639, 1.5606

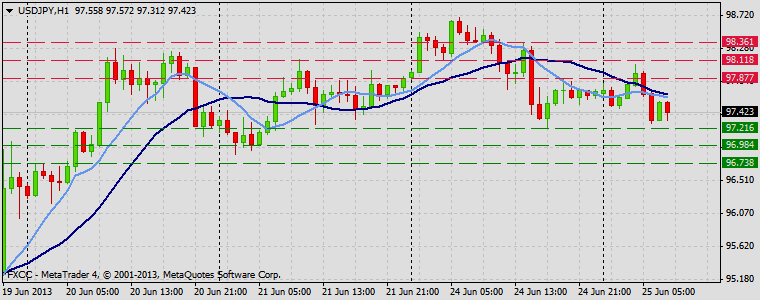

USDJPY :

HIGH 94.837 LOW 94.098 BID 94.722 ASK 94.726 CHANGE 0.67% TIME 08. 14:09

OUTLOOK SUMMARY . Down

TREND CONDITION . Sideway