Forex technical indicators that are easy to use

Post on: 11 Июнь, 2015 No Comment

Forex technical indicators that are some of the most simplest and easy to use technical analysis in forex include Trend links, trend channel, support and resistance and moving averages. By having a sound understanding of these forex technical indicators can go a long way when analyzing charts to place more successful trades.

Technical analysis is nothing but the study of supply and demand in the forex markets, which is useful to identify the direction of the asset or in other words, identifying the trends in the forex markets. This in turn helps forex traders to identify trading opportunities by making use of the forex technical indicators. The success factor is primarily based on which forex technical indicators to use at a given moment and reflects on how experienced a forex trader is. Forex technical indicators may not be something you want to be out there for everyone to see, but traders get to know just how savvy they are in forex trading if you can automatically pick any of the forex technical indicators at any given moment.

Below we list some of the basic forex technical indicators that any trader can use including its definition and how it can be used in forex trading. Bear in mind that there are many different types of forex technical indicators and the ones mentioned below are only a few. However it must be noted that the forex technical indicators presented in this article makes for easy understanding and this can be utilized by forex traders at all levels.

List of Forex Technical Indicators

Trend Line. The trend line is defined as a straight line connecting two or more price points and extending into the future to act as a line of support or resistance. The trend line itself could be an uptrend line which is usually drawn between the bottoms in a bullish market and becomes a good support if the price goes down again and a downtrend line which is drawn between price tops on the chart when market is down and is considered as a resistance when the price turns to up direction.

The line which touches more tops or bottoms is known as a trend line forex technical indicators and is more stronger and the resulting signals produced by it is more reliable.

Trend Channel. The space between two lines(trend lines) is referred to as the trend channel. The trend line and a parallel line to it which is always drawn on the opposite side of the trend line so it is drawn between tops in an up trend direction or through bottoms in a bearish price movement. The trend channel requires some conditions to give an accurate signal, the most important are: to be a wide channel, more wider more reliable and to last more longer.

Moving Averages. The moving averages is a technical indicator that is one of the oldest and most commonly used in technical analysis. Simply put, the moving average is a shift of data. As an illustration, a 5 day moving average is calculated by adding the closing prices for the last five periods, measured and divided by 5. Learn more about Moving Averages here .

The moving average forex technical indicators is the line that passes through the various average points for a specified period.

Support and Resistance. Support for a price is the area where there are lots of buyers than sellers. Purchasing at a support level is generally considered to be a good buy and thus, the buyers generally outnumber the sellers as it is low risk.

Resistance on the other hand is the opposite to the concept of a support level. At this point, there are more sellers than buyers as the probability of price reversal at resistance level is high. The large number of sellers at resistance point means that it prevents the price from rising further. More details on support and resistance in forex .

A forex technical indicator is basically a series of data points that are used to predict movements in currencies. Some of the other commonly used forex technical indicators are listed below:

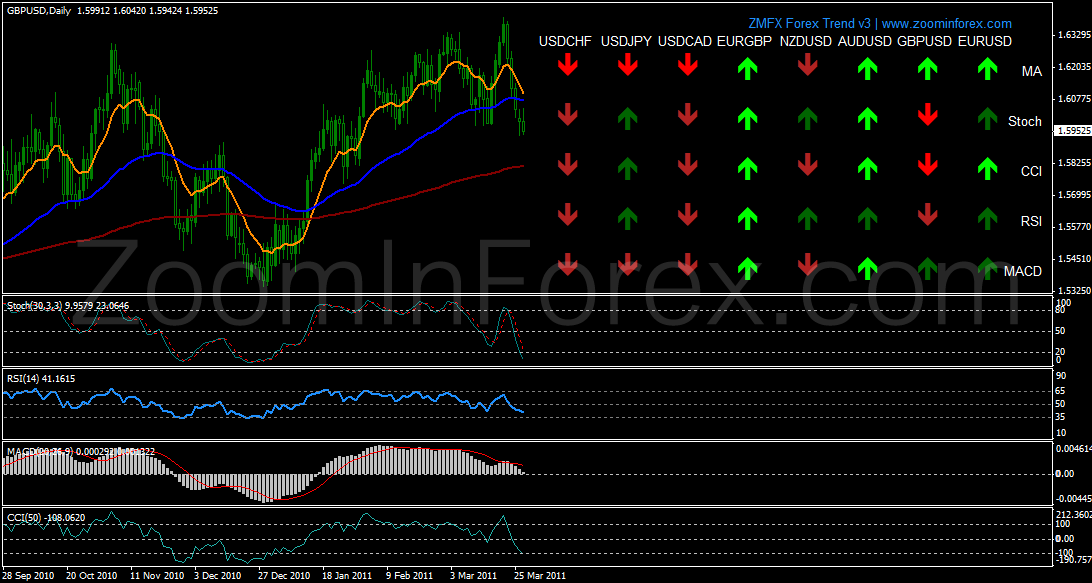

Relative Strength Index. The RSI forex technical indicators calculates the difference in values between the closes over the observation period. The RSI values are averaged with an upward average being calculated for periods with higher closes and vice-versa for down-average. The RSI is an extremely popular price following oscillator as a measure of a currency pairs price relative to itself and its past performance. Read more on trading with RSI .

Stochastic Oscillator. The Stochastic Oscillator forex technical indicators tracks market momentum and consists of two oscillator lines, called %D and %K. Oscillator readings below 20% are considered oversold. Oscillator readings above 80% are considered overbought. Learn more on Stochastics Oscillator .

Commoditiy Channel index. The CCI momentum forex technical indicators measures the strength of a prevailing trend. ADX and can be extremely useful to determine if a trend is strong or weak or to filter out false breakouts in non-trending markets. The CCI is commonly used to indicate break outs. Read more about Commodity Channel index .

Bollinger bands. Bollinger Bands can be used to measure changes in supply and demand for the underlying currency pair. Bollinger Bands are charted by calculating a simple moving average of price and then creating two bands, a specified number of standard deviations above and below the moving average.

Average True Range. A measure of volatility that was introduced by Welles Wilder. Wilder originally developed the ATR for commodities but the indicator can also be used for Forex. ATR does not provide any information about the direction of the trend (up or down), it only provides useful info about how volatile a currency pair is.

Average Directional index. A momentum indicator that measures the strength of a prevailing trend. ADX and can be extremely useful to determine if a trend is strong or weak or to filter out false breakouts in non-trending markets.

Forex Technical Indicators Practical Usage

Forex technical indicators are effective tools to use in making trading decisions yet only a few traders know how to use these forex technical indicators successfully. This is because a lot of traders make some mistakes when using these indicators.

As a thumb rule, when making trading decisions, the fewer the forex technical indicators a trader uses, the easier it is to decide where the markets are heading. One of the common mistakes being that most of the traders use too many indicators simultaneously. This is as a result of the belief that the more indicators one uses, the more accurate their trading signals would be. Unfortunately, using too many forex technical indicators can usually lead to confusion since some of them might give conflicting signals.

Traders must also consider the aspect of time frames when using the various forex technical indicators. In conclusion, traders must understand that using the right forex technical indicators will allow you to make good trades and keep you out of bad ones. Use the above mentioned forex technical indicators to verify the message of your chart pattern and spot profitable trades.