FOREX Technical Analysis Part 1

Post on: 30 Июнь, 2015 No Comment

FOREX Technical Analysis — Part 1

There are two different analysis that pertain to the FOREX market: Technical analysis and Fundamental analysis. While Technical analysis predicts market movements based on historical economic data, Fundamental analysis predicts market movements by analyzing current ecomonic and political events.

Technical analysis comes from three assumptions: Price movements are a result of a combination of all market forces, the prices of currencies follow trends, and price movement can be predicted from historical trends. Let’s take a look at each one:

Price movements are a result of a combination of all market forces — economic conditions, political events, seasons, supply and demand, and even weather conditions have an affect on currency prices. In technical analysis, however, the cause of market movement is not what matters. Instead, it is the market movement that matters.

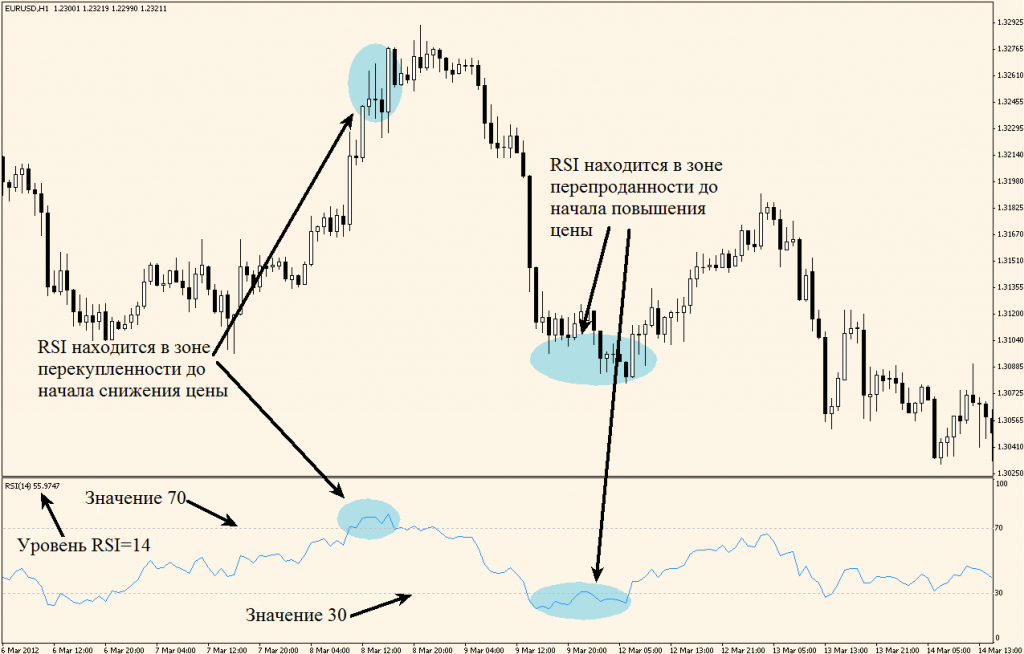

The prices of currencies follow trends — There are market patterns that can be seen, and those patterns have consequences that can be predicted based on the patterns.

The price movement can be predicted from historical trends — For more than 100 years, FOREX data has been collected and analyzed. Over this period of time, certain patterns have emerged, and these patterns have a profound effect on the way that we react to certain conditions, and on psychology in general.

FOREX traders use both fundamental and technical analysis on a daily basis. Typically, they use technical analysis, and back that up with the fundamental analysis, just to be sure. Unlike fundamental analysis, which is based on one country at a time, technical analysis can be applied to multiple currencies at one time. Unless you know and understand the political and economical conditions in France, fundamental analysis for that country won’t be much good to you — but technical data, which is based on history, is useful.

Many beginners don’t understand the importance of technical analysis in the FOREX market. But if you want to be successful in FOREX trading, you must have a strategy. That strategy is formulated with the use of technical analysis, which is used to predict movement in the market.

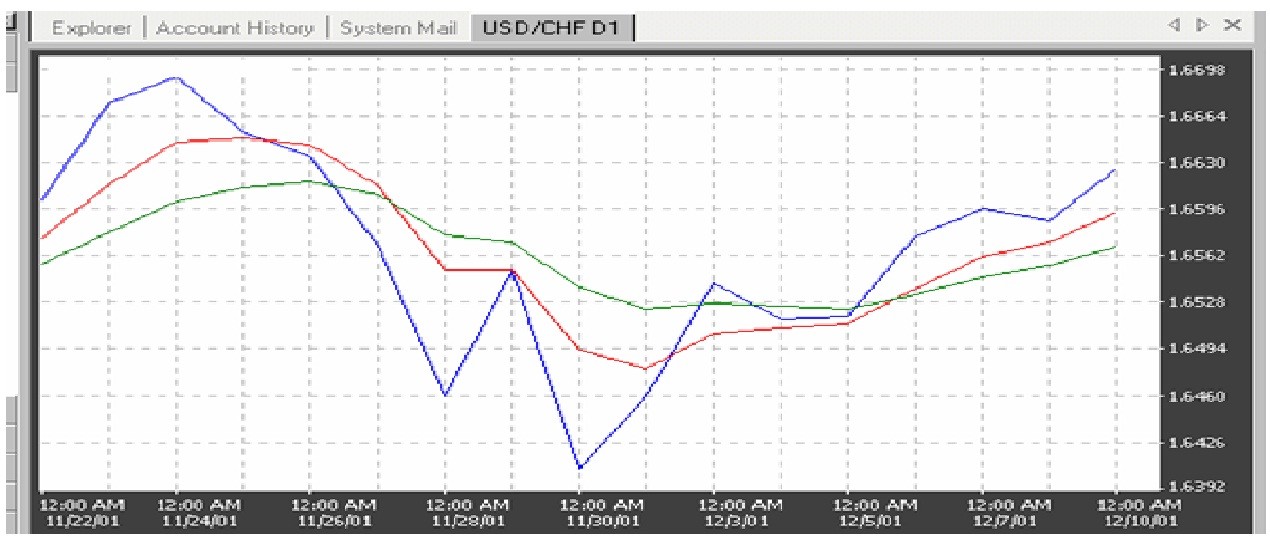

Your FOREX broker should provide you with charts and charting software for technical analysis. You may be charged a monthly fee for the use of the charts and software, but in the long-run, that expense is not only worth paying, it is vital to your trading strategy. Charts can be manipulated in various ways, with zooms, overlays, and detailed information. Charts should, of course, be in real-time.

Before you start FOREX trading, it is a good idea to open a demo account. Many brokers offer these types of accounts, that will allow you to use all of the tools. Learn to use those tools and how to analyze data collected with the use of those tools before you start trading!